|

|

|

|

|||||

|

|

Guidewire Software (GWRE) recently unveiled a new step in its mission to empower Japanese insurers by building market-specific functionality for PolicyCenter on Guidewire Cloud. This initiative reflects Guidewire’s continued investment in helping insurers in Japan accelerate digital transformation and deliver superior customer experiences. In April 2025, it announced a $60 million investment over the next five years to expand its operations in Japan. The substantial investment aims to empower insurers with advanced capabilities by delivering localized, cloud-based core system features that enhance agility, ensure compliance and promote profitable growth.

To speed up delivery, Guidewire is partnering with Capgemini in Japan (Capgemini) and Nomura Research Institute (“NRI”). Capgemini, a long-standing Guidewire PartnerConnect Consulting Global Strategic partner, brings global expertise in insurance technology transformation. NRI, one of Japan’s most respected consulting firms, provides local market knowledge and trusted advisory capabilities.

Previously, Japanese insurers used accelerators to customize Guidewire’s solutions for local needs. Now, these features will be integrated into PolicyCenter, ensuring a smoother, faster and more efficient deployment process. This development builds on Guidewire’s earlier success with ClaimCenter extensions for Japan, further aligning its core systems with the region's unique requirements.

By embedding local requirements directly into PolicyCenter on the cloud, Guidewire is enabling insurers to improve agility to respond faster to market and regulatory changes and deliver better customer experiences with modern, cost-effective cloud solutions.

Guidewire faces mounting risks as its growing reliance on Tier 1 deals heightens concentration concerns, with any slowdown in North America or Europe likely stalling ARR momentum. Rising operating expenses add further pressure on profitability amid a weak macro backdrop. Further, international expansion into markets like Japan, Brazil and Belgium introduces forex volatility, regulatory hurdles and integration risks that could strain margins and delay revenue contributions.

However, Guidewire is seeing strong momentum in its Cloud business. The company has built a robust ecosystem of 27,000 practitioners across 38 system integrators and continues to enhance its platform with digital frameworks, automation and other services to drive subscription growth. In the last reported quarter, Guidewire secured 19 deals (57 for the year), including nine Tier 1 wins.

The 10-year Liberty Mutual deal was highlighted by the management as a milestone moment. Endorsement of the Guidewire platform by Liberty Mutual, which is a key Tier 1 insurer, provides validation of platform maturity, scalability and referenceability. Liberty is transitioning its on-premises ClaimCenter instance to the cloud. It has also made a decade-long commitment to adopt PolicyCenter on the Guidewire Cloud platform.

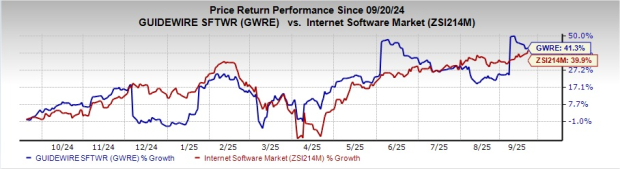

Guidewire currently carries a Zacks Rank #3 (Hold). Shares of the company have surged 41.3% in the past year compared with the Zacks Internet - Software industry's rise of 39.9%.

Ubiquiti Inc. (UI) carries a Zacks Rank #1(Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here

In the last reported quarter, it delivered an earnings surprise of 61.29%. Ubiquiti invests significantly in research and development activities to develop innovative products and state-of-the-art technology, expanding its addressable market and staying at the cutting edge of networking technology. The company believes its new product pipeline will help increase average selling prices for high-performance, best-value products, thus boosting the top line. Ubiquiti is witnessing healthy traction in the Enterprise Technology segment.

Headquartered in Carlsbad, CA, Viasat Inc. (VSAT) carries a Zacks Rank #2 (Buy). It designs, develops and markets advanced digital satellite telecommunications and other wireless networking and signal processing equipment. It provides high-bandwidth, high-performance communication solutions to the public, as well as to military, enterprise, and government agencies. Viasat’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models.

InterDigital, Inc. (IDCC) currently carries a Zacks Rank #2. The company delivered an average earnings surprise of 54.27% in the trailing four quarters.

InterDigital’s global footprint, diversified product portfolio and the ability to penetrate different markets are impressive. It is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. Apart from its strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive significant value, considering the massive size of the market it licenses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 16 hours | |

| 17 hours | |

| 21 hours | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite