|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Upstart was using artificial intelligence before it became commonplace.

Now that companies are embracing AI, Upstart’s growth prospects are bright.

This stock has underperformed of late, but the analyst community thinks this weakness isn’t merited.

Anybody who buys a particular stock obviously does so with the expectation that it will gain in value. No level-headed investor genuinely expects a normal-sized trade to become life-changing, though.

Yet, there's no denying it happens. Amazon and Nvidia are a couple of names that come to mind.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Could an up-and-comer like Upstart (NASDAQ: UPST) be the next millionaire-making stock most don't see coming? Although most investors aren't convinced, a small handful are. Here's what they're seeing, along with what the rest of the crowd is missing.

Upstart is a new kind of credit-reporting bureau akin to Equifax (NYSE: EFX), TransUnion (NYSE: TRU), and Experian (OTC: EXPG.Y), although it also plays a credit-scoring role like Fair Isaac's (NYSE: FICO) FICO model.

Even with all the ways it's like the industry's legacy services, however, it's also distinctly different from these established names...and it's better. Its technology is easier for would-be lenders to use than traditional ways of retrieving a credit score. It also provides lenders with a more accurate assessment of someone's creditworthiness.

Image source: Getty Images.

The key is the underlying platform itself.

One of Upstart's co-founders -- computer science and economics student Paul Gu -- did something that no one else had even attempted it before, or tried to imitate in the meantime. He developed an artificial intelligence algorithm that incorporates all the relevant information regarding a would-be borrower to paint a better picture of an individual's creditworthiness.

Upstart's platform looks at more than 2,500 unique variables as part of its credit-scoring process. Some of them are obvious ones, like income, employment, and someone's repayment history. Many of its other data points aren't ones on Fair Isaac's radar, even though they arguably should be.

More important to lenders, borrowers, and even interested investors, the approach is proving to be a better one for every party involved. Its solution allows for 43% more approvals without any additional defaults compared to the more traditional approach of determining an individual's credit score. More than nine out of 10 of its loan approvals are automated, and therefore completed in a matter of seconds. Lenders just need access to the company's application programming interface, or API, which links their systems to Upstart's.

The technology works. But that doesn't mean Upstart's growth has been easy or consistent since its debut in 2012.

Like any start-up launching into a long-established industry dominated by a handful of powerful incumbents, this start-up has struggled at times. The mainstreaming (and then explosion) of artificial intelligence since ChatGPT's launch in late 2022, however, appears to have been the proverbial tipping point for this outfit. There are now more than 100 banks using Upstart's technology, up from fewer than 60 as of early 2022 and fewer than 20 at the beginning of 2021.

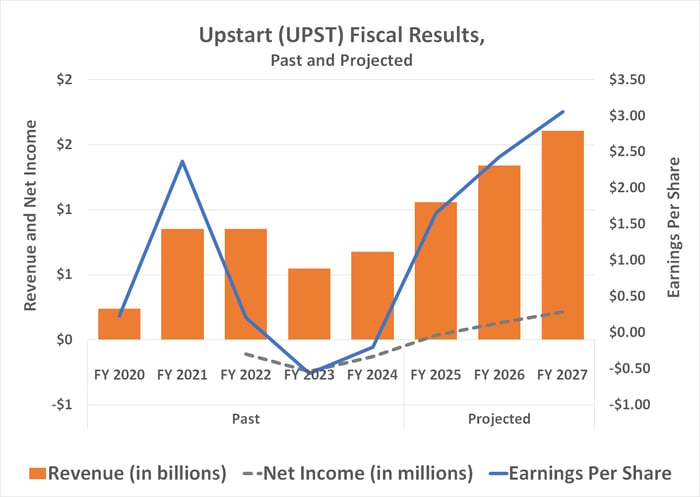

That's the chief reason its revenue has not only grown every quarter since the third quarter of last year, but is now accelerating. So too is the company's bottom line. Upstart swung to a profit in this year's Q2 and analysts expect earnings to continue rising. This year's full-year per-share estimated profit of $1.65 per share is projected to rise to $2.49 next year.

Data sources: MarketWatch, CNBC. StockAnalysis, Simply Wall St. Chart by author.

But that's still only a drop in the bucket. The 697,092 loans that Upstart's platform originated last year -- worth a total of $5.9 billion -- are a mere fraction of the total U.S. loan market. Numbers from the Federal Reserve indicate that U.S. consumers took out $131 billion in new mortgage loans just in Q2 of this year alone. They also collectively borrowed $13 billion to purchase vehicles, and took out $9 billion in home equity loans.

Although only the latter two loan types are currently facilitated by Upstart, that's still an enormous opportunity. Indeed, Mordor Intelligence believes the U.S. digital lending business is set to grow at an annualized pace of more than 13% through 2030, now that using artificial intelligence to quickly facilitate loans is an option. Furthermore, this growth could persist well beyond that point in time.

Upstart is well-positioned to capture at least its fair share of this growth, and realistically speaking, capture more than its fair share of it.

So, yes, buying Upstart stock today could help set you up for life, particularly given its lethargic performance since late last year, which doesn't reflect its long-term growth potential. Most investors seem concerned about the prospect of economic weakness, and fear the effect it could have on the company's lending and credit-scoring business.

Upstart's business continues to climb that wall of worry. This year's swing to profitability is being fueled by top-line growth that is forecast to roll in at 66% more than last year's, to be followed by next year's 27% growth. Lenders and borrowers continue to fall in love with just how well Upstart's solution works.

This might help seal the deal: Although most investors aren't very bullish right now, the analyst community covering the company mostly is. Their one-year average price target of $77.57 is almost 60% higher than the stock's recent price of $48.58. That's not a bad way to start out a new trade, even if you should only consider a stake in this company if you're truly committed to making it a long-term holding. There's likely to be a lot of volatility along the way.

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $657,979!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,122,746!*

Now, it’s worth noting Stock Advisor’s total average return is 1,060% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 7, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Equifax, Nvidia, and Upstart. The Motley Fool recommends Experian Plc and Fair Isaac. The Motley Fool has a disclosure policy.

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite