|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

About the Industry

Internet - Services companies are primarily those that rely on huge software and hardware infrastructure, referred to as their properties, to deliver various services to consumers. People can avail the services by accessing these properties with their personal connected devices from almost anywhere in the world.

Companies generally operate two models: an ad-based model and an ad-free model where the service is charged. Alphabet, Baidu and Akamai are some of the larger players while Crexendo, Upwork, Dropbox, Etsy, Shopify, Uber, Lyft and Trivago are some of the emerging players. Very large players (mainly Alphabet) tend to skew averages.Because of the diversity of services offered, it is difficult to identify industrywide factors that could affect all players. The effect of macro factors such as inflation, rate hikes, supply chain issues and so forth vary by company.

Factors Determining Industry Performance

Zacks Industry Rank Has Improved Slightly

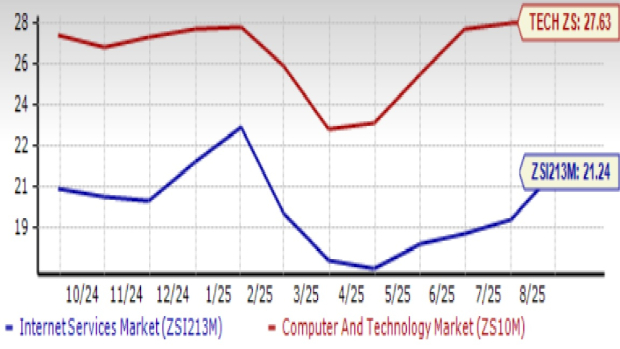

The Zacks Internet - Services industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #99, which places it among the top 40% of 245 Zacks-classified industries.

The group’s Zacks Industry Rank, which is basically the average rank of all the member stocks, indicates that there are several opportunities in the space.

Looking at the aggregate earnings estimate revisions over the past year, we see that the 2025 estimate has responded very positively to both the first and second quarter results, jumping up materially in both periods. As a result, it is up 14.1% over the past year. The Zacks Consensus Estimate for 2026 continued to decline until June but jumped up thereafter. Overall, this netted a 1.6% increase for the year.

Historically, the top 50% of Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. So the industry having moved into the top 50% indicates that it may be turning a corner.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Stock Market Performance Has Been Volatile

Over the past year, the industry has been more volatile than both the broader Technology sector and the S&P 500. It has at times traded at a discount and at times at a premium only to fall back after some time.

The industry’s net gain of 29.9% over the past year is more than the broader sector’s 22.2% gain and the S&P 500’s 15.6% gain.

One-Year Price Performance

Industry's Current Valuation Is Attractive

On the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at a 21.24X multiple, which is a premium to its median value of 19.76X over the past year. It is, however, a discount to the S&P 500’s 22.8X and a greater discount to the sector’s 27.63X.

Over the past year, the industry has traded in the range of 17.17X to 23.17X, a broader range than the S&P’s 20.61X to 22.8X. The sector has traded in the 23.14X to 27.65X range.

Forward 12 Month Price-to-Earnings (P/E) Ratio

2 Solid Bets

We are spoiled for choice because a number of players in the Internet Services industry are looking good at this point. This despite the fact that the industry is highly diverse, and so there’s the possibility that some players would be doing exceedingly well while others not so much. We currently have a Zacks #2 (Buy) rating on Dropbox and Crexendo.

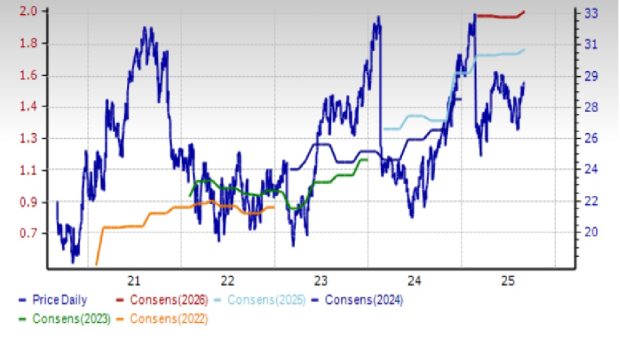

Dropbox, Inc. (DBX): San Francisco, California-based Dropbox provides a content collaboration platform worldwide. The company's platform facilitates collaboration between individuals, families, teams and organizations (professional services, technology, media, education, industrial, consumer and retail, and financial services industries). The free sign-up through its website or app offers limited features and is supplemented with a paid subscription tier for premium features.

Over the last couple of years, Dropbox has been incorporating AI across its business to improve customer experience and thereby increase the average revenue per user. Its universal AI-powered search platform Dash has been popular with customers, leading to the launch of Dash for Business last October. This enabled a headcount of around 528 employees, the second such reduction in 18 months. The flatter operating structure should increase efficiencies, besides realigning the business with current growth objectives.

The company beat earnings estimates in the last quarter by 19.5% and the 2025 estimate is up 7 cents (2.7%) in the last 30 days. The 2026 estimate is also up 7 cents (2.4%). Analysts currently expect 2025 revenue and earnings growth of -2.2% and 7.6%, respectively. For 2026, they’re expecting 0.1% revenue growth and 10.7% earnings growth.

The shares of this Zacks Rank #2 (Buy) stock are up 15.6% over the past year.

Price and Consensus: DBX

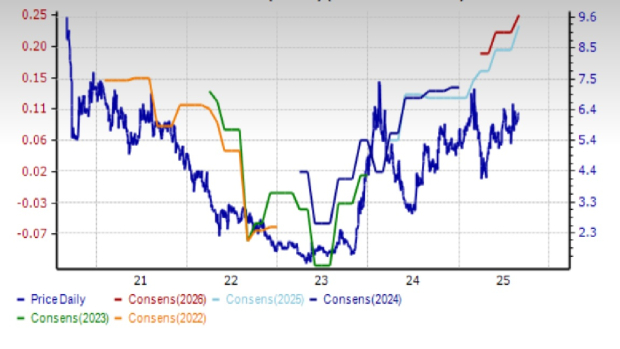

Crexendo, Inc. (CXDO): Tempe, Arizona-based Crexendo is a provider of Unified Communications as a Service (UCaaS), Call Center as a Service (CCaaS), communication platform software solutions, and collaboration services designed to provide enterprise-class cloud communication solutions to businesses of any size through their business partners, agents and direct channels.

The company is seeing significant growth opportunity for its adaptable and reliable software solutions where Crexendo operates in a niche not attractive to larger players like Microsoft and Cisco. Additionally, the integration of AI in telecom services is enabling it to better serve a diverse clientele of small, mid-size and enterprise-level customers. Management has said that telecom services growth will come from both internal sales efforts and strategic, accretive acquisitions.

Crexendo entered into an agreement with Oracle last year, under which it is migrating its services to Oracle Cloud Infrastructure (OCI) to significantly reduce costs, improve performance and reliability, increase scale, and increase focus on product development. The migration of international operations is complete and significant progress has also been made in U.S. migration with the goal of completion by year-end.

Crexendo topped estimates in the last quarter. Its revenue beat by around 2.2% while earnings beat by 75%. The 2025 estimate has increased 4 cents (13.8%) in the last 30 days while the 2026 estimate increased 3 cents (9.1%). At these levels, they represent a 11% increase in revenue and a 26.9% increase in earnings for 2025. Revenue and earnings are expected to grow a respective 10.9% and 9.1% the following year.

The shares of this Zacks Rank #2 (Buy) stock are up 22.4% over the past year.

Price and Consensus: CXDO

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| 6 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite