|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Mosaic Company MOS and Nutrien Ltd. NTR are two of the biggest players in the fertilizer space, producing key nutrients like potash and phosphate. The underlying strength of the agricultural market and attractive farm economics are spurring demand for fertilizers globally. Farmer economics remain favorable in most global growing regions due to strong crop demand and affordable inputs.

Strong grower economics, improved affordability and low inventory levels are driving potash demand globally. The phosphate market is also benefiting from higher global demand and low producer and channel inventories. Strong demand and supply tightness have also led to an uptick in phosphate and potash prices this year.

Let’s dive deep and closely compare the fundamentals of these two major fertilizer producers to determine which one is a better investment option now amid the current environment.

MOS is benefiting from the strong demand for phosphate and potash, aided by favorable agricultural conditions. Its actions to improve its operating cost structure through transformation plans are expected to boost profitability.

Mosaic remains on track with its cost-reduction plan, which is now expected to drive $250 million in run-rate cost reductions by the end of 2026, having already achieved $150 million in cost reduction targets. The additional cost reductions are expected to be realized through optimization of the supply chain, automation of administrative functions, absorption of fixed costs and operational cost cuts.

MOS also remains committed to carrying out investments with high returns and moderate capital expenditures. It has completed the 800,000-ton MicroEssentials capacity conversion, with volumes expected to rise 25% in 2025. The Esterhazy Hydrofloat project, which added 400,000 tons in milling capacity, is complete and produced the first potash tons in July 2025, with a ramp-up expected by the end of the year.

Hydrofloat will enable Mosaic to produce low-cost potash tons. The construction of a new blending and distribution center in Palmeirante, Brazil, was also completed in July 2025, supporting the company’s long-term growth objectives in Brazilian agriculture markets. The facility is expected to enable Mosaic Fertilizantes to increase overall sales by 1 million tons.

MOS generates substantial cash flows, which enable it to finance its strategic growth investment, pay down debt and drive shareholder value. The company generated an operating cash flow of $610 million and a free cash flow of $305 million in the second quarter of 2025. It expects to generate stronger cash flow in the second half of 2025, allowing debt reductions and shareholder returns through dividends and buybacks.

Further, Mosaic offers a healthy dividend yield of roughly 2.6% at the current stock price. It has a payout ratio of 49% (a ratio below 60% is a good indicator that the dividend will be sustainable). MOS has a five-year annualized dividend growth rate of 41.6%.

Nutrien is benefiting from healthy demand for crop nutrients, its actions to reduce costs and strategic acquisitions. Improving fertilizer prices are providing further support. It is seeing healthy fertilizer demand in its major markets.

The company expects an increase in U.S. corn acreage in 2025 and sees strong demand for crop inputs. NTR’s second-quarter and first-half 2025 potash sales volumes reached record highs, driven by favorable potash affordability and robust consumption in North America and major offshore markets. It has raised potash sales volume guidance to 13.9-14.5 million tons, driven by anticipated higher global demand.

NTR should also gain from acquisitions and increased adoption of its digital platform. It continues to expand its footprint in Brazil through acquisitions. It is expected to continue pursuing targeted opportunities in its core markets. The company expects to utilize part of its free cash flow for incremental growth investments, including tuck-in acquisitions in the retail business in 2025.

Cost and operational efficiency initiatives are also expected to aid the company’s performance. NTR remains focused on lowering the cost of production in the potash business. The company has announced several strategic actions to reduce its controllable costs and boost free cash flow. NTR has accelerated operational efficiency and cost-saving initiatives and anticipates achieving around $200 million of total savings in 2025. The company is ahead of schedule on this cost-reduction goal.

NTR generates substantial cash flows and has a strong balance sheet, enabling it to finance its strategic growth investment, pay down debt and drive shareholder value. At the end of the second quarter, Nutrien had cash and cash equivalents of $1,387 million, up around 38% year over year. Cash provided by operating activities surged 40% year over year to $2,538 million for the quarter, supported by higher selling prices and sales volumes.

Further, Nutrien returned $0.8 billion to its shareholders in the first half of 2025 through dividends and share buybacks. NTR offers a healthy dividend yield of roughly 3.8% at the current stock price. It has a payout ratio of 66%. NTR has a five-year annualized dividend growth rate of 6.6%.

However, lower operating rates are expected to weigh on the company’s nitrogen volumes in the back half of 2025. The company expects lower ammonia operating rates in the second half. Operating rates are expected to fall to roughly 85% in the second half from around 98% in the first half. Planned turnaround activities at Nutrien’s North American plants are expected to impact operating rates. Exposure to volatile input costs and supply tightness could also pressure margins.

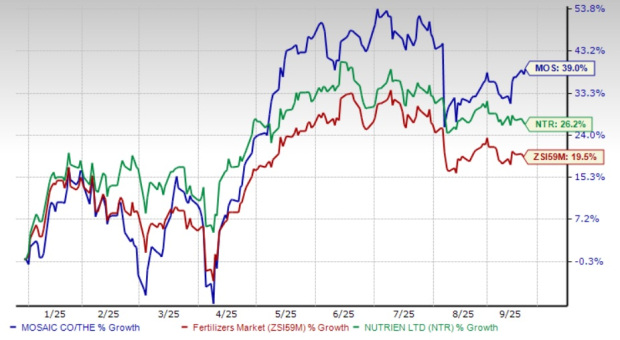

The MOS stock is up 39% year to date, while NTR has gained 26.2% compared with the Zacks Fertilizers industry’s rise of 19.5%.

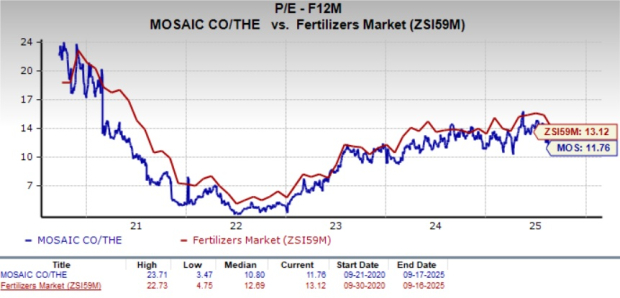

MOS is currently trading at a forward 12-month earnings multiple of 11.76. This represents a roughly 10.4% discount when stacked up with the industry average of 13.12X.

NTR is currently trading at a forward 12-month earnings multiple of 12.79, above MOS but below the industry.

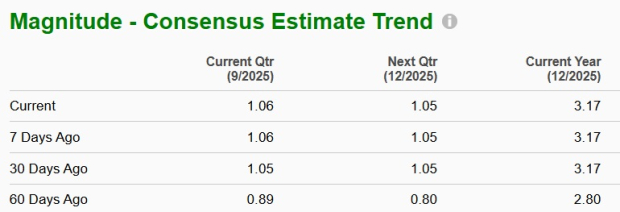

The Zacks Consensus Estimate for Mosaic’s 2025 sales implies a year-over-year rise of 16.8%. The same for EPS suggests a 60.1% year-over-year increase. The EPS estimates for 2025 have been trending higher over the past 60 days.

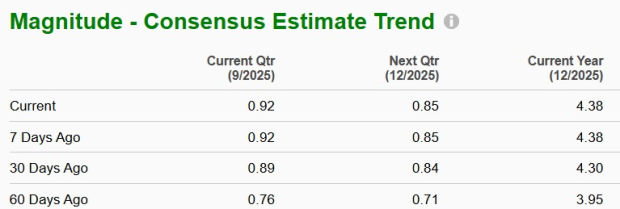

The consensus estimate for Nutrien’s 2025 sales and EPS implies a year-over-year rise of 3.4% and 26.2%, respectively. The EPS estimates for 2025 have been trending northward over the past 60 days.

Both Mosaic and Nutrien are benefiting from strong global demand for fertilizers, thanks to the favorable agricultural conditions and supportive farm economics. Healthy demand, improving fertilizer prices and strategic growth initiatives are expected to aid their performance. Cost-reduction initiatives should also boost margins. MOS appears to have a slight edge over NTR due to its more attractive valuation and higher dividend growth rate. In addition, Mosaic’s higher earnings growth projections suggest that it may offer better investment prospects in the current market environment.

MOS currently carries a Zacks Rank #2 (Buy), while NTR has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 9 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 |

Walmart Stock, Parade Of Gold Leaders Headline Another Busy Earnings Calendar

NTR

Investor's Business Daily

|

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite