|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

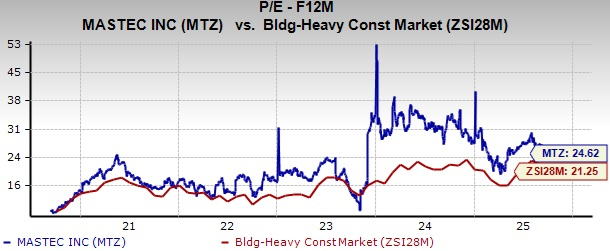

MasTec, Inc. MTZ is trading at a higher valuation compared with its peers. The company’s forward 12-month price-to-earnings (P/E) ratio is 24.62X, above the Zacks Building Products – Heavy Construction industry’s 21.25X. It also stands higher than the broader Construction sector’s 20.39X and exceeds the S&P 500 multiple of 22.95X.

Moreover, MasTec is currently trading at a premium compared with similar players like AECOM ACM, EMCOR Group, Inc. EME and Fluor Corporation FLR. AECOM, EMCOR and Fluor are trading lower with forward 12-month P/E multiples of 22.17, 23.75 and 18.33.

Shares of MasTec have surged 72% over the past year, outperforming 57.8% growth in the industry. The stock has also surpassed the broader Construction sector's rise of 5.4% and the S&P 500 index’s 19.9% growth during the same period.

MasTec is gaining from strong demand across its end markets. Expansion in fiber networks and wireless build-outs is driving growth in communications, while rising investment in renewables supports clean energy projects. Grid modernization is driving margin gains in power delivery. A record backlog adds visibility and supports the company’s raised 2025 guidance.

The MTZ stock has outperformed peers over the past year, with AECOM rising 34.4%, EMCOR surging 70.7% and Fluor slipping 7.5%.

Let us explore the key factors driving growth and why the stock may remain attractive despite its elevated valuation.

The company is benefiting from a surge in communications infrastructure needs. Fiber expansion and wireless build-outs are creating steady opportunities as telecom and technology players push for broader connectivity and network upgrades. Demand is also being supported by federal investment and rising requirements linked to data center development.

In the second quarter of 2025, communications backlog rose 13% year over year to a record $5 billion, supported by strong demand for both fiber and wireless projects. Federal broadband programs and increased capital spending from hyperscalers further strengthened visibility, positioning the company to benefit from sustained industry investments.

Rising investment in renewables and infrastructure is fueling strong momentum for the company’s clean energy segment. Supportive legislation and tax incentives have further reinforced demand, while utilities and developers continue to accelerate renewable power projects.

In the second quarter of 2025, clean energy and infrastructure backlog rose 11% sequentially to a record $4.9 billion, supported by new awards across both renewables and infrastructure. With legislation extending renewable tax credits through 2027 and bookings already building into 2026, the company has clear visibility into continued growth in this segment.

The company is witnessing steady growth in power delivery as utilities invest to strengthen grid infrastructure. Rising electricity demand and the need to modernize aging systems are fueling project activity across transmission, distribution and substations.

In the second quarter of 2025, utilities advanced transmission and distribution upgrades, supporting volume growth and creating a steady pipeline of opportunities. With continued capital commitments toward grid reliability and new generation capacity, the company is positioned to capture further growth in this segment in the coming years.

A growing backlog highlights strong demand across the company’s diverse portfolio. As of June 30, 2025, the 18-month backlog stood at $16.45 billion, up 23.3% year over year and 4% sequentially. Growth was led by clean energy and infrastructure bookings, supported by strong renewables demand, and steady contributions from communications and power delivery. This healthy backlog provides multi-year revenue visibility across all major segments.

On the back of this strength, the company raised its 2025 outlook. Revenues are projected at $13.90-14 billion, whereas it reported $12.30 billion in 2024. Adjusted earnings are expected between $6.23 and $6.44 per share, above the prior mentioned $5.90-$6.25, suggesting a significant rise from the $3.95 reported in 2024. The improved guidance indicates stronger revenue momentum, continued margin gains in non-pipeline operations, and backlog at record levels. With these drivers in place, the company is positioned to sustain growth through 2025 and beyond.

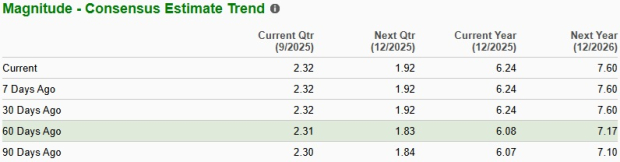

Despite its high valuation, MasTec’s upward revisions in earnings per share (EPS) estimates highlight analysts’ confidence in the stock. MTZ’s earnings estimates for 2025 and 2026 have trended upward in the past 60 days to $6.24 and $7.60 per share, respectively. The estimated figures imply year-over-year growth of 58% and 21.8%, respectively.

Meanwhile, AECOM and EMCOR’s earnings in the current year are likely to witness year-over-year increases of 15.9% and 16.2%, respectively, while that for Fluor is expected to decline 12.5%.

MasTec continues to demonstrate broad-based strength across communications, clean energy and power delivery, supported by record backlog and an improved 2025 outlook. These drivers provide strong visibility into future performance, even as the stock trades at a premium valuation compared with peers. The company’s positioning in high-growth areas such as broadband expansion, renewable energy and grid modernization underlines its long-term potential.

Backed by healthy demand trends, rising project awards and sustained earnings momentum, MasTec currently flaunts a Zacks Rank #1 (Strong Buy). This indicates confidence in the company’s ability to deliver above-industry growth and justify its higher trading multiple, making the stock attractive for investors seeking exposure to infrastructure and clean energy expansion. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite