|

|

|

|

|||||

|

|

Oracle bolstered the case for the artificial intelligence spending boom last week. The cloud computing giant’s backlog soared 359% to $455 billion, driven by spending from AI hyperscalers like Amazon, a blockbuster deal with OpenAI, and more.

But there won’t be an AI age without massive energy growth.

Today’s Full Court Finance at Zacks explores three top energy stocks to buy now to ride the AI-driven boom: Talen Energy Corporation, MasTec, Inc., and Constellation Energy.

AI marks a paradigm shift for energy demand. Generative AI platforms such as ChatGPT use 10x the energy of an average Google search. Large data centers consume as much electricity as a midsize city. Electricity demand is set to grow by ~25% by 2030 and ~75% by 2050 from 2023 levels.

The U.S. government is aiming to quadruple nuclear energy capacity by 2050 and restart the domestic uranium industry to help support soaring energy demand.

Amazon, Meta, Microsoft, and Alphabet are using their collective trillion-dollar balance sheets to secure more power across nuclear, natural gas, solar, and beyond. The AI hyperscalers are also supporting R&D and more for small modular nuclear reactors and other cutting-edge energy technologies.

Wall Street, big tech, and the U.S. government know we won’t reach the abundant, AI-driven future that they are all betting on without massive energy industry expansion. This is why next-gen energy stocks such as Vistra, GE Vernova, and others have soared over the last several years, outpacing the likes of Nvidia and other pure-play AI stocks along the way.

Buy Amazon Energy Partner Talen Stock for Huge AI Upside

Talen TLN is a leading independent power producer and infrastructure firm, with a portfolio that includes nuclear, natural gas, and more.

Talen has secured deals with Amazon AMZN to supply nuclear power to its AI data centers.

The stock soared to new all-time highs after it announced a big deal to buy natural gas plants in July. The planned acquisition is projected to expand its annual generation capacity by 50% and boost free cash flow per share by over 40% in 2026 and 50% through 2029. The deal highlights the soaring demand for power from Amazon and other AI companies.

Wall Street loves Talen, with 12 of the 13 brokerage recommendations Zacks has at “Strong Buys.” The company’s earnings outlook has soared since its Q2 release to land TLN a Zacks Rank #1 (Strong Buy). Its earnings per share (EPS) are projected to soar 300% in 2026 on 75% stronger sales.

Talen stock has soared 145% in the past year to nearly triple Nvidia NVDA. Despite trading at new highs, it trades 8% below its Zacks price target.

Better yet, Talen trades at a 70% discount to its highs at 23X forward 12-month earnings. This marks a slight premium to its industry despite its huge outperformance and a small discount to the S&P 500.

Constellation Energy CEG is the largest U.S. nuclear power plant operator.

The company is at the leading edge of the growing relationship between big tech and nuclear, having secured separate 20-year power purchase agreements with Microsoft and Meta. The deals will also help Constellation explore its expansion into next-gen small modular reactors.

The nuclear energy leader is establishing itself as one of the energy giants of the AI age via its planned $27 billion deal to buy natural gas and geothermal powerhouse Calpine—expected to close in Q4 2025. The acquisition creates the largest clean energy firm and expands Constellation’s footprint into power-hungry, tech-heavy Texas and California.

Wall Street also loves Constellation because it raised its dividend by 10% in 2025 after it boosted its payout by 25% in 2024. The nuclear energy powerhouse is expected to grow its adjusted earnings by 9% in 2025 and 26% in 2026, as part of its “visible, double-digit long-term base EPS growth backed by the Nuclear Production Tax Credit.”

CEG stock has charged 195% in the past two years, including a 45% climb in 2025. Yet it trades 8% below its August peak and looks ready to possibly breakout after retaking its 50-day moving average. Constellation also trades at a 20% discount to its highs at 29.6X forward earnings.

MasTec, Inc. MTZ is a leading national infrastructure construction company, helping build, install, maintain, and upgrade massive projects across energy, communication, and utility infrastructure.

MTZ benefits directly from the AI data center boom, as well as the broader energy transition and electrification, grid hardening and expansion, and other key long-term trends.

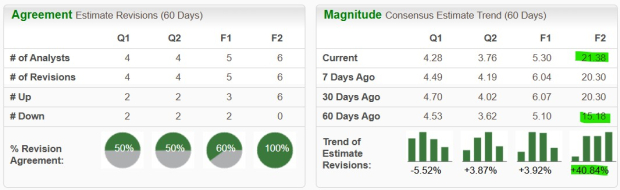

MTZ’s 18-month backlog climbed 23% YoY last quarter to $16.5 billion, driven by “significant” new awards in its “Clean Energy and Infrastructure” division. MasTec’s recent upward earnings revisions help it earn a Zacks Rank #2 (Buy)—they also extend a long-term trend of positive revisions. The company is projected to expand its EPS by 58% in 2025 and another 22% next year.

On top of that, 19 of the 20 brokerage recommendations Zacks has are at “Strong Buys.” MasTec’s Building Products-Heavy Construction industry ranks in the top 2% of 245% Zacks industries, boosting its bull case since studies have shown that roughly half of a stock's price movement can be attributed to its industry group.

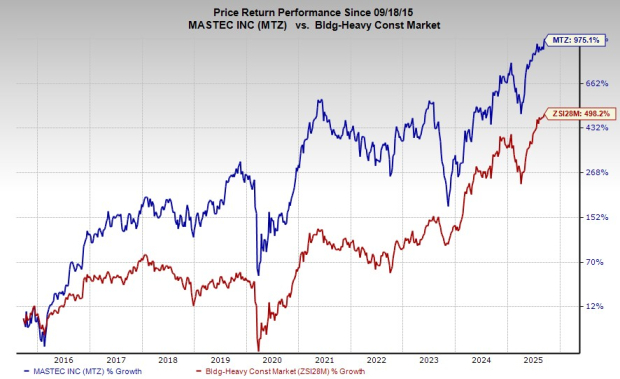

MasTec stock has surged 1,700% in the past 15 years to triple the S&P 500 and blow away its highly ranked industry’s 1000%. The stock has ripped 65% in the past 12 months to trade near all-time highs alongside the market. And yet, MTZ trades around 45% below its highs over the past five years at 28.2X forward 12-month earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 18 min | |

| 19 min | |

| 41 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Tech Firms Arent Just Encouraging Their Workers to Use AI. Theyre Enforcing It.

AMZN

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite