|

|

|

|

|||||

|

|

Both Rigel Pharmaceuticals RIGL and Amicus Therapeutics FOLD are developing and commercializing treatments for rare medical conditions where existing therapies are limited, with the goal of establishing leadership in their respective areas.

While Rigel, a small biotech, is developing drugs targeting immunology, oncology, and rare diseases, Amicus, a mid-cap stock, is developing therapies for rare and genetic diseases, particularly lysosomal storage disorders.

Rigel’s lead drug is Tavalisse, an oral spleen tyrosine kinase inhibitor, approved for treating adult patients with chronic immune thrombocytopenia (“ITP”) who have had an insufficient response to a previous treatment. Meanwhile, Amicus’ lead product is Galafold, which is the first oral precision medicine approved for treating patients living with Fabry disease, having amenable genetic variants.

Let's examine the fundamentals of the two stocks to make a prudent choice.

Tavalisse, Rigel’s first product, was launched in the United States in 2018. Tavalisse, which has been driving the majority of the company’s revenues, generated sales of $68.5 million in the first half of 2025, up around 44% year over year. The drug remains the key top-line driver for RIGL.

Tavalisse sales are being driven by continued strong new patient demand and the momentum is expected to continue in the second half of 2025.

Rigel is also making good progress with its second FDA-approved product, Rezlidhia (olutasidenib). The drug is indicated for treating relapsed/refractory acute myeloid leukemia (“AML”) with a susceptible IDH1 mutation. Rezlidhia sales increased 31% year over year during the first half of 2025.

Rigel added a third product, Gavreto (pralsetinib), to its portfolio after it acquired commercial rights to the drug from Blueprint Medicines, now part of Sanofi SNY, in 2024. The company started recognizing Gavreto sales from June 2024. Incremental sales from the drug boosted Rigel’s top line during the first half of 2025.

Looking ahead, sales are expected to grow steadily as Rigel expands its commercial footprint and strengthens its marketing infrastructure, driving continued momentum for Tavalisse while focusing on improving demand for Rezlidhia and Gavreto.

Owing to the strong sales performance of its marketed products, Rigel increased its total revenue guidance last month. The company now projects total revenues of $270-$280 million for 2025, compared with the previous expectation of $200-$210 million.

Rigel has R289 in its pipeline, a novel dual IRAK1 and IRAK4 inhibitor, in an early-stage study for treating patients with lower-risk myelodysplastic syndrome (MDS). The company is also exploring Rezlidhia’s (olutasidenib) use beyond relapsed or refractory IDH1-mutated AML into other cancers with IDH1 mutations, such as recurrent glioma.

Amicus’ first marketed product, Galafold, has shown solid uptake since its launch. The sales of the drug have been rising consistently year over year. In the first six months of 2025, Galafold generated sales worth $233.1 million, increasing around 11% on a year-over-year basis. Label expansion, combined with approvals in additional geographies, drove sales in recent quarters. The drug remains the key revenue driver for the company.

Also, Galafold has a strong IP portfolio in the United States, providing patent protection through 2038.

Amicus’ Pombiliti (cipaglucosidase alfa) + Opfolda (miglustat), a two-component therapy, is approved for treating adults with late-onset Pompe disease (LOPD). The two-component therapy is also approved in Europe.

The approval helped FOLD tap into a market with a significant commercial opportunity. During the first six months of 2025, the combo drug generated sales worth $46.8 million, up around 74% on a year-over-year basis.

The combination drug has been witnessing a steady launch so far, which continues to build momentum with an increasing rate of commercial patient starts in new markets.

Per management, more patients are now switching to Pombiliti and Opfolda from Sanofi’s Pompe disease drugs, Myozyme/Lumizyme, as well as from Nexviazyme. The company expects the benefit of patient starts in new launch markets to be more weighted toward the second half of 2025.

However, FOLD remains heavily reliant on Galafold for its overall revenue growth, making the company vulnerable to any regulatory setbacks for the drug. Though Pombiliti + Opfolda has been seeing a strong launch, it is yet to generate incremental sales. Stiff competition from established players like Sanofi in the Pompe disease market remains a headwind.

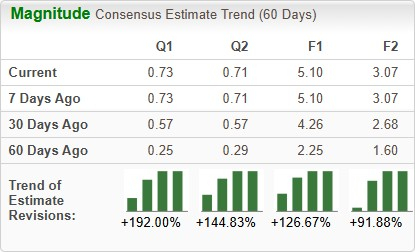

The Zacks Consensus Estimate for Rigel’s 2025 sales and earnings per share (EPS) implies a year-over-year increase of around 57% and 415%, respectively. EPS estimates for both 2025 and 2026 have been trending upward over the past 60 days.

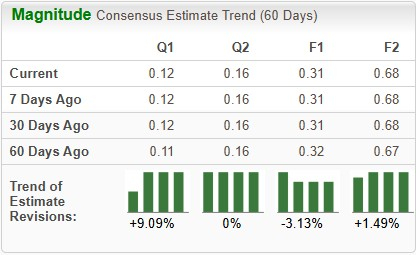

The Zacks Consensus Estimate for Amicus’ 2025 sales and EPS implies a year-over-year increase of around 18% and 29%, respectively. While EPS estimates have been decreasing for 2025, the same for 2026 have been trending upward over the past 60 days.

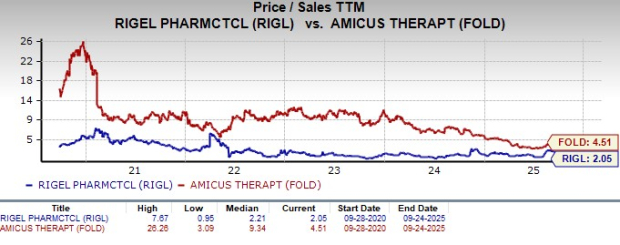

Year to date, shares of RIGL have rallied 80.1%, while those of FOLD have decreased 11.3%. In comparison, the industry has returned 11.7%, as seen in the chart below.

From a valuation standpoint, Amicus is more expensive than Rigel, going by the price-to-sales (P/S) ratio. FOLD’s shares currently trade at 4.51 times trailing sales value, higher than 2.05 for RIGL.

Between the two stocks discussed above, Rigel sports a Zacks Rank #1 (Strong Buy) and can be backed as the better pick over Amicus, which currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Rigel’s strong performance in the first half of 2025 is likely to continue in the second half. The upbeat guidance for 2025, buoyed by strong growth in Tavalisse sales and other marketed products, presents an optimistic outlook. Analysts expect RIGL’s 2025 sales and EPS to substantially rise on a year-over-year basis, highlighting its strong upside potential.

On the contrary, Amicus’ high reliance on Galafold for revenues is not a risk-free strategy and underscores the company’s vulnerability to regulatory and competitive risks. Although Galafold sales are rising and the company has diversified somewhat through the approval of Pombiliti + Opfolda, stiff competition from established players having huge resources remains a worry.

Rigel’s recent developments, growing portfolio, improving earnings estimates, stock price appreciation and a cheaper valuation make it a clear-cut winner over Amicus.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 7 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite