|

|

|

|

|||||

|

|

CorMedix CRMD has experienced significant growth in 2025, fueled by the strong uptake of the company’s lead marketed drug, DefenCath (Taurolidine + Heparin). The FDA approved CorMedix’s DefenCath in late 2023 as the first and only antimicrobial catheter lock solution in the United States. The drug is indicated to reduce the incidence of catheter-related bloodstream infections (CRBSIs) in adult patients with kidney failure who receive chronic hemodialysis through a central venous catheter.

DefenCath is the first approved product in CorMedix’s marketed portfolio, giving the company a regular income stream.

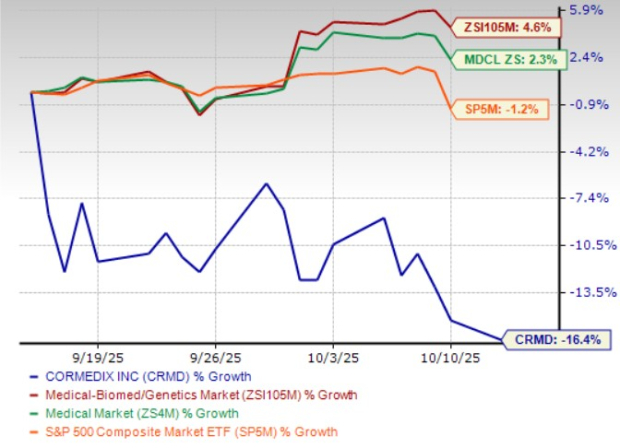

However, in the past month, shares of CorMedix have lost 16.4% against the industry’s 4.6% growth. The stock has also underperformed the sector and the S&P 500 during the same period, as shown in the chart below.

Several internal and external factors could have influenced the stock price decline, including investor uncertainty regarding the continuity of DefenCath’s uptake in the U.S. market when its reimbursement agreement with Medicaid expires, the company’s lack of a deep pipeline and potential competition in the CRBSIs market. Let’s analyze CorMedix’s strengths and weaknesses to understand how to play the stock amid the recent share price drop.

CorMedix launched DefenCath commercially in April 2024 in the inpatient setting and in July 2024 in the outpatient hemodialysis setting.

In the first half of 2025, DefenCath delivered $78.8 million in net revenues, reflecting a solid start to its commercial journey. CorMedix has also raised its guidance for DefenCath sales to the range of $200-$215 million in 2025 compared with the previous expectation of $180-$200 million in sales.

Importantly, DefenCath holds a unique market position as the only FDA-approved therapy for a niche condition, supported by patent protection through 2033. This exclusivity provides a long runway for revenue generation.

Looking ahead, sales are expected to build steadily as CorMedix expands its commercial footprint and strengthens its marketing infrastructure. Moreover, eligibility for reimbursement in the U.S. healthcare system enhances patient access and should serve as a strong catalyst for growth in the years ahead.

CorMedix is also planning future potential label expansion of DefenCath into total parenteral nutrition (TPN). Subject to approval, CRMD expects the peak annual sales of DefenCath in the TPN indication to be in the range of $150-$200 million.

In September, CorMedix closed the $300 million acquisition of Melinta Therapeutics, a move that significantly broadened and diversified its marketed product portfolio. The deal added seven approved therapies, including Minocin, Rezzayo, Vabomere, Orbactiv, Baxdela, Kimyrsa, and Toprol-XL, to CRMD’s marketed portfolio, expanding its reach in the hospital acute care and infectious disease markets.

The expanded portfolio not only strengthens the company’s revenue base but also positions it for near-term growth opportunities, particularly with Rezzayo, which is currently approved for the treatment of candidemia and invasive candidiasis in adults. The drug is also being evaluated in a phase III study for prophylaxis of invasive fungal infections in adult patients undergoing allogeneic blood and marrow transplant, with study completion expected in the first half of 2026. If successful, the phase III data will support a regulatory filing for Rezzayo in this additional indication.

Financially, CorMedix expects its 2025 pro forma revenues to be in the $325-$350 million range, reflecting the immediate contribution from Melinta’s portfolio, which generated $120 million in 2024. In 2025, CorMedix anticipates Melinta’s portfolio to generate $125 million to $135 million in revenues.

The company expects the acquisition to be accretive to earnings per share beginning in 2026, supported by projected annual cost synergies of $35-$45 million. The transaction underscores CorMedix’s strategy to accelerate growth by expanding its hospital-focused offerings while building a more durable, diversified commercial platform.

DefenCath combines taurolidine, an antimicrobial agent, with the anticoagulant heparin in a fixed-dose formulation designed for a niche population of kidney failure patients. While CorMedix currently enjoys a first-mover advantage in the United States with no direct competitors in CRBSI prevention, the competitive landscape carries risks. Larger players, such as Pfizer PFE, Amphastar Pharmaceuticals AMPH, B. Braun, Baxter and Fresenius Kabi USA LLC, already market heparin across a range of indications in the United States. With their deeper pipelines, manufacturing scale and financial resources, these companies could quickly emerge as formidable rivals if they choose to pursue CRBSI-specific applications, potentially eroding CorMedix’s market exclusivity and long-term growth prospects.

Pfizer already markets Heparin Sodium Injection, an anticoagulant with broad clinical applications ranging from the treatment of venous thrombosis and pulmonary embolism to use in surgery, dialysis, and transfusion settings. Backed by its global scale, extensive clinical infrastructure and financial resources, Pfizer could quickly pivot to CRBSI-specific indications, posing a significant challenge to CorMedix’s foothold.

Amphastar currently markets Enoxaparin, a complex low molecular weight heparin with multiple indications. AMPH controls its entire supply chain by producing the active pharmaceutical ingredient in-house, giving it stronger cost efficiencies and quality oversight. This vertically integrated model, combined with Amphastar’s manufacturing expertise, underscores the competitive risk for CorMedix if the company decides to extend its anticoagulant capabilities into the CRBSI market targeted by DefenCath.

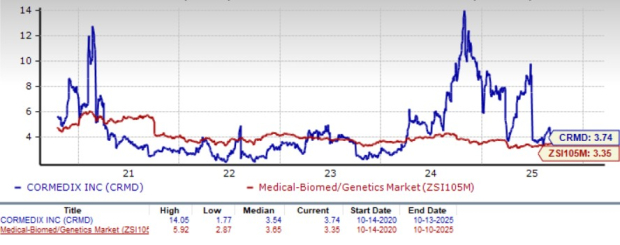

From a valuation standpoint, CorMedix stock is trading at a premium to the industry. Going by the price/book ratio, the company’s shares currently trade at 3.74 trailing 12-month book value per share, higher than 3.35 for the industry. The stock is also trading above its five-year mean of 3.54.

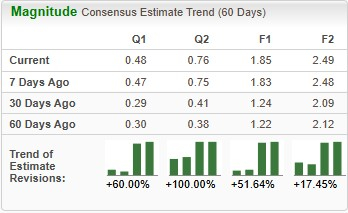

Estimates for CorMedix’s 2025 earnings have improved from $1.22 to $1.85 per share in the past 60 days, and estimates for 2026 earnings have improved from $2.12 to $2.49 over the same timeframe.

CorMedix’s share price declined over the past month, underperforming the broader market as investors weigh uncertainties around DefenCath’s reimbursement renewal and concerns about the company’s limited pipeline depth. Investors are also likely concerned by the potential competition from larger heparin players, such as Pfizer and Amphastar, which could eventually challenge CorMedix’s position in the catheter-related infection prevention market.

Despite this recent setback, the impact is likely to be temporary, as CorMedix is actively addressing key concerns by diversifying its revenue base and reducing reliance on DefenCath. The flagship therapy continues to deliver a reliable revenue stream in a niche market, generating nearly $79 million in net sales in the first half of the year, with full-year sales now projected between $200 million and $215 million. Potential future label expansion in the TPN indication could further enhance long-term growth prospects.

The acquisition of Melinta has expanded CorMedix’s marketed portfolio by seven additional therapies, strengthening its presence in the acute care and infectious disease markets and further diversifying revenue sources. Management now anticipates 2025 pro forma revenues of $325-$350 million, with the deal expected to be accretive to earnings per share by 2026.

Collectively, CorMedix’s unique positioning, expanding portfolio and improving earnings estimates support an optimistic outlook, positioning the company for both near-term success and sustainable long-term growth. Thus, investors are recommended to use this opportunity to create/expand their position in this Zacks Rank #2 (Buy) stock for meaningful gains in both the short and long term. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite