|

|

|

|

|||||

|

|

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Amphenol (NYSE:APH) and its peers.

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

The 10 electronic components & manufacturing stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.7% while next quarter’s revenue guidance was in line.

Luckily, electronic components & manufacturing stocks have performed well with share prices up 11.4% on average since the latest earnings results.

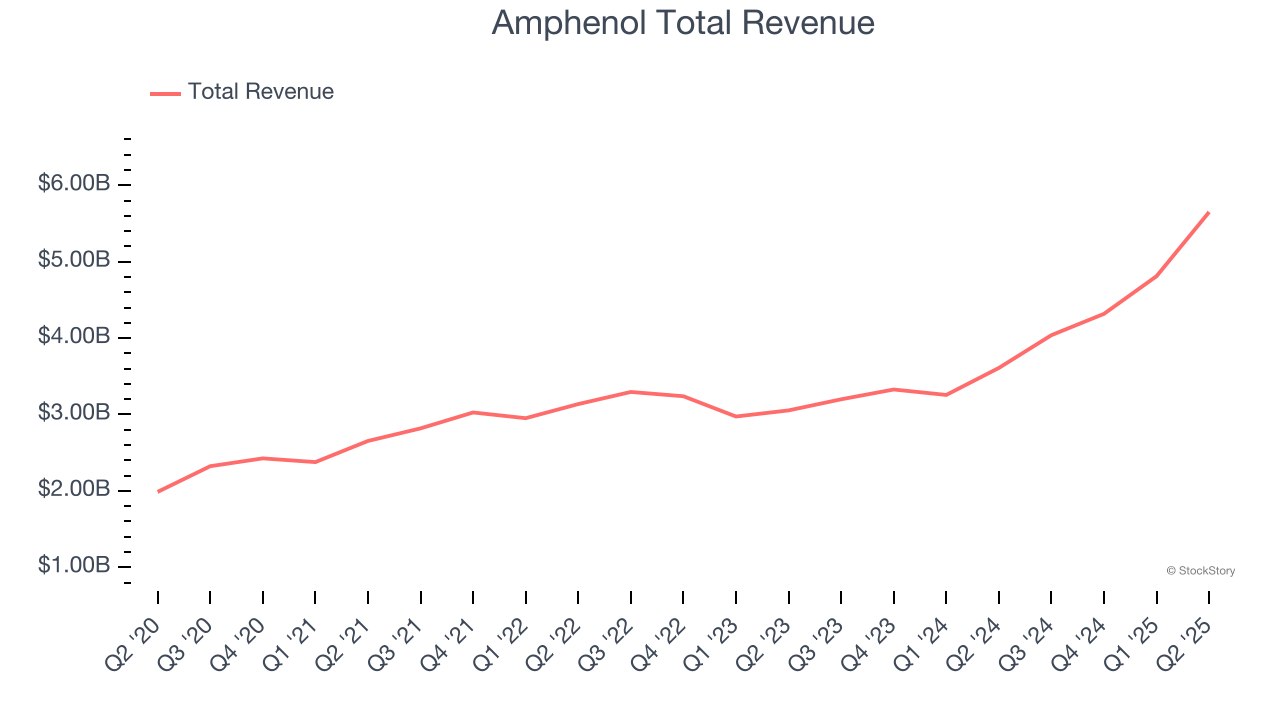

With over 90 years of connecting the world's technologies, Amphenol (NYSE:APH) designs and manufactures connectors, cables, sensors, and interconnect systems that enable electrical and electronic connections across virtually every industry.

Amphenol reported revenues of $5.65 billion, up 56.5% year on year. This print exceeded analysts’ expectations by 11.9%. Overall, it was a very strong quarter for the company with sale and EPS guidance for next quarter exceeding analysts' estimates.

“We are pleased to have closed the second quarter of 2025 with record sales and Adjusted Diluted EPS, both significantly exceeding the high end of our guidance,” said Amphenol President and Chief Executive Officer, R. Adam Norwitt.

Amphenol achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 22.2% since reporting and currently trades at $124.40.

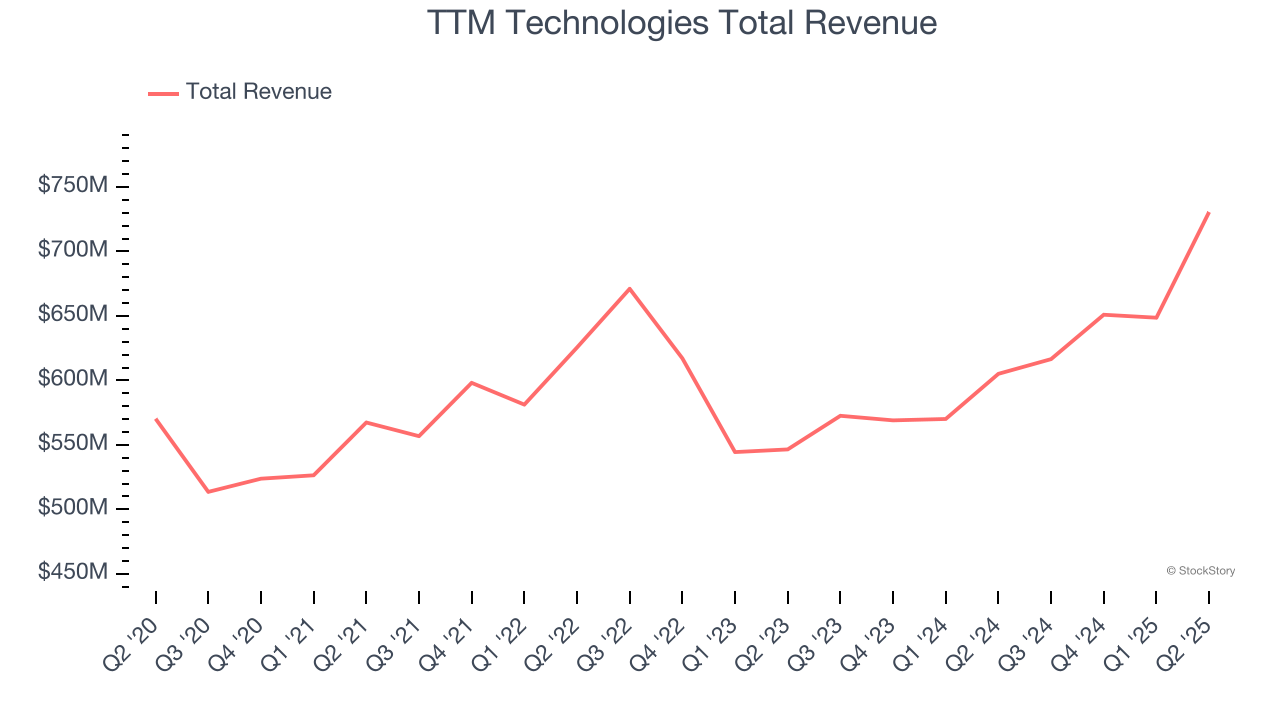

As one of the world's largest printed circuit board manufacturers with facilities spanning North America and Asia, TTM Technologies (NASDAQ:TTMI) manufactures printed circuit boards (PCBs) and radio frequency (RF) components for aerospace, defense, automotive, and telecommunications industries.

TTM Technologies reported revenues of $730.6 million, up 20.7% year on year, outperforming analysts’ expectations by 9%. The business had an exceptional quarter with an impressive beat of analysts’ EPS guidance for next quarter estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 7.5% since reporting. It currently trades at $52.40.

Is now the time to buy TTM Technologies? Access our full analysis of the earnings results here, it’s free.

With roots dating back to 1832, making it one of America's oldest continuously operating companies, Rogers (NYSE:ROG) designs and manufactures specialized engineered materials and components used in electric vehicles, telecommunications, renewable energy, and other high-performance applications.

Rogers reported revenues of $202.8 million, down 5.3% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS guidance for next quarter estimates.

Interestingly, the stock is up 24.7% since the results and currently trades at $81.75.

Read our full analysis of Rogers’s results here.

Operating as a critical behind-the-scenes partner for complex technology products since 1979, Benchmark Electronics (NYSE:BHE) provides advanced manufacturing, engineering, and technology solutions for original equipment manufacturers across aerospace, medical, industrial, and technology sectors.

Benchmark reported revenues of $642.3 million, down 3.5% year on year. This result beat analysts’ expectations by 0.6%. Zooming out, it was a mixed quarter as it also recorded a narrow beat of analysts’ EPS guidance for next quarter estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

The stock is up 2.2% since reporting and currently trades at $40.13.

Read our full, actionable report on Benchmark here, it’s free.

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE:KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

Knowles reported revenues of $145.9 million, down 28.7% year on year. This print topped analysts’ expectations by 4.4%. It was a very strong quarter with revenue and EPS guidance for the next quarter topping analysts’ expectations.

Knowles had the slowest revenue growth among its peers. The stock is up 21.1% since reporting and currently trades at $22.59.

Read our full, actionable report on Knowles here, it’s free.

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| 6 hours | |

| 6 hours | |

| 6 hours | |

| Feb-22 | |

| Feb-20 |

This AI Stock Roars To Profit, Builds Bullish Base Ahead Of This Key Catalyst

APH

Investor's Business Daily

|

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-16 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite