|

|

|

|

|||||

|

|

Catalyst Pharmaceuticals CPRX, along with its licensor, SERB, recently announced entering into a settlement agreement with Lupin Pharmaceuticals regarding the Firdapse (amifampridine)patent litigation.

The settlement agreement resolves the patent litigation brought by Catalyst Pharmaceuticals and SERB against Lupin for submitting an abbreviated new drug application (ANDA) to the FDA seeking marketing approval for a generic version of Firdapse 10 mg tablets before applicable patents expire.

Firdapse is currently approved in the United States, the EU and Japan for the symptomatic treatment of Lambert-Eaton Myasthenic Syndrome (LEMS) in adults. In 2022, Catalyst Pharmaceuticals received FDA approval for the label expansion of Firdapse in the United States for treating LEMS in pediatric patients (six years and older). Last year, the FDA approved the company’s regulatory filing to increase the maximum daily dose of Firdapse for adults and pediatric patients weighing more than 45 kg from 80 mg to 100 mg for the treatment of LEMS.

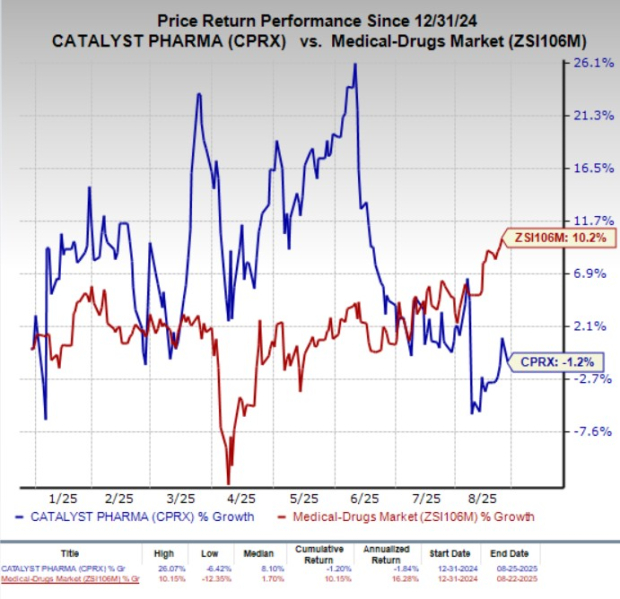

Year to date, Catalyst Pharmaceuticals’ shares have lost 1.2% against the industry’s 10.2% growth.

Per the settlement terms, Lupin has agreed not to market its generic version of Firdapse in the United States, subject to approval, before Feb. 25, 2035, unless specific exceptions outlined in the agreement arise. Additionally, Catalyst Pharmaceuticals/SERB and Lupin will end all ongoing patent litigation over Firdapse patents in the U.S. District Court in New Jersey.

Catalyst Pharmaceuticals and Lupin are required to submit the confidential settlement agreement for review by the U.S. Federal Trade Commission and the U.S. Department of Justice, as mandated by law.

Catalyst Pharmaceuticals has previously resolved similar ANDA-related litigation for Firdapse with Teva Pharmaceuticals and Inventia Life Science Pty Ltd. However, the ongoing patent dispute with the remaining defendant, Hetero, concerning Firdapse’s Orange Book-listed patents remains active.

This is another huge win for Catalyst Pharmaceuticals as it protects the company’s Firdapse sales from generic erosion in the U.S. market for LEMS treatment. The drug is the primary top-line driver for CPRX, accounting for 62% of the company’s net product sales in 2024. In the first half of 2025, Firdapse sales generated $168.6 million in revenues.

Apart from Firdapse, Catalyst Pharmaceuticals markets two other drugs in the United States — Fycompa (perampanel) CIII for epilepsy and Agamree (vamorolone) for Duchenne muscular dystrophy. The sales of these drugs generate incremental revenues for the company, easing the burden on Firdapse for revenue generation.

Catalyst Pharmaceuticals acquired the U.S. rights for Fycompa from Eisai in 2023. In the same year, the company also acquired North American commercial and developmental rights to vamorolone from Santhera Pharma.

However, the two patents protecting Fycompa are set to expire in 2025 and 2026. As a result, a significant decline in Fycompa sales is expected in the upcoming years due to the entry of generic alternatives for the epilepsy indication, which will intensify competition and erode market exclusivity.

Catalyst Pharmaceuticals, Inc. price-consensus-chart | Catalyst Pharmaceuticals, Inc. Quote

Catalyst Pharmaceuticals currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are CorMedix CRMD, Pharming Group PHAR and Kiniksa Pharmaceuticals KNSA, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s earnings per share have increased from 93 cents to $1.22 for 2025. During the same time, earnings per share estimates for 2026 have increased from $1.64 to $2.12. Year to date, shares of CRMD have surged 69.5%.

CorMedix’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 34.85%.

In the past 60 days, estimates for Pharming Group’s 2025 loss per share have narrowed from 43 cents to 10 cents. For 2026, the estimate for PHAR’s earnings per share is currently pegged at 27 cents. PHAR stock has rallied 41.9% year to date.

Pharming Group’s earnings beat estimates in two of the trailing four reported quarters and missed on the remaining two occasions, delivering an average negative surprise of 39.14%.

In the past 60 days, estimates for Kiniksa Pharmaceuticals’ 2025 earnings per share have increased from 74 cents to $1.03. Earnings per share estimates for 2026 have increased from $1.19 to $1.60 during the same period. KNSA stock has surged 67% year to date.

Kiniksa Pharmaceuticals’ earnings beat estimates in two of the trailing four reported quarters and missed on the remaining two occasions, delivering an average negative surprise of 330.56%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 |

Why Pharming, A Top 3% Biotech Stock, Just Took A Double-Digit Beating

PHAR -17.07%

Investor's Business Daily

|

| Feb-02 | |

| Feb-02 | |

| Jan-31 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite