|

|

|

|

|||||

|

|

Intuitive Surgical’s ISRG Ion platform is rapidly scaling, with procedures surging 52% year over year to 35,000 in second-quarter 2025. Yet management’s commentary made clear that Ion’s next growth phase hinges not only on utilization gains but also on product cost optimization. CEO David Rosa emphasized improving Ion’s product costs as a top priority, alongside workflow enhancements and international expansion.

This focus comes at a critical juncture. ISRG’s pro forma gross margin slipped to 67.9% from 70% a year ago, weighed by a higher mix of lower-margin Ion and da Vinci 5 revenue, as well as tariff pressures that reduced margins by about 60 basis points. For the full year, management now expects tariffs to shave roughly 100 basis points off margins. Against this backdrop, Ion’s cost discipline could emerge as a key offset.

Ion remains early in its lifecycle, with 905 installed systems and growing adoption across the United States, Australia, and Korea. As scale builds, management is working to optimize manufacturing and streamline the supply chain. These moves are consistent with Intuitive Surgical’s broader strategy to expand its industrial-scale capabilities and mitigate inflationary and trade-related cost headwinds.

If Intuitive Surgical can materially lower Ion’s production costs while sustaining robust procedure growth, the platform could evolve from a margin drag into a margin lever. With tariffs and input costs expected to pressure profitability in the coming quarters, Ion’s trajectory will be closely watched. Cost efficiency, paired with utilization-driven operating leverage, has the potential to bolster gross margins and preserve Intuitive’s ability to invest in innovation while defending profitability.

In the near term, Ion remains a margin drag, but management’s cost-optimization efforts suggest it could become a margin contributor over time.

Johnson & Johnson’s JNJ MedTech arm advanced its MONARCH bronchoscopy system in 2025. In March, J&J announced FDA 510(k) clearance of “Monarch Quest,” an AI-powered navigation software upgrade for the platform. Monarch Quest leverages NVIDIA’s RTX processors (boosting on-board compute ~260%) and integrates GE HealthCare’s 3D C-arm imaging to improve targeting of peripheral lung nodules.

New clinical evidence further validated Monarch’s benefits. In May, results from the global TARGET trial (679 patients, 21 centers) were published in Chest, reporting that clinicians reached 98.7% of targeted lung lesions using J&J’s Monarch with an 83.2% diagnostic yield. Safety outcomes were comparable to conventional bronchoscopy. J&J cited these results as reinforcing Monarch’s role in expediting early lung cancer diagnosis and further improving its AI-driven guidance capabilities.

Medtronic’s MDT Hugo RAS system also made significant progress between March and September 2025. In April, Medtronic reported that its U.S. Expand URO trial (137 patients) has met the primary safety and effectiveness endpoints, attaining a 98.5% surgical success rate, and that it has submitted Hugo for FDA review for urological procedures.

The company has also completed enrollment in IDE studies of hernia and benign gynecology procedures and launched an oncologic gynecology trial to support future filings. Hugo is already in clinical use in 25+ countries with a growing body of supporting studies.

Momentum continued late in 2025. In July, Hugo’s new LigaSure vessel-sealing instrument earned CE Mark in Europe, expanding the system’s capabilities for gynecologic, general and urologic surgeries. Adoption expanded in Asia — the Seoul National University Hospital performed Hugo’s first cases (prostatectomy and pancreaticoduodenectomy) in May 2025. In September, Medtronic announced that its U.S. hernia trial (193 patients) met all endpoints with a 100% technical success rate. Hugo is now in use in 30+ countries worldwide, bolstering Medtronic’s expectation of FDA clearance (for urology) and broader commercialization in the United States later in 2025.

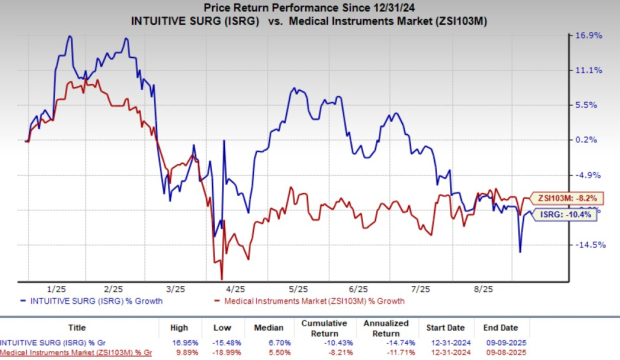

Shares of ISRG have lost 10.4% in the year-to-date period compared with the industry’s decline of 8.2%.

From a valuation standpoint, Intuitive Surgical trades at a forward price-to-earnings ratio of 52.64, above the industry average. But, it is still lower than its five-year median of 71.93. ISRG carries a Value Score of D.

The Zacks Consensus Estimate for Intuitive Surgical’s 2025 earnings implies an 11.3% rise from the year-ago period’s level.

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Mar-08 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Google Grabs Attention, But Funds Go Crazy For This 'Pick-And-Shovel' AI Stock

JNJ

Investor's Business Daily

|

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite