|

|

|

|

|||||

|

|

Robinhood Markets HOOD and BGC Group BGC operate in the financial services space. Both leverage technology to innovate within the brokerage domain, with HOOD targeting retail investors through its mass-market trading platform and BGC catering to institutional clients with brokerage and financial technology solutions.

Robinhood has become a household name for commission-free trading, mobile-first investing and recently evolving into a “financial super-app” complete with social networking, AI tools and futures trading. Meanwhile, BGC Group is a globally recognized brokerage and financial technology provider that caters to institutions across asset classes, from fixed income and FX to equities, commodities and derivatives.

Hence, the question arises: Which brokerage stock, Robinhood or BGC Group, offers greater upside today? Let’s break down their fundamentals, financial performance, growth prospects and more before making any decision.

Robinhood is being added to the S&P 500 on Sept. 22, a milestone reflecting its growth and reliability. This also underscores the company’s transformation from a disruptive, commission-free brokerage app to a platform with growing institutional credibility.

Robinhood became extremely popular among younger generations in early 2021, riding on the meme stock wave. However, the GameStop short squeeze exposed fragile risk management and collateral practices, leading to trading curbs and drawing congressional scrutiny, lawsuits and regulatory challenges. This lingered into 2022, as billions in losses highlighted HOOD’s dependence on volatile retail activity. This forced leadership to overhaul capital, collateral and compliance practices while shifting away from hyper-growth toward resilience.

By 2024, Robinhood had regained momentum. A solid industry-wise rebound in retail trading and higher interest income drove a return to profitability, with options and crypto revenues powering record quarterly results. The company expanded its product mix, signaled expansion into crypto derivatives and laid the groundwork for deeper institutional-grade infrastructure. These initiatives positioned it as a diversified brokerage rather than a one-dimensional trading platform.

This year, strong results extended across asset classes, fueled by surging crypto volumes and robust options activity. Improved retention and growing assets under custody highlighted a maturing platform with earnings power beyond meme-era cycles.

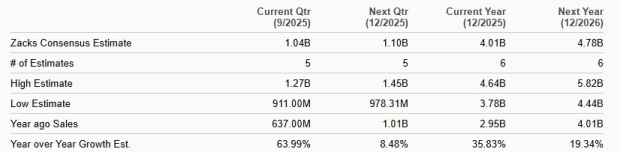

Therefore, HOOD’s top-line growth is likely to be impressive. The Zacks Consensus Estimate for sales indicates growth of 35.8% and 19.3% for 2025 and 2026, respectively.

HOOD Sales Estimates

BGC Group offers voice/hybrid and fully electronic brokerage services. The company’s proprietary Fenics platform powers its electronic trading operations, enabling faster, more efficient transactions. The platform provides trading solutions, market data and analytics to institutional clients.

Following the 2023 spin-off of its commercial real estate arm, BGC Group has sharpened its focus on its capital markets and fintech operations. This shift toward technology-driven services allows the company to enhance margins and reduce dependence on traditional, labor-intensive models.

The acquisitions of OTC Global Holdings, LP (an energy and commodities brokerage firm) and Sage Energy Partners, LP (an energy and environmental brokerage firm) strengthened its growth strategy, making Energy, Commodities and Shipping its largest asset class. Together, these deals are expected to add more than $450 million in annual revenues and cement BGC’s presence in the energy sector. Alongside the 2023 buyouts of ContiCap, Open Energy Group and Trident, BGC Group has bolstered its market share and emerged as a leading global brokerage firm.

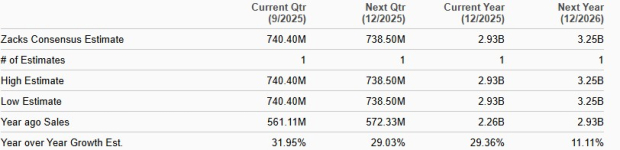

BGC Group is well-positioned to capitalize on growing environmental and energy transition trends and will keep benefiting from consistent global demand for oil, the single largest source of energy. As such, the company’s top-line growth is anticipated to be robust. The Zacks Consensus Estimate for sales suggests an increase of 29.4% and 11.1% for 2025 and 2026, respectively.

BGC Sales Estimates

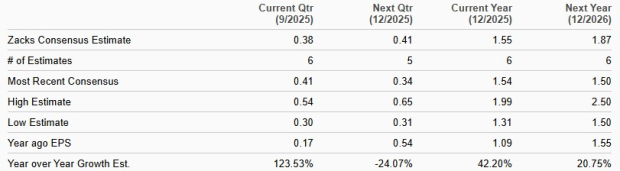

Over the past 30 days, the Zacks Consensus Estimate for HOOD’s 2025 and 2026 earnings has been revised upward. Earnings estimates for 2025 and 2026 imply 42.2% and 20.8% growth, respectively.

Earnings Estimates for HOOD

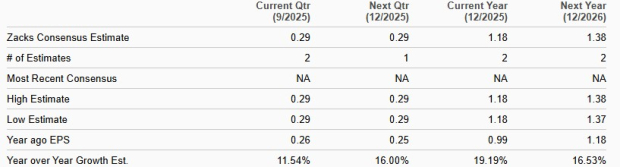

BGC Group’s earnings estimates for 2025 and 2026 have remained unchanged over the past month. The consensus mark for BGC’s 2025 and 2026 earnings suggests a 19.2% and 16.5% rise for 2025 and 2026, respectively.

Earnings Estimates for BGC

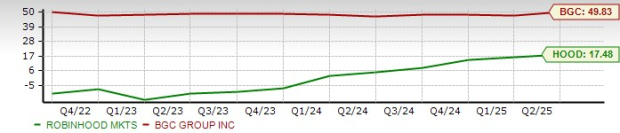

This year, shares of HOOD have skyrocketed 218.1%, while BGC Group is up only 10.7%. Further, the industry has jumped 22.8% in the same time frame.

HOOD & BGC YTD Price Performance

Hence, HOOD has an edge over BGC Group in terms of investor optimism.

Valuation-wise, HOOD is currently trading at the price-to-book (P/TB) of 13.05X. Meanwhile, BGC stock is currently trading at the 12-month trailing P/TB of 4.30X.

HOOD & BGC P/B Ratio

Thus, Robinhood is expensive compared with BGC Group.

BGC Group’s return on equity (ROE) of 49.03% is way higher than HOOD’s 17.48%. This reflects BGC’s efficient use of shareholder funds in generating profits.

ROE

Robinhood and BGC Group represent two distinct approaches within the fintech and brokerage space. HOOD is aggressively expanding its retail-focused ecosystem through innovation, acquisitions and global reach, positioning itself as a next-generation financial services platform. In contrast, BGC is reinforcing its dominance in institutional markets, specifically in energy and commodities, leveraging its advanced trading technologies and acquisitions.

Robinhood appears to offer greater upside than BGC Group, driven by its stronger growth trajectory and expanding market relevance. Inclusion in the S&P 500 validates its credibility, while product diversification into crypto derivatives, options and futures underscores its evolution into a broad fintech platform. Further, bullish investor sentiments and robust sales and earnings growth prospects validate HOOD as a better choice despite its premium valuation.

At present, BGC Group carries a Zacks Rank #3 (Hold), while HOOD sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite