|

|

|

|

|||||

|

|

Lennar Corporation LEN has gained 23.2% in the past three months, underperforming the Zacks Building Products - Home Builders industry, but notably outperforming the broader Zacks Construction sector and the S&P 500 index.

The housing market of the United States is still under pressure due to affordability concerns, given that the mortgage rate has been hovering around 6.5% since February 2025. Many homebuyers are still not used to this high range of interest rates and are backing away from purchasing a new house.

To address this core issue, Lennar has implemented several initiatives, including lowering the average sales price (ASP) and offering necessary purchasing incentives. Although these efforts are showing positive results, they are directly hurting its margins.

Challenging Housing Market: The housing market of the United States seems far from normalizing, given the still-high mortgage rate scenario, keeping homebuyers at bay. This scenario is directly impacting Lennar’s prospects, especially in the near and midterms. As of May 31, 2025, the company’s backlog was 15,538 homes, down 13.1% year over year, with potential housing revenues from backlog down 21.3% to $6.48 billion.

Moreover, to counter the adverse impact of the housing market, the company has been offering homes at a lower ASP, which is reducing its top-line growth as a ripple effect. As of the first half of fiscal 2025, the ASP of home deliveries was $398,000, down from $420,000 in the comparable period a year ago. During the same time frame, the homebuilding revenues declined year over year by 1.2% to $15.13 billion.

Pressures on Margins: Lennar’s focus on maintaining volume by using price incentives and mortgage buydowns has weighed heavily on profitability. During the first six months of fiscal 2025, the gross margin on home sales contracted year over year by 400 basis points (bps) to 18.2%.

Despite management’s longer-term plan to rebuild margins through cost efficiencies, the near-term outlook remains muted. With home prices under pressure and Lennar continuing to deploy incentives to meet affordability thresholds, near-term margin expansion or earnings acceleration seems to be unrealistic. According to the company, the third-quarter fiscal 2025 guidance indicates that margins will remain flat sequentially at 18% and decline from 22.5% a year ago.

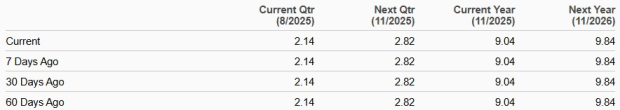

LEN’s earnings estimates for fiscal 2025 and fiscal 2026 have remained unchanged over the past 60 days at $9.04 and $9.84 per share, respectively, depicting limited upside potential for the stock.

The estimated figure for fiscal 2025 indicates a year-over-year decline of 34.8%, while that of fiscal 2026 reflects an improvement of 8.8%.

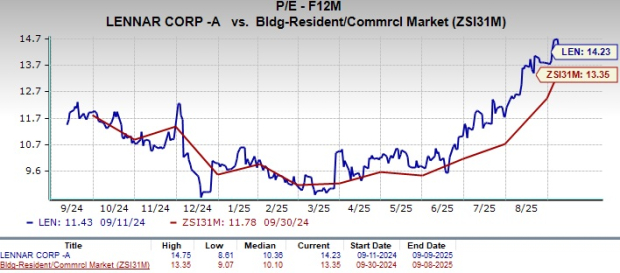

LEN stock is currently trading at a premium compared with its industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 14.23, as shown in the chart below. The overvaluation of the stock, compared with its peers, is making it difficult for investors to figure out a suitable entry point.

Lennar’s 2025 position looks like a volume-first play supported by targeted incentives, while D.R. Horton, Inc. DHI, PulteGroup, Inc. PHM and Toll Brothers, Inc. TOL each lean on different mixes of price support, scale and product positioning.

D.R. Horton is leaning towards elevating incentive spending to increase homebuying. Its orders being the largest in the industry reflect scale-driven resilience and a heavier reliance on promotions to manage affordability. On the other hand, PulteGroup presents a mixed picture, where incentive offerings increased, but its net new orders and backlog trends indicate more regional variability. Toll Brothers operates in a higher-priced, luxury niche, where average delivered prices and profit per home are significantly higher. It utilizes periodic national events and targeted concessions rather than broad-based buydowns, resulting in generally less incentive pressure, but also faces slower transaction volumes compared with the volume builders.

Relative to D.R. Horton and PulteGroup, Lennar’s advantage is operational scale plus a disciplined, high-throughput model that lets it convert incentives into meaningful unit volumes. Toll Brothers’ advantage is basically the absence of luxury pricing.

Lennar’s technology-driven transformation is central to its long-term investment case. It is evolving from a traditional homebuilder into a tech-enabled manufacturing platform, aiming to unlock scalable efficiencies, reduce customer acquisition costs and modernize its entire operating model. Through “Lennar Machine” alongside a new high-tech land management platform, currently being developed in partnership with Palantir Technologies Inc. PLTR, the company is positioning itself for long-term revenue growth and margin expansion, even if it sacrifices short-term growth.

Besides, its focus on an asset-light & land-light model is enabling it to build cash flow and maintain a strong financial position. By shifting from land ownership to land control through third-party land banks, Lennar reduces capital intensity and improves return on invested capital. At the second quarter of fiscal 2025-end, the company reported that 98% of its homesites are now controlled rather than owned, up sharply from 79% a year ago.

As discussed above, Lennar’s efforts to support affordability, through lower ASPs and heavy use of buying incentives, are sustaining home delivery volumes but eroding profitability. Backlog declines of more than 13% and revenue erosion of 21% from backlog further highlight weakening demand visibility.

Despite the company’s operational scale and efficiency-driven model, the overall U.S. housing market remains constrained by mortgage rates near 6.5%, keeping affordability at the forefront of challenges.

Long-term initiatives, such as its asset-light land strategy and technology integration through partnerships, offer credible opportunities for margin recovery and scalable efficiencies. However, these structural advantages are unlikely to offset current cyclical pressures in the housing market.

Thus, after considering muted earnings prospects for fiscal 2025 and a premium valuation, it is prudent for existing investors to shake off this Zacks Rank #4 (Sell) stock from their portfolio until the market trends move in favor of it.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 59 min | |

| 2 hours | |

| 4 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite