|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

CoreWeave CRWV and Alphabet GOOGL provide cloud infrastructure services for AI workloads. CoreWeave offers GPU-accelerated infrastructure for AI, while Google is a well-established tech giant with diverse revenue sources and an expanding presence in the cloud and AI sectors.

Increased spending on AI infrastructure benefits CRWV and GOOGL, but not equally. So, if an investor wants to make a smart buy in the AI infrastructure space, which stock stands out?

Let’s scrutinize closely to find out which of these two stocks currently holds the edge, and more importantly, which might be the smarter bet now.

The booming demand for AI infrastructure is greatly benefiting CoreWeave, which saw its revenues skyrocket by 207% to $1.2 billion in the second quarter. This marked the company's significant milestone of its first-ever billion-dollar quarter. Adjusted EBITDA almost tripled to $753.2 million.

Strategic partnerships with major players like OpenAI and NVIDIA bode well. CoreWeave recently announced yet another expansion of its contract with OpenAI. The new expansion contract, worth $6.5 billion, involves CRWV supplying capacity for OpenAI training of its next-generation models. The total value of OpenAI contact now stands at an impressive $22.4 billion, which includes $11.9 billion agreement in March and $4 billion expansion in May. OpenAI’s (which is a leading AI company) massive contract not only enhances revenue visibility for CRWV but also validates its AI infrastructure as cutting-edge and reliable.

Collaboration with NVIDIA is another positive aspect. CoreWeave was among the first cloud providers to put NVIDIA H100, H200, and GH200 clusters into production for AI workloads. The company's cloud services are also optimized for NVIDIA GB200 NVL72 rack-scale systems. Additionally, it deployed NVIDIA GB200 NVL72 and HGX B200 systems at scale, integrated into its “Mission Control” for enhanced reliability and performance. NVIDIA also has an agreement with CRWV to purchase residual unsold capacity through April 13, 2032, subject to certain conditions.

CoreWeave is actively expanding its data center network, enabling it to serve a diverse client base with low latency and high reliability. With over 900 MW of active power targeted by year-end, CRWV is positioning itself as a top-tier provider capable of supporting large-scale AI training and inference workloads. The launch of a new Ventures Fund to invest in AI startups and several acquisitions like Weights & Biases (acquired), Core Scientific, and OpenPipe (announced) strengthen CRWV’s position.

Nonetheless, CRWV’s aggressive expansion strategy is powered partly by hefty leverage, leading to heavy interest costs, which can undermine profitability. Interest expense surged to $267 million compared with $67 million a year ago. For the third quarter, it expects interest expenses to be between $350 million and $390 million, owing to high leverage. It has a massive capex plan of $20-$23 billion. Higher capex can be a concern if revenues do not keep up the required pace to sustain such high capital intensity, especially in a macro environment where AI demand cycles could fluctuate due to competitive pricing and regulatory changes.

Alphabet is one of the dominant names in the AI cloud infrastructure space with its Google Cloud. It leads the cloud computing space, along with Microsoft and Amazon Web Services. In the last reported quarter, Google Cloud revenues (14.1% of total revenues) surged 32% year over year to $13.6 billion, driven by growth across Google Cloud products, AI infrastructure and GenAI solutions. Google Cloud’s annual revenue run rate is more than $50 billion now.

Google is witnessing increasing traction for its wide-ranging AI portfolio, given its differentiated full-stack (spanning from AI infrastructure, research, models, tools, and other products and platforms) approach to AI. GOOGL has a vast network of AI-optimized data centers and cloud regions with 42 regions and 127 zones. Google's network is supported by edge locations and subsea cables. It recently announced a new transatlantic subsea cable system called Sol to link the United States, Bermuda, the Azores and Spain.

Apart from expanding AI infrastructure and cloud footprint, its dominant position in the search domain is a key catalyst. In the second quarter of 2025, Search and other revenues (56.2% of total revenues) increased 11.7% year over year to $54.19 billion. The momentum is being driven by features like AI Overview, which boasts 2 billion users per month and is available across 200 countries. It recently made AI mode available in five new (Hindi, Indonesian, Japanese, Korean and Brazilian Portuguese) languages. YouTube’s advertising revenues improved 13.1% year over year to $9.77 billion.

Apart from business diversification, Alphabet has stupendous financial resources. As of June 30, 2025, cash, cash equivalents and marketable securities were $95.15 billion. Alphabet generated $27.75 billion of cash from operations in the second quarter of 2025. GOOGL spent $22.45 billion on capital expenditure, generating a free cash flow of $5.3 billion in the reported quarter.

However, the intense competition from Azure and AWS is concerning. Heavy capex spend could strain margins if AI returns do not materialize. Amid explosive cloud and AI demand, it heavily invests in infrastructure and has earmarked a staggering $85 billion (up $10 billion from the previous estimate) in capex for 2025 alone.

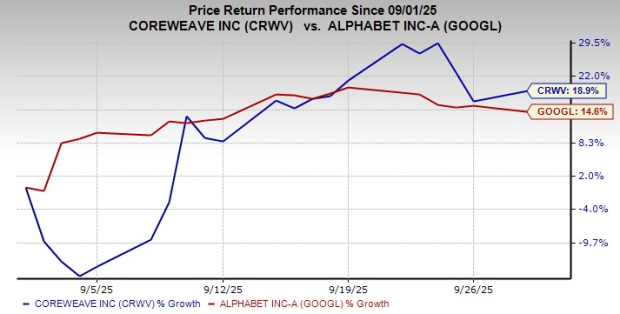

CRWV shares have gained 18.9% while GOOGL stock is up 14.6%.

Valuation-wise, both Google and CoreWeave are overvalued, as suggested by the Value Score of D and F, respectively.

In terms of Price/Book, CRWV shares are trading at 21.12X, lower than GOOGL’s 8.13X.

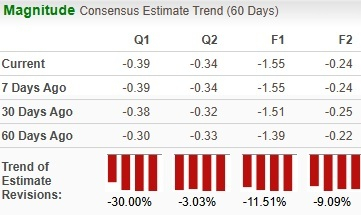

Analysts have revised earnings estimates downward for CRWV's bottom line for the current year.

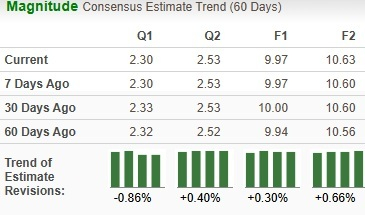

For GOOGL, there is a marginal upward revision.

The stocks carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Both CoreWeave and Alphabet are well-positioned to benefit from the surging demand for AI infrastructure. Alphabet brings unmatched scale, diversification, and financial resilience, with its cloud segment experiencing rapid expansion. It remains a long-term safe bet for investors seeking stability and steady exposure to AI.

CoreWeave is capturing outsized growth, fueled by massive OpenAI contracts and NVIDIA integration. For investors looking for explosive AI-driven growth, CoreWeave seems a more compelling play.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

GOOGL

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 7 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite