|

|

|

|

|||||

|

|

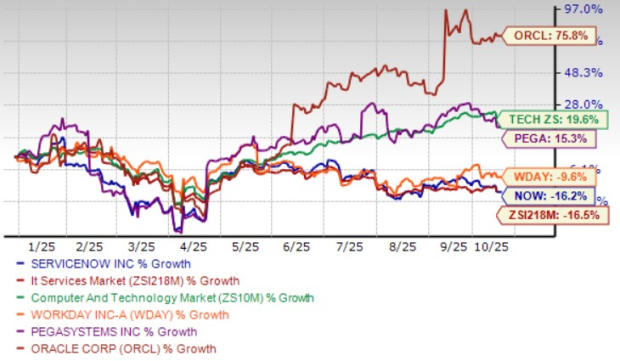

ServiceNow NOW shares have plunged 16.1% year to date (YTD), underperforming the Zacks Computer and Technology sector’s return of 19.6% reflecting macroeconomic challenges and stiff competition from the likes of Workday WDAY, Oracle ORCL and Pegasystems PEGA. Shares of Oracle and Pegasystems returned 75.8% and 15.3% YTD, while Workday has dropped 9.6%.

NOW’s decline can be attributed to challenging macroeconomic trends along with tariff-related uncertainties. Slowing growth prospects in the U.S. public domain have been a headwind for ServiceNow. Subscription revenues are expected to grow at a slower pace, which is hurting investor optimism.

ServiceNow raised subscription revenue guidance for 2025, which is now expected between $12.775 billion and $12.795 billion, suggesting 19.5-20% on a non-GAAP constant currency (cc) basis. This is slower than NOW’s subscription revenue growth rate of 23% in 2024. The Zacks Consensus Estimate for 2025 subscription revenues is pegged at $12.79 billion, indicating 20.1% growth from 2024.

For third-quarter 2025, NOW expects subscription revenues between $3.26 billion and $3.265 billion, suggesting year-over-year growth of 19.5% at cc. The Zacks Consensus Estimate for third-quarter 2025 subscription revenues is pegged at $3.26 billion, indicating 20.2% growth from the year-ago quarter.

ServiceNow stock has a Value Score of F, which suggests a stretched valuation at this moment.

The stock is trading at a premium, with a forward 12-month price/sales of 12.31X compared with the broader sector’s 6.73X, Workday’s 6.03X, Pegasystems’ 5.16X and Oracle’s 11.56X.

NOW’s workflows are gaining traction. In the second quarter of 2025, technology workflows won 40 deals worth over $1 million, including four over $5 million. ITSM, ITOM, ITAM, security and risk were all in at least 15 of the top 20 deals. CRM and industry workflows were in 17 of NOW’s top 20 deals, with 17 of those deals over $1 million. Core business workflows were in 16 of the top 20 deals, with seven deals over $1 million.

NOW ended the reported quarter with 528 customers generating more than $5 million in ACV. The number of customers contributing $20 million or more increased by more than 30% year over year. ServiceNow closed 89 deals greater than $1 million in net new ACV in the reported quarter, including 11 deals over $5 million.

ServiceNow is gaining a footprint among enterprises with Workflow Data Fabric included in 17 of the company’s top 20 largest deals. Through Workflow Data Fabric, ServiceNow offers a combination of data, analytics and AI that, along with agentic AI, helps enterprises get faster and smarter outcomes. CRM workflow offers a massive growth opportunity for ServiceNow, driven by sales and order management solutions and acquisitions of Logik.ai, which helped NOW close 9 CPQ deals in June alone.

ServiceNow’s latest Zurich platform promises rapid AI adoption through the combination of multi-agentic AI development, enterprise-grade security and autonomous workflows. The Zurich release offers a Build Agent that brings vibe coding to enterprise scale. Vibe coding allows employees to create production-ready applications from natural language prompts. Developer Sandbox helps developers build better applications by providing isolated environments for building and testing. It supports collaboration by multiple teams, as well as building and testing without any conflict. ServiceNow Vault Console centralizes discovery, classification, and protection of sensitive data across workflows, while Machine Identity Console manages and secures API and bot identities.

ServiceNow is benefiting from a rich partner base that includes the likes of NVIDIA, Cisco Systems, Amazon, Aptiv, Vodafone Business, UKG, Zoom and others.

The NVIDIA-NOW collaboration is redefining employee support as the semiconductor giant is using ServiceNow AI to resolve issues, deliver personalized help and provide answers in a short span of time. The long-term partners have collaborated to develop the Apriel Nemotron 15B model that evaluates relationships, applies rules, and weighs goals to reach conclusions or make decisions. ServiceNow and NVIDIA plan to bring accelerated data processing to ServiceNow Workflow Data Fabric with the integration of select NVIDIA NeMo microservices.

ServiceNow’s collaboration with Amazon Web Services helped in bi-directional data integration solutions to eliminate enterprise silos. ServiceNow and Cisco have collaborated to bring together the latter’s AI Defense with ServiceNow SecOps to provide more holistic AI risk management and governance. The integration of ServiceNow CRM capabilities with Aptiv’s platforms and technology from Wind River will offer greater automation and efficiency for telecommunication and enterprise customers.

The Zacks Consensus Estimate for NOW’s 2025 and 2026 reflects positive revision trends. The 2025 earnings estimate of $16.82 per share has increased by a penny over the past 60 days and indicates 20.83% growth from 2024’s reported figure.

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

The Zacks Consensus Estimate for NOW’s 2026 earnings estimate is currently pegged at $19.84 per share, up a couple of cents over the past 60 days and suggests 17.94% growth over 2025’s estimated figure.

NOW’s expanding portfolio, growing workflow adoption, rich partner base and positive earnings estimate revisions are expected to improve its top-line growth. This also justifies a premium valuation.

ServiceNow currently has a Zacks Rank #2 (Buy) and a Growth Score of B, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

Will AI Kill Software? Fear Creeps Beyond 'Saaspocalypse,' Hits IBM, DoorDash

NOW WDAY

Investor's Business Daily

|

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite