|

|

|

|

|||||

|

|

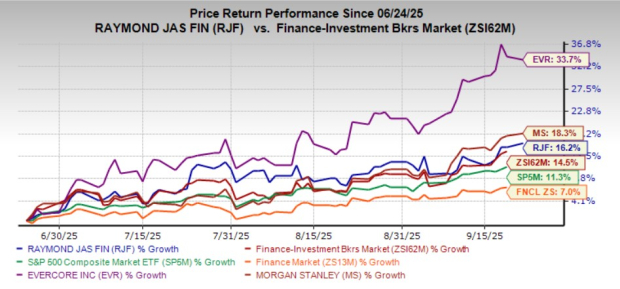

Raymond James RJF shares touched a new 52-week high of $176.65 during Monday’s trading session. Over the past three months, the stock has risen 16.2%, outperforming the industry, the Zacks Finance sector and the S&P 500 index. However, RJF stock underperformed its peers — Morgan Stanley MS and Evercore EVR.

Three-Month Price Performance

Can RJF sustain the ongoing momentum and offer more upside potential for your portfolio? Let us find out.

Fed Rate Cuts to Aid Investment Banking Income: On Sept. 17, the Federal Reserve implemented a rate cut for the first time in 2025, reducing the lending rate by 25 basis points and signaling two more cuts before the end of the year. This was driven by ongoing inflationary pressures and a weaker job market as the effects of the Trump administration’s tariff policies began to kick in. Hence, industry-wide deal-making activities, which have already rebounded following a brief lull in April and May, are expected to get further impetus.

As global deal-making came to a grinding halt at the beginning of 2022, it weighed on RJF’s investment banking (IB) business. The company’s IB fees (in the Capital Markets segment) declined in 2022 and 2023. The trend has reversed since then. Ramond James’ IB fees grew 7% in fiscal 2024, with the momentum continuing during the first nine months of fiscal 2025.

Raymond James will likely witness a solid improvement in IB fees in the upcoming period, driven by a healthy pipeline and active merger & acquisition (M&A) market.

Strategic Acquisitions & Expansion: Raymond James has accomplished several opportunistic deals over the past years, which have helped expand into Europe and Canada. In fiscal 2023, the company acquired Canada-based Solus Trust Company Limited. In fiscal 2022, it acquired SumRidge Partners, TriState Capital Holdings and the U.K.-based Charles Stanley Group PLC.

These deals, along with several past ones, have positioned RJF well for future growth. Management looks forward to actively growing through acquisitions to strengthen the Private Client Group and Asset Management segments. In May 2024, the company announced that it had forayed into the lucrative private credit business through a partnership with Eldridge Industries.

Impressive Capital Distributions: RJF has an impressive record of regularly raising dividends over the last decade. The last dividend hike of 11.1% was announced in December 2024. The company increased its dividend five times in the past five years, and its payout has grown 18.14% over the same time. RJF's payout ratio currently sits at 19% of earnings.

Dividend Yield

Similarly, Morgan Stanley has increased its dividends five times over the past five years, while Evercore has hiked its dividend six times in the same time frame.

Raymond James has a share repurchase plan in place. In December 2024, it authorized the repurchase of shares worth up to $1.5 billion, which replaced the previous authorization. As of June. 30, 2025, $749 million remained available under the buyback authorization. Given its robust capital position and lower dividend payout ratio compared with peers, Raymond James is expected to sustain efficient capital distributions.

Raymond James’ 12-month forward price to earnings (P/E) ratio of 15.15X is slightly below the industry’s 15.31X. This indicates that its shares are trading at a discount.

Forward 12-Month P/E Ratio

Morgan Stanley has a forward 12-month P/E of 17.18X, while Evercore is trading at 17.92X. This implies RJF is expensive than both of them.

Unsustainable Brokerage Fee Given Capital Markets Volatility: Raymond James is heavily reliant on the performance of capital markets to generate brokerage fees. Though higher volatility and client activity led to an improved trading performance in 2020 and 2021, the metric declined as market activity normalized. The metric witnessed a negative compound annual growth rate (CAGR) of 3.7% over the last four fiscal years (2020-2024).

Though brokerage fees increased in the first nine months of fiscal 2025, the volatile nature of the capital markets business and expectations that it will gradually normalize toward the pre-pandemic level are likely to make growth less sustainable.

Rising Expenses to Hurt Profitability: Raymond James has been recording a continued increase in expenses. The company’s non-interest expenses recorded a CAGR of 8.5% over the last three fiscal years (2021-2024), with the uptrend persisting during the first nine months of fiscal 2025. This was due to higher compensation costs and bank loan loss provisions.

Going forward, higher compensation costs, technological investments, regulatory changes, inorganic expansion efforts, and a highly competitive environment will likely lead to a rise in expenses.

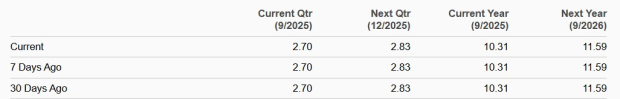

Over the past month, the Zacks Consensus Estimate for earnings of $10.31 and $11.59 per share for fiscal 2025 and fiscal 2026, respectively, has remained unchanged.

Estimate Revision Trend

Further, the projected figures imply growth of 2.6% for fiscal 2025 and 12.5% for fiscal 2026.

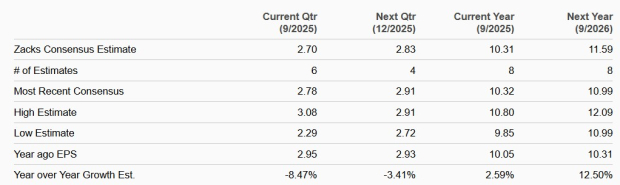

Earnings Estimates

Solid IB business prospects, given interest rate cut, organic and inorganic growth efforts to diversify operations and a strong balance sheet will aid RJF’s financials. An attractive valuation is another positive.

However, unsustainable brokerage fee income on account of normalizing client activity and elevated expenses are roadblocks. Also, mixed analyst sentiments pose near-term concerns.

Thus, RJF stock remains a cautious bet for investors at the moment. Those who own the stock can hold it for now.

Raymond James currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 11 hours | |

| 13 hours | |

| 19 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite