|

|

|

|

|||||

|

|

As the world is shifting toward renewable energy, solar power companies are capturing growing attention from investors. Among the key players are Enphase Energy, Inc. ENPH and SolarEdge Technologies, Inc. SEDG, both prominent forerunners in solar inverters and energy management solutions. Increasing adoption of clean energy and rising demand for distributed energy resources position these companies well for growth in the expanding solar market.

Enphase Energyspecializes in microinverter systems that maximize solar panel efficiency, along with battery storage and energy management platforms. Meanwhile, SolarEdge focuses on power optimizers, inverters and advanced monitoring solutions, with a larger presence in utility-scale projects.

Now, let’s take a closer look to determine which of these stocks is a stronger contender in the evolving solar market.

Recent Achievements: Enphase Energy ended second-quarter 2025 on a solid note, with 15.8% year-over-year growth in earnings per share and a 2.4% rise in revenues.

More recently, Enphase Energy signed a new safe harbor agreement with another leading solar and battery financing company that offers third-party ownership (TPO) agreements to homeowners, including leases and power purchase agreements (PPAs).

The company also launched its IQ Battery 5P with FlexPhase for customers in Australia. In July 2025, Enphase Energy launched its fourth-generation Enphase Energy System, which stands out for its smaller footprint, enhanced features, easier installation and unmatched reliability. These announcements reflect Enphase Energy’s efforts to expand its market reach.

Financial Stability: Enphase Energy ended the second quarter of 2025 with cash and cash equivalents of $1.53 billion. Its long-term debt stood at $0.57 billion, while its current debt was pinned at $0.63 billion. This indicates a strong financial position, which could boost the company's ability to reliably fund its ongoing operations and future growth plans.

Challenges to Note: Enphase Energy faces significant exposure to global trade policies, as many of its key components and battery cells are sourced from China, India and other Asian countries. Rising tariffs under recent U.S. executive orders could materially increase costs and pressure margins, while stricter domestic content rules under the newly passed One Big Beautiful Bill Act may add compliance burdens and limit access to tax incentives.

Additionally, Enphase Energy’s products are experiencing a broad-based slowdown in Europe. It continues to face business challenges across Europe, owing to lower utility rates and unfavorable changes in government policies. This weak demand environment could weigh on near-term revenues and slow the company’s growth momentum.

Recent Achievements: SolarEdge ended second-quarter 2025 on a solid note, with narrower loss than the prior-year period. The company’s revenues also increased 9.1% year over year.

More recently, SolarEdge announced a strategic partnership with Schaeffler to deploy electric vehicle (EV) charging infrastructure and software across its sites in Europe. The collaboration will support the commissioning of around 2,300 charging points, expanding SolarEdge’s footprint in the fast-growing EV charging market while strengthening its presence in Europe’s clean energy transition.

Moreover, in July 2025, SolarEdge signed a deal with Solar Landscape to provide U.S.-made solar technology for more than 500 rooftop projects across several states. These projects, planned for 2025 and 2026, show SolarEdge’s ability to use local supply chains, meet domestic content rules and speed up project timelines.

Financial Stability: SolarEdge ended the second quarter with cash and cash equivalents of $785 million. Its long-term debt stood at $372 million, while its current debt was pinned at $342 million. This indicates a strong financial position, which could boost the company's ability to reliably fund its ongoing operations and future growth plans.

Challenges to Note: SolarEdge’s operations remain vulnerable to global trade and geopolitical risks. The ongoing Russia-Ukraine conflict continues to pose supply-chain challenges, with potential disruptions in the transit of goods and higher raw material and shipping costs. Meanwhile, U.S. tariffs on foreign imports add further uncertainty, as some key components are still sourced outside the country. Any escalation in trade tensions could increase costs and impact profitability.

Additionally, policy shifts under the One Big Beautiful Act are expected to reduce the availability of clean energy tax credits, especially for residential and commercial solar customers. This could lower demand for SolarEdge’s products.

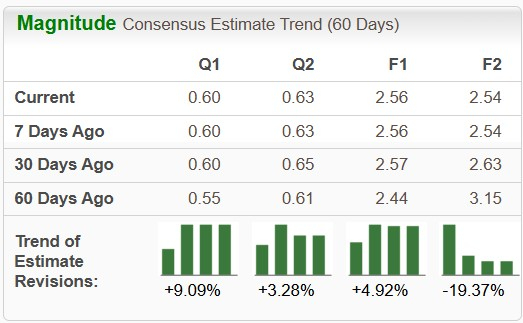

The Zacks Consensus Estimate for ENPH’s 2025 earnings per share (EPS) is pegged at $2.56, indicating year-over-year growth of 8%. The consensus estimate for revenues is pinned at $1.45 billion, implying growth of 8.8%. The company’s near-term EPS estimates have improved over the past 60 days, except that for 2026.

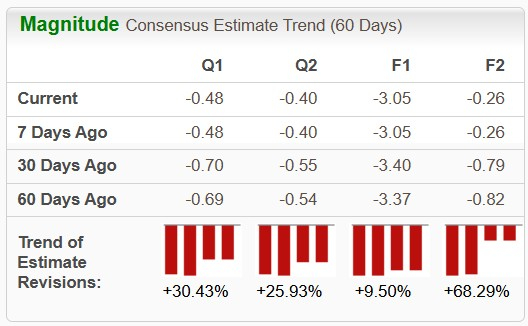

For SEDG, the Zacks Consensus Estimate for 2025 loss is pegged at $3.05 per share, indicating an improvement from the prior-year quarter’s loss of $22.99. Its consensus estimate for revenues is pinned at $1.15 billion, implying growth of 24.5%. The company’s near-term EPS estimates have improved over the past 60 days.

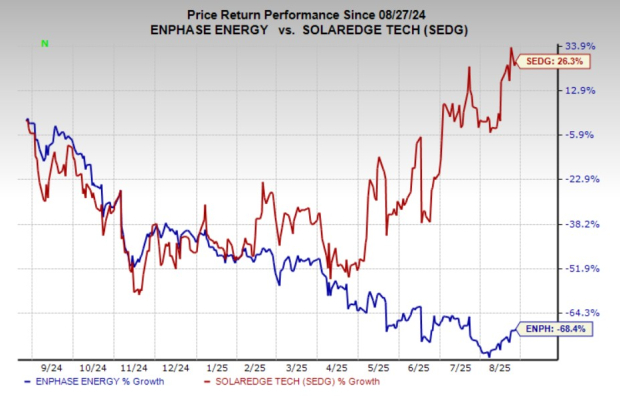

SEDG has outperformed ENPH over the past year. Shares of SEDG have gained 26.3% against ENPH’s decline of 68.4%.

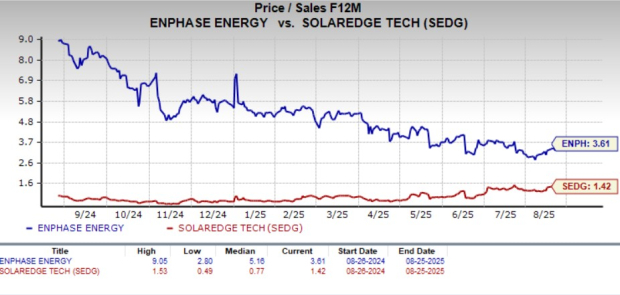

ENPH trades at a forward 12-month Price/Sales (P/S F12M) multiple of 3.61X compared with SEDG’s 1.42X, making SEDG relatively more attractive from a valuation perspective.

Both Enphase Energy and SolarEdge stand to benefit from the clean energy transition. ENPH faces some pressure from trade risks and softer demand trends in Europe, which may weigh on near-term momentum. By contrast, SolarEdge has a more diversified product base, strong partnerships for U.S.-manufactured technology and expansion into EV charging, supporting long-term growth potential.

SolarEdge also benefits from a more robust stock performance and discounted valuation, making it more appealing for investors focused on both growth and stability.

Enphase Energy currently carries a Zacks Rank #4 (Sell), while SolarEdge has a Zacks Rank #3 (Hold).

You can see the full list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-23 |

This Basing Israeli Solar Stock Is Set to Go On The AI Offensive In 2026

SEDG +9.37% SEDG

Investor's Business Daily

|

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite