|

|

|

|

|||||

|

|

Descartes Systems (DSGX) reported second-quarter fiscal 2026 non-GAAP earnings per share (EPS) of 43 cents, which lagged the Zacks Consensus Estimate by 12.2%. The bottom line, however, grew 7.5% year over year and 4.9% sequentially.

Revenues in the quarter totaled $179.8 million, up 10% year over year and 7% sequentially. The growth was supported by synergies from acquisitions completed in the second half of fiscal 2025, as well as the addition of 3GTMS in the first quarter of the fiscal year. Continued growth from both new and existing customers further boosted results, with strong momentum in global trade intelligence, customs and regulatory compliance, and transportation management solutions. Forex contributed about $2 million to revenues this quarter, driven by a weaker U.S. dollar against the British pound, euro and Canadian dollar compared to last year.

Descartes' strategy of acquisition-driven expansion, targeting niche players that bolster its logistics and supply chain software portfolio, bodes well. In June, it acquired PackageRoute Holdco, Inc., a final-mile carrier solutions provider, for approximately $1.9 million (net of cash acquired). While relatively small in scale, this acquisition cushions its GroundCloud business.

In August, DSGX acquired Finale, Inc., a U.S.-based provider of cloud-based inventory management solutions designed for e-commerce businesses. The deal was valued at $40 million upfront (net of cash acquired), with up to $15 million in contingent consideration based on performance.

The Descartes Systems Group Inc. price-consensus-eps-surprise-chart | The Descartes Systems Group Inc. Quote

Finale’s solutions help small and medium-sized ecommerce companies scale their operations, anchoring Descartes’ Global Logistics Network (GLN). This acquisition expands DSGX’s footprint in e-commerce enablement, a high-growth vertical that aligns with global consumption trends.

However, global supply chains remain under pressure from shifting trade dynamics, tariffs, sanctions and persistent uncertainties in transportation costs. Shippers, carriers and logistics providers have been forced to adapt quickly, often grappling with unpredictable cross-border movement costs and fluctuating investment decisions. The GLN continues to drive recurring revenues and customer reliance, supporting Descartes in an uncertain landscape.

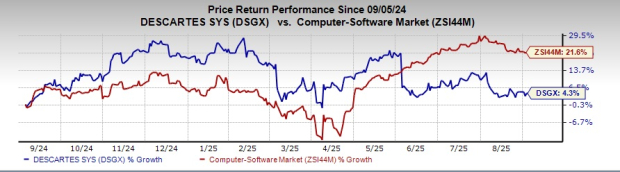

In the past year, shares have gained 4.3% compared with the Zacks Computer - Software industry's growth of 21.6%.

Services revenues (contributed 93% of total revenues) in the reported quarter amounted to $166.8 million, up 14% year over year, fueled by its ongoing emphasis on expanding recurring revenue streams.

License revenues (less than 1% of total revenues) were $0.2 million.

Professional services and other revenues (7%) fell 19% year over year to $12.8 million. Other revenues include hardware sales. The decline primarily reflects unusually high hardware revenues in GroundCloud in the prior-year quarter, driven by an AI-related replenishment cycle.

The gross margin for the quarter under review was 77%, up from 75%, mainly due to lower-margin GroundCloud hardware sales recorded in the previous year quarter.

Driven by sales momentum amid higher operating costs, DSGX delivered 14% adjusted EBITDA growth to a record $80.2 million.

Adjusted EBITDA margin was 44.6%, up from 43.2% in the prior-year quarter, partly reflecting lower-margin hardware sales.

Income from Operations was $48.2 million, up 5% year over year and 4% sequentially.

In the quarter under discussion, cash generated from operating activities amounted to $63.3 million, a significant 82% jump year over year and 18% quarter over quarter. Cash flow was affected by one-off items such as personnel departure payments ($5 million in the current quarter) and acquisition-related contingent considerations ($25 million in the prior-year quarter). Even with these adjustments, the sharp increase highlights the underlying strength of Descartes’ operating model.

As of July 31, 2025, the company had $240.6 million in cash, up from $176.4 million as of April 30, 2025, driven by strong operating cash flow, offset by roughly $2 million for the Package Growth acquisition and just more than $1 million in earn-out payments from a prior deal.

DSGX expects strong cash flow conversion, with operating cash flow projected at 80–90% of adjusted EBITDA in the upcoming quarters.

DSGX currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cadence Design Systems (CDNS) reported second-quarter 2025 non-GAAP EPS of $1.65, which beat the Zacks Consensus Estimate by 5.1%. The bottom line increased 28.9% year over year, exceeding management’s guided range of $1.55-$1.61. Revenues of $1.275 billion beat the Zacks Consensus Estimate by 1.3% and increased 20.3% year over year. The figure beat CDNS’ guided range of $1.25-$1.27 billion. The top line was driven by broad-based demand for its solutions, especially the AI-driven portfolio, amid robust design activity.

PTC Inc. (PTC) reported third-quarter fiscal 2025 non-GAAP EPS of $1.64, beating the Zacks Consensus Estimate by 34.4%. The company reported non-GAAP EPS of 98 cents in the prior-year quarter. Management had estimated non-GAAP EPS in the range of $1.05 to $1.30. Revenues came in at $644 million, rising 24% year over year (up 22% at constant currency or cc). The top line beat the consensus estimate by 10.6%. Management projected revenues in the $560-$600 million band.

Blackbaud, Inc. (BLKB) reported second-quarter 2025 non-GAAP earnings per share (EPS) of $1.21, which surpassed the Zacks Consensus Estimate by 15.2%. The bottom line increased around 12% year over year. Total revenues decreased 2.1% year over year to $281.4 million. This was due to the divestiture of EVERFI. The top line surpassed the Zacks Consensus Estimate by 1.3%. The company is increasing its full-year 2025 financial guidance across all major metrics, reflecting its strong first-half performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 15 hours | |

| 18 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite