|

|

|

|

|||||

|

|

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Addus HomeCare (NASDAQ:ADUS) and the best and worst performers in the senior health, home health & hospice industry.

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

The 7 senior health, home health & hospice stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 2%.

In light of this news, share prices of the companies have held steady as they are up 4.4% on average since the latest earnings results.

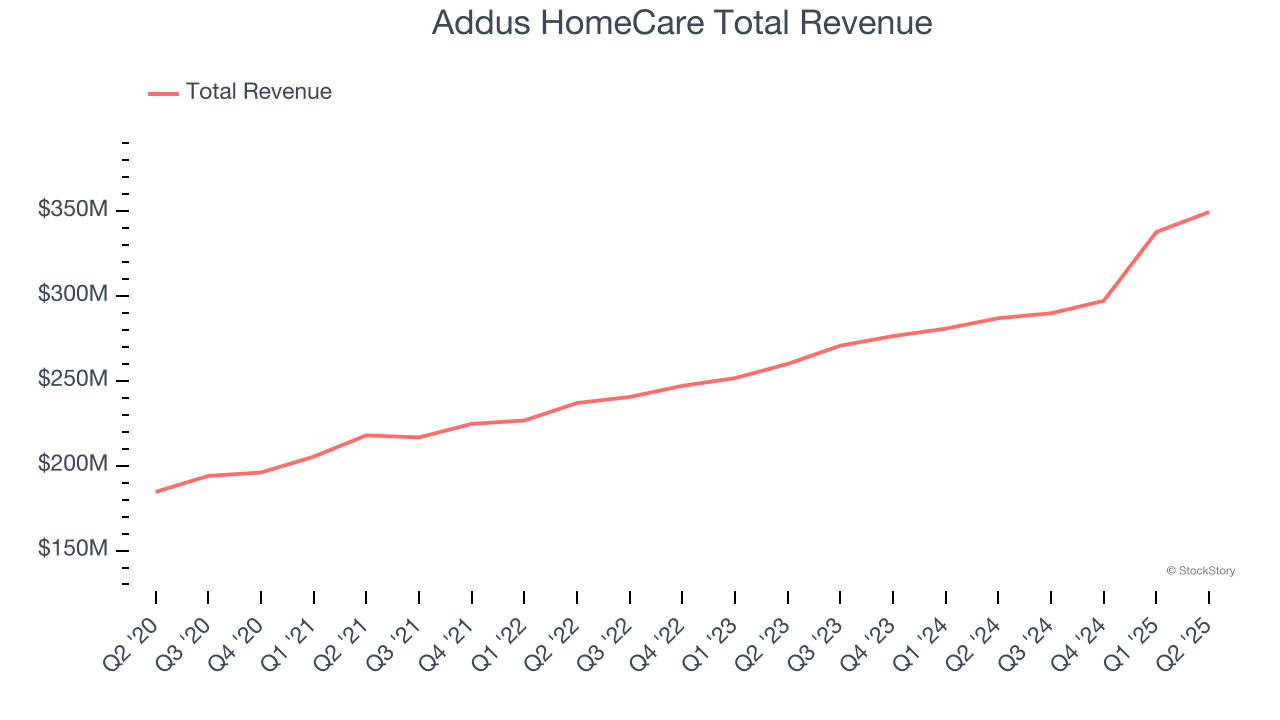

Serving approximately 66,000 clients across 22 states with a focus on "dual eligible" Medicare and Medicaid beneficiaries, Addus HomeCare (NASDAQ:ADUS) provides in-home personal care, hospice, and home health services to elderly, chronically ill, and disabled individuals.

Addus HomeCare reported revenues of $349.4 million, up 21.8% year on year. This print exceeded analysts’ expectations by 0.8%. Despite the top-line beat, it was still a mixed quarter for the company with a beat of analysts’ EPS estimates but a slight miss of analysts’ sales volume estimates.

Commenting on the results, Dirk Allison, Chairman and Chief Executive Officer, said, “Addus delivered another strong financial and operating performance for the second quarter of 2025, as we continued to execute our strategy with consistent and favorable results. Notably, our net service revenue for the second quarter of 2025 was up 21.8% year-over-year, and adjusted EBITDA increased 24.5% over the same period last year. These results reflect solid organic growth and include the additional revenue from the personal care operations of Gentiva, which we acquired on December 2, 2024. We continue to see robust demand for our services, reflecting the growing recognition of the value and cost-effectiveness of home-based care. With our proven operating model across the continuum of care and expanding scale in key markets, Addus is well positioned to meet this demand and continue to capitalize on additional growth opportunities.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $107.99.

Read our full report on Addus HomeCare here, it’s free.

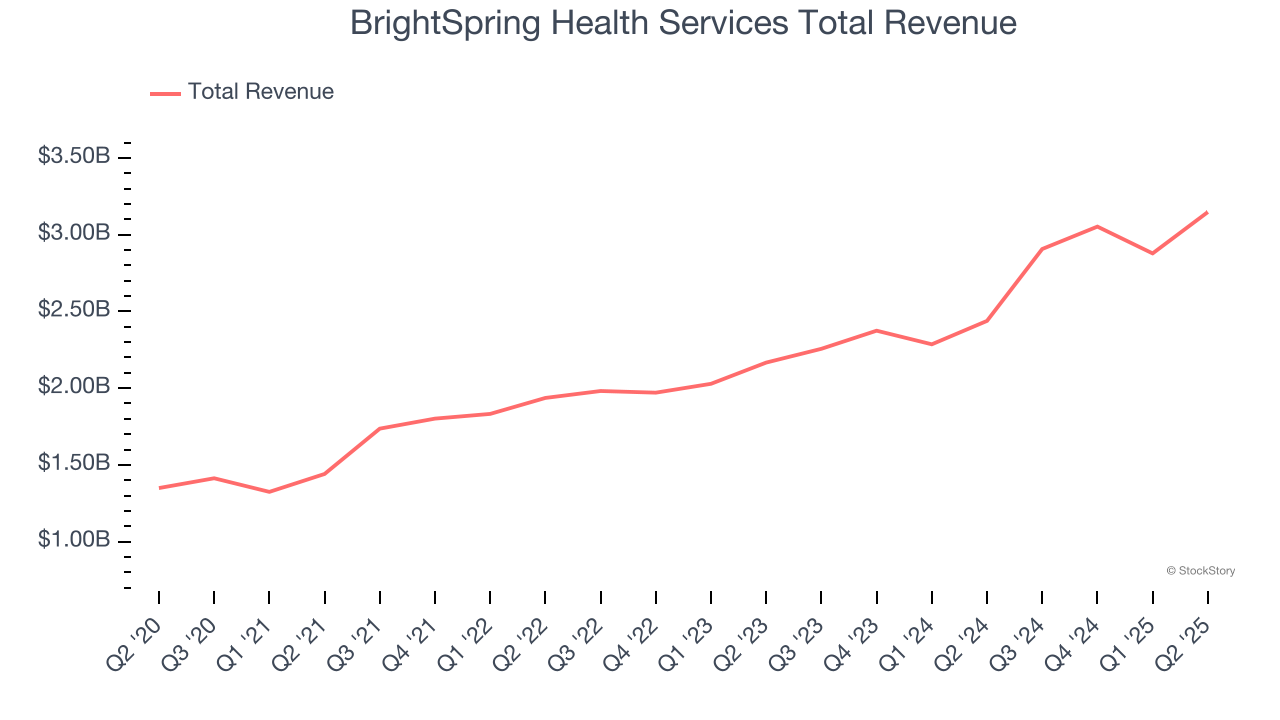

Founded in 1974, BrightSpring Health Services (NASDAQ:BTSG) offers home health care, hospice, neuro-rehabilitation, and pharmacy services.

BrightSpring Health Services reported revenues of $3.15 billion, up 29.1% year on year, outperforming analysts’ expectations by 5.2%. The business had a very strong quarter with a beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

BrightSpring Health Services pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 31.7% since reporting. It currently trades at $27.20.

Is now the time to buy BrightSpring Health Services? Access our full analysis of the earnings results here, it’s free.

With a unique business model combining end-of-life care and household services, Chemed (NYSE:CHE) operates two distinct businesses: VITAS, which provides hospice care for terminally ill patients, and Roto-Rooter, which offers plumbing and water restoration services.

Chemed reported revenues of $618.8 million, up 3.8% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 2% since the results and currently trades at $457.36.

Read our full analysis of Chemed’s results here.

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE:BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

Brookdale reported revenues of $812.9 million, up 4.6% year on year. This number came in 0.6% below analysts' expectations. It was a softer quarter as it also produced a significant miss of analysts’ EPS estimates.

Brookdale had the weakest performance against analyst estimates among its peers. The stock is down 3.3% since reporting and currently trades at $7.53.

Read our full, actionable report on Brookdale here, it’s free.

Spun off from The Ensign Group in 2019 to focus on non-skilled nursing healthcare services, Pennant Group (NASDAQ:PNTG) operates home health, hospice, and senior living facilities across 13 western and midwestern states, serving patients of all ages including seniors.

The Pennant Group reported revenues of $219.5 million, up 30.1% year on year. This result beat analysts’ expectations by 4.2%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ full-year EPS guidance estimates.

The Pennant Group delivered the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 9.4% since reporting and currently trades at $24.36.

Read our full, actionable report on The Pennant Group here, it’s free.

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-18 | |

| Feb-12 | |

| Feb-09 | |

| Dec-30 | |

| Dec-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite