|

|

|

|

|||||

|

|

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at consumer internet stocks, starting with Alphabet (NASDAQ:GOOGL).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 48 consumer internet stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 4.4% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 5.9% on average since the latest earnings results.

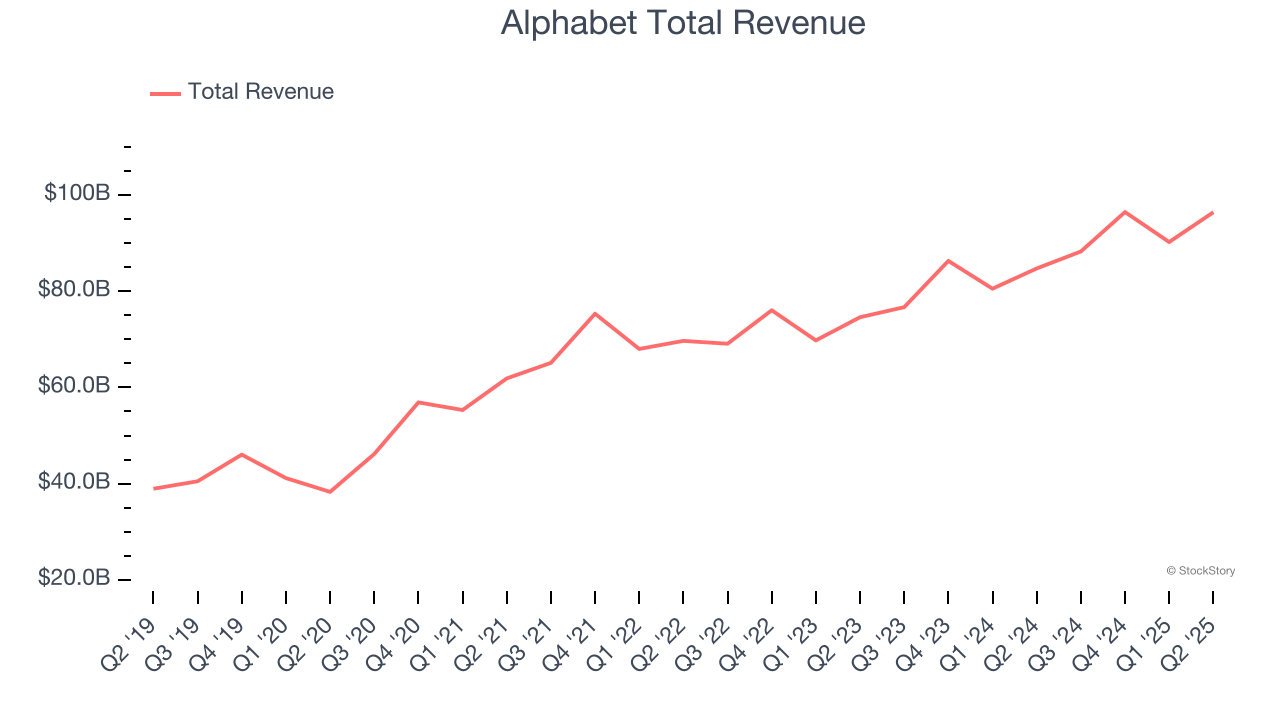

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ:GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

Alphabet reported revenues of $96.43 billion, up 13.8% year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a very strong quarter for the company with a beat of analysts’ revenue estimates, as Google Cloud Platform, Google Search, and YouTube all beat.

Sundar Pichai, CEO, said: "We had a standout quarter, with robust growth across the company. We are leading at the frontier of AI and shipping at an incredible pace. AI is positively impacting every part of the business, driving strong momentum. Search delivered double-digit revenue growth, and our new features, like AI Overviews and AI Mode, are performing well. We continue to see strong performance in YouTube as well as subscriptions offerings. And Cloud had strong growth in revenues, backlog and profitability. Its annual revenue run-rate is now more than $50 billion. With this strong and growing demand for our Cloud products and services, we are increasing our investment in capital expenditures in 2025 to approximately $85 billion and are excited by the opportunity ahead.”

Interestingly, the stock is up 7.1% since reporting and currently trades at $203.93.

We think Alphabet is a good business, but is it a buy today? Read our full report here, it’s free.

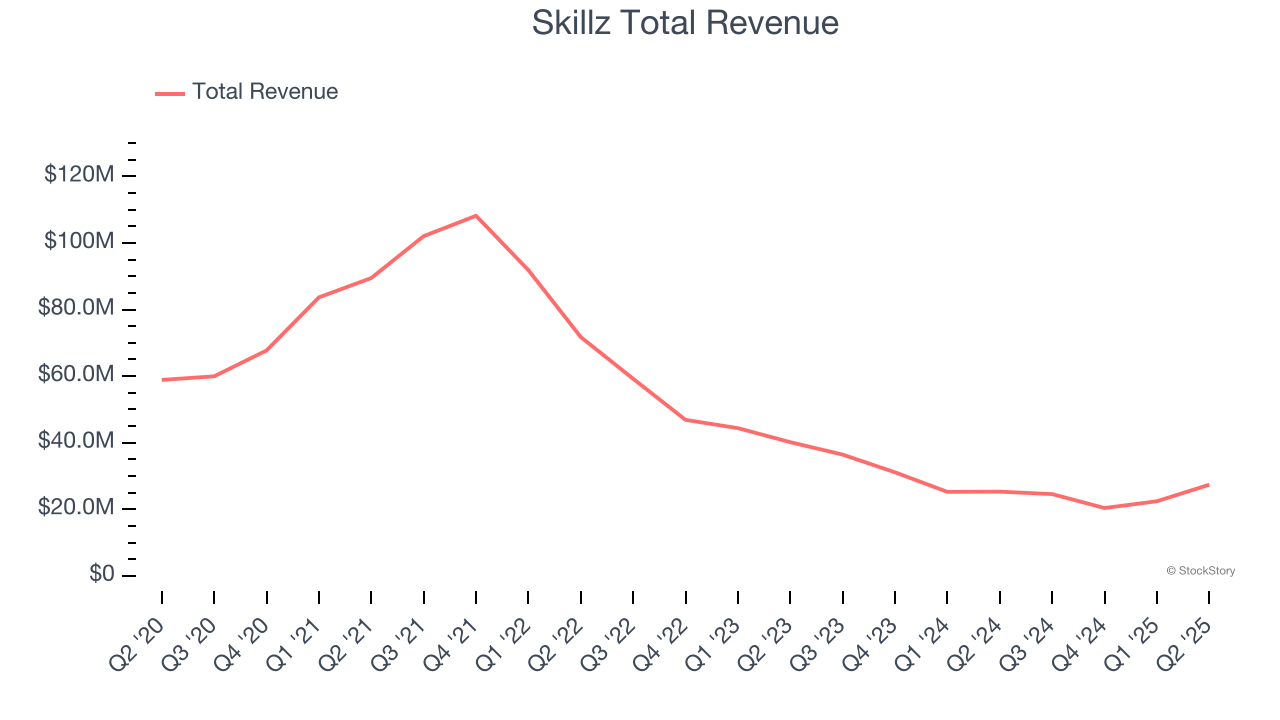

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $27.37 million, up 8.2% year on year, outperforming analysts’ expectations by 19.9%. The business had an incredible quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 34% since reporting. It currently trades at $8.90.

Is now the time to buy Skillz? Access our full analysis of the earnings results here, it’s free.

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

Coinbase reported revenues of $1.50 billion, up 3.3% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates.

Coinbase delivered the weakest performance against analyst estimates in the group. The company reported 8.7 million monthly active users, up 6.1% year on year. As expected, the stock is down 15.8% since the results and currently trades at $317.80.

Read our full analysis of Coinbase’s results here.

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.84 billion, up 41.9% year on year. This result topped analysts’ expectations by 5.7%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

The company reported 143,280 units sold, up 41.2% year on year. The stock is up 5.2% since reporting and currently trades at $350.75.

Read our full, actionable report on Carvana here, it’s free.

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NYSE:DASH) operates an on-demand food delivery platform.

DoorDash reported revenues of $3.28 billion, up 24.9% year on year. This print beat analysts’ expectations by 3.8%. It was a strong quarter as it also produced strong growth in its requests and a decent beat of analysts’ EBITDA estimates.

The company reported 761 million service requests, up 19.8% year on year. The stock is down 3.7% since reporting and currently trades at $248.50.

Read our full, actionable report on DoorDash here, it’s free.

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| 21 min | |

| 1 hour | |

| 1 hour | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite