|

|

|

|

|||||

|

|

Dover Corporation DOV is set to release third-quarter 2025 results on Oct. 23, before the opening bell.

The Zacks Consensus Estimate for DOV’s revenues is pegged at $2.09 billion, indicating a 5.5% rise from the year-ago reported figure.

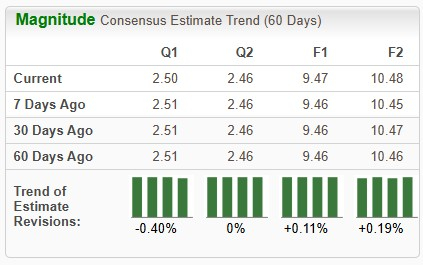

The consensus estimate for earnings is pegged at $2.50 per share, which implies year-over-year growth of 10.1%. The estimate has moved down 0.4% in the past 60 days.

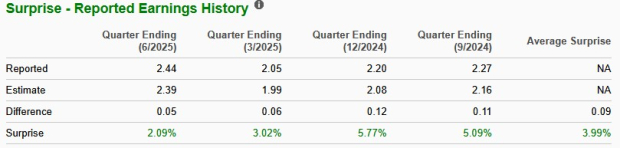

DOV’s earnings beat the Zacks Consensus Estimates in the trailing four quarters, as seen in the chart below. Dover has an average earnings surprise of around 4%.

Our model does not predict an earnings beat for Dover this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), which increases the chances of an earnings beat. That is not the case here, as you can see below.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: Dover has an Earnings ESP of -0.20%.

Zacks Rank: DOV currently carries a Zacks Rank of 2.

DOV has been witnessing robust bookings across its segments on strong demand and shipment levels, which are likely to have benefited its third-quarter performance. Gains from the recent acquisitions are expected to have aided.

However, the impacts of divestitures and lower volumes in vehicle services are expected to have negated these gains. The company has also been facing reduced volumes in food retail door cases and services businesses.

Dover’s margins are likely to have benefited from robust volumes, an improved price-cost spread and tight cost controls for a while. However, the negative impacts of supply-chain constraints and input inflation have been acting as headwinds. These are likely to get reflected in DOV’s earnings results.

In the Engineered Products segment, ongoing strong demand in the waste-handling and improved production performance are expected to have been offset by weak demand in the vehicle-service business. Our estimate for the segment’s revenues is pegged at $293 million, indicating a 1% decline from the prior-year quarter’s actual.

The estimate for the Engineered Products segment’s adjusted EBITDA is pegged at $61 million, indicating a 0.1% decline from the prior-year quarter.

The Clean Energy and Fueling Solutions segment is likely to have gained from solid shipments in clean energy components, fluid transport, and North American retail software and equipment. We expect the segment’s revenues to be $538 million, indicating growth of 7.5% from the year-earlier actual. Organic growth is projected at 3.6%, while acquisitions are expected to contribute 4.1% to sales growth. Unfavorable impacts of currency translation are expected to have a negative 0.2% impact on the segment’s results.

The estimate for the Clean Energy and Fueling Solutions segment’s adjusted EBITDA is pegged at $115 million, indicating a 6.3% increase from the year-ago quarter’s actual, driven by pricing actions and productivity initiatives.

The Imaging and Identification segment's results are expected to reflect benefits from increased serialization software sales. We expect the segment’s organic sales to be 0.7% for the quarter.

Acquisitions are expected to add 0.3%, which is likely to be offset by an unfavorable 0.9% impact of foreign currency. Our prediction for the segment’s revenues is $284 million, indicating a 0.2% rise from the prior-year quarter’s actual.

We project the segment’s adjusted EBITDA to be $84 million, which indicates 2.8% growth from the third-quarter 2024 reported figure, aided by pricing initiatives and cost controls.

Dover’s Pumps and Process Solutions segment’s results are likely to reflect growth in biopharma and platform cycles businesses. Our model predicts year-over-year growth of 6.7% for the segment’s organic sales. The contribution from the FW Murphy acquisition is expected to be 2.3%, while currency translation is anticipated to have a year-over-year positive impact of 0.3%.

We anticipate the segment’s revenues to increase 9.3% year over year to $516 million. The consensus mark for the segment’s third-quarter adjusted EBITDA is pegged at $172 million, implying 14.5% year-over-year growth.

In the Climate and Sustainability Technologies segment, results are expected to gain from ongoing momentum in demand in food retail systems. We anticipate the segment’s organic sales to rise 5.3% year over year.

We expect quarterly revenues to be $455 million, implying a 5.5% increase from the year-earlier figure. The estimate for the segment’s adjusted EBITDA is pegged at $87.2 million, whereas it reported $83 million in the third quarter of 2024.

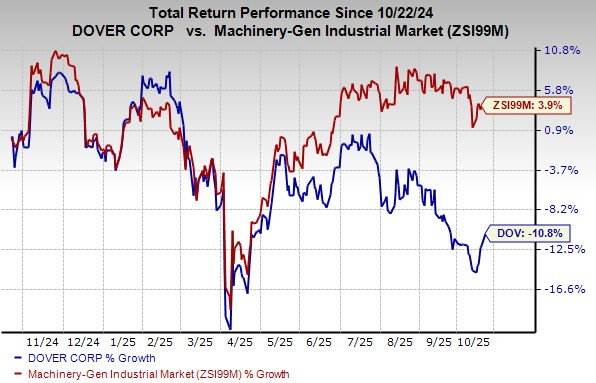

Dover’s shares have lost 10.8% in the past year against the industry’s 3.9% growth.

Here are some companies with the right combination of elements to post an earnings beat in their upcoming releases.

Hubbell Incorporated HUBB, slated to release third-quarter 2025 results on Oct. 28, has an Earnings ESP of +0.12% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hubbell’s third-quarter 2025 earnings is pegged at $5.00 per share, suggesting a year-over-year rise of 11.4%. Hubbell has a trailing four-quarter average surprise of 2.3%.

Illinois Tool Works Inc. ITW, slated to release third-quarter 2025 results on Oct. 24, has an Earnings ESP of +0.84% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for Illinois Tool Works’ third-quarter 2025 earnings is pegged at $2.69 per share, suggesting a year-over-year rise of 1.5%. ITW has a trailing four-quarter average surprise of 2.3%.

Otis Worldwide Corporation OTIS, set to release third-quarter 2025 results on Oct. 29, has an Earnings ESP of +0.02% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for Otis Worldwide’s third-quarter 2025 earnings is pegged at $1.00 per share, suggesting a year-over-year rise of 4.2%. Otis Worldwide has a trailing four-quarter average surprise of 0.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-17 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite