|

|

|

|

|||||

|

|

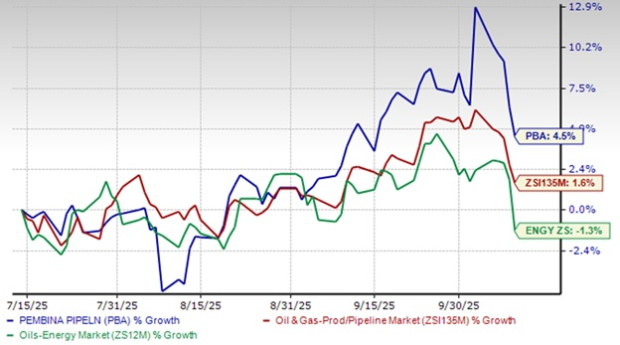

Over the past three months, Pembina Pipeline Corporation PBA has outperformed both the broader Oil & Gas Production and Pipelines sub-industry (ZSI135M) and the overall Oil-Energy sector (ZS12M). PBA’s share price has increased 4.5% compared with a more modest 1.6% rise for its sub-industry and a 1.3% decline for the sector. This relative outperformance highlights PBA's stronger investor confidence and market resilience during the short period, even amid a volatile energy sector landscape.

Image Source: Zacks Investment Research

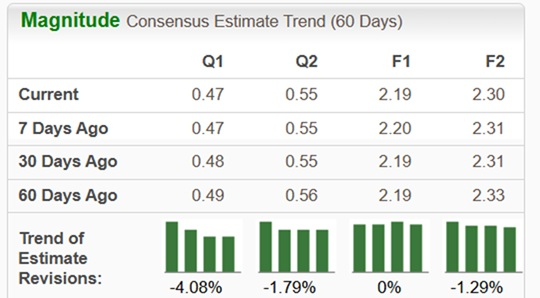

Over the past 60 days, the Zacks Consensus Estimate for PBA’s earnings per share (“EPS”) for the next fiscal year (F1) has remained steady at $2.19, while the estimate for the fiscal year after the next (F2) has seen a slight decrease of 1.29% from $2.33 to $2.30. Both estimates have shown minimal fluctuation, but F2 has experienced a minor decline compared with previous projections. The trend in estimate revisions reflects stability, with recent adjustments being relatively small.

Image Source: Zacks Investment Research

Integrated Value Chain Provides Unparalleled Competitive Moats: PBA differentiates itself as the only Canadian energy infrastructure company with a fully integrated value chain across all commodities — natural gas, NGLs, condensate and crude oil. This scope and scale, combined with access to diverse premium markets, create significant competitive advantages. The company can offer customers a full suite of services, from processing to transportation and export, making it a one-stop shop and deeply embedding assets within the energy ecosystem.

Industry-Leading Project Execution Driving Cost Advantages: The company has a proven track record of executing major capital projects on time and under budget, which directly enhances returns. A prime example is the RFS IV project, which is trending approximately 5% under its previous cost estimate. Management highlights that on a cost-per-barrel basis, PBA is delivering this expansion 15-20% lower than competing projects. This capital discipline provides a competitive edge in toll negotiations and ensures that new infrastructure is highly economic from the start.

Over C$1 Billion in Fully-Supported Pipeline Expansion Opportunities: To handle growing volumes from the Western Canadian Sedimentary Basin, PBA is advancing more than C$1 billion in proposed conventional pipeline expansions, including the Fox Creek-to-Namao and Taylor-to-Gordondale projects. These are not speculative projects, they are secured by long-term contracts underpinned by take-or-pay agreements and areas of dedication. This demand-driven growth, with final investment decisions expected soon, provides a visible pipeline of future fee-based earnings.

Successful Recontracting and Long-Term Volume Commitments: Despite a competitive landscape, PBA has been successful in extending its contract life. The weighted average contract life on its Peace and Northern pipeline systems is approximately seven and a half years, and has actually increased slightly over the past two years. This demonstrates the company's ability to "blend and extend" contracts with customers, ensuring a strong and durable base of committed volumes and providing clear visibility on future cash flows from its core assets.

Recent Financial Performance Shows Year-Over-Year Declines: PBA's second-quarter 2025 results revealed declines in several key financial metrics compared with the same period last year. Adjusted EBITDA fell 7% to C$1.01 billion, earnings decreased 13% to C$417 million and adjusted cash flow from operating activities dropped 17% to C$698 million. These weak results highlight near-term operational and market headwinds that may concern investors seeking consistent growth.

Significant Exposure to Volatile Commodity-Based Marketing Earnings: PBA’s Marketing & New Ventures division saw a dramatic 48% decrease in adjusted EBITDA for the quarter, primarily due to lower NGL margins and prices. This segment's performance is inherently tied to commodity price spreads and can be highly volatile. This volatility introduces an element of unpredictability to the company's overall earnings, making it harder to forecast financial results with certainty despite the largely fee-based nature of the other divisions.

Potential for Customer Consolidation and Efficiency to Pressure Tolls: As producers in Western Canada consolidate to gain efficiencies, they may use their increased scale to negotiate more aggressively on transportation and processing costs. PBA’s management addressed this directly, noting that as customers grow, their dollar-per-unit costs typically go down. This trend could create ongoing downward pressure on the tolls and fees that PBA can charge, impacting long-term margin growth.

Intensifying Competitive Landscape Pressuring Market Position: Management directly addressed an investor narrative of "death by a thousand cuts," acknowledging that the competitive environment is fiercer than ever. This includes competition from other midstream players and the risk of producers bringing some midstream activities in-house. While confident in the position, PBA admitted it will not win every barrel, indicating that market share gains may become more challenging and costly to achieve in the future.

PBA boasts a fully integrated value chain across all commodities, offering unmatched competitive advantages in Canada’s energy infrastructure space. Its strong project execution and capital discipline have led to cost-effective expansions, while more than C$1 billion in secured pipeline projects and long-term contract extensions provide visibility into future earnings.

However, recent financial results show year-over-year declines in EBITDA, earnings and cash flow, and the company remains exposed to volatile commodity-based marketing earnings. Additionally, increasing customer consolidation and intensifying competition may pressure toll rates and market share going forward. Given this mix of strengths and potential challenges, investors should wait for a more opportune entry point instead of adding this company to their portfolios.

Currently, PBA has a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at some better-ranked stocks like Canadian Natural Resources Limited CNQ, TechnipFMC plc FTI, currently sporting a Zacks Rank #1 (Strong Buy) each, and Oceaneering International OII, holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Canadian Natural is one of Canada's largest independent oil and natural gas producers, with operations spanning exploration, development and production across North America, the North Sea and Offshore Africa. The company focuses on a diversified portfolio of assets, including oil sands, conventional crude oil, natural gas and thermal in-situ operations. Canadian Natural is valued at $65.53 billion.

TechnipFMC is a global leader in oil and gas services, specializing in the design, engineering and construction of complex energy infrastructure projects. The company provides a wide range of solutions across the upstream, midstream and downstream sectors, including subsea systems, surface technologies and engineering services. TechnipFMC’s expertise enables energy companies to optimize production, improve efficiency and reduce environmental impact, making it a vital player in the evolving energy landscape. It is valued at $14.71 billion.

Oceaneering International is a global provider of engineered services and products primarily to the offshore oil and gas industry, specializing in remotely operated vehicles, subsea engineering and asset integrity management. The company combines advanced technology and expertise to deliver innovative solutions that enhance safety, efficiency and environmental performance in challenging marine environments. Oceaneering International is valued at $2.22 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite