|

|

|

|

|||||

|

|

The enterprise software market is witnessing strong momentum as businesses increasingly seek platforms that unify workflows and embed AI into daily operations. Both monday.com MNDY and Salesforce CRM are playing central roles in this shift. Salesforce has long dominated enterprise CRM with its multi-cloud portfolio, while monday.com has emerged as a flexible Work OS, gaining traction among small and mid-sized teams as a lightweight collaboration and project management platform.

Per Grand View Research, the global enterprise software market was valued at $263.8 billion in 2024 and is projected to reach $517.3 billion by 2030, reflecting a 12.1% CAGR. With both MNDY and CRM converging on this growth opportunity, the question is which one is better positioned to benefit. Let us delve deeper to find out.

monday.com is facing mounting challenges that raise questions about its ability to sustain upside. While the platform is gaining adoption among small and mid-sized teams, its push into enterprise workflows has exposed gaps in depth and efficiency.

monday CRM, built to extend the platform into customer relationship workflows, is gaining traction, though revenue remains modest at $100k in annual recurring revenue. This progress has come at a steep cost, with research and development rising to $59.2 million (20% of revenues) and sales and marketing reaching $139.2 million (47% of revenues). The product highlights how new modules are stretching resources without yet delivering meaningful efficiency.

The core Work Management product is also showing signs of strain. Revenue rose 27% year over year to $299 million in the June 2025 quarter; however, momentum is being sustained through expensive customer acquisition. Net dollar retention slipped to 111% in June 2025 from 112% in the previous quarter, with the Zacks Consensus Estimate being pegged at 110.11% for the September 2025 quarter. Slowing expansion within existing accounts suggests that the flagship product is maturing, placing greater pressure on new offerings to carry growth.

AI initiatives add another layer of cost without yet proving returns. Tools such as monday magic and monday sidekick are intended to differentiate the platform, but development spending remains high and integration remains limited compared with established players. Non-GAAP operating margin was 15% in the June 2025 quarter, down from 16% a year ago, reflecting higher sales and marketing and product development costs that continue to limit operating leverage.

The Zacks Consensus Estimate for 2025 earnings is pegged at $3.93 per share, up by 3.7% over the past 30 days, indicating an improvement over the year-ago earnings of $3.5 per share.

monday.com Ltd. price-consensus-chart | monday.com Ltd. Quote

Salesforce is one of the largest enterprise software providers, best known for its CRM platform. It has expanded into a multi-cloud portfolio spanning sales, service, marketing, integration and analytics, with newer tools like Data Cloud and Agentforce embedding AI into workflows.

Sales and Service Clouds remain the largest contributors, providing core customer management functions widely adopted across industries. Their maturity supports renewal stability, limiting incremental growth, as these products already hold deep penetration in large enterprises. To offset this, Salesforce is leaning on newer areas, particularly AI. Data Cloud and Agentforce generated $1.2 billion in recurring revenues in the July 2025 quarter, up 120% year over year, with over 40% of Agentforce deals sourced from existing accounts. These offerings highlight Salesforce’s ability to monetize innovation within its installed base, though their contribution remains modest compared with overall revenues.

Financial results reflect the maturity of Salesforce’s profile. Total remaining performance obligation was $59.9 billion in the July 2025 quarter, up 10% year over year, while the Zacks Consensus Estimate for fiscal 2026 stands at $59.5 billion, suggesting expectations for measured growth. Non-GAAP operating margin was 34.3% in the July quarter, with guidance of 34.1% for fiscal 2026, indicating profitability is likely to hold steady as Salesforce balances reinvestment with shareholder returns.

The Zacks Consensus Estimate for fiscal 2026 earnings is pegged at $11.30 per share, unchanged over the past 30 days, indicating an improvement over the year-ago earnings of $10.2 per share.

Salesforce Inc. price-consensus-chart | Salesforce Inc. Quote

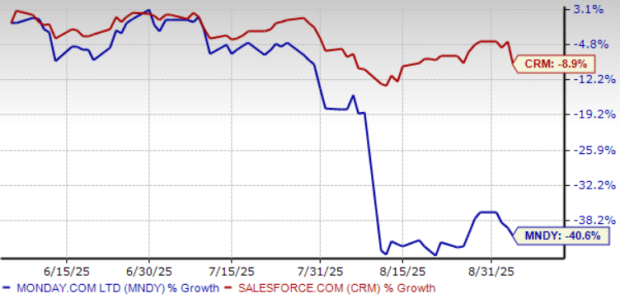

In the past three months, monday.com’s stock has underperformed sharply, plunging 40.6% compared with a more modest 8.9% decline for Salesforce. The steep drop in MNDY reflects investor caution around high spending levels and slowing customer expansion, while CRM’s diversified portfolio has provided greater resilience.

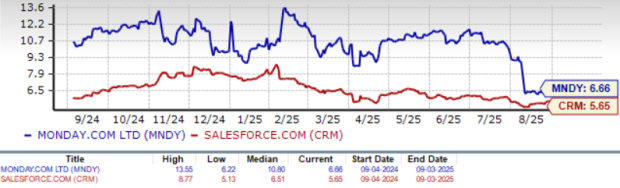

On valuation, monday.com trades at 6.66X forward 12-month sales, above Salesforce’s 5.65X. Despite the premium, MNDY faces heavier execution risks and profitability pressures, which make its multiple appear stretched. While CRM’s lower multiple looks more balanced given its scale, margin consistency and visibility from long-term contracts.

Salesforce and monday.com both operate in attractive segments of the enterprise software market. monday.com is contending with high spending, slowing customer expansion and reliance on unscaled products, factors that have pressured its share performance and leave limited room for its valuation premium. Salesforce, in contrast, benefits from a broader portfolio, stable margins and early contributions from AI, which provide steadier visibility even as growth moderates. Investors should track CRM stock for attractive entry points while staying away from MNDY.

With Salesforce carrying a Zacks Rank #3 (Hold) compared with monday.com’s Zacks Rank #5 (Strong Sell), CRM holds the relative edge.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 6 hours | |

| 15 hours | |

| 15 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite