|

|

|

|

|||||

|

|

Ecolab, Inc. ECL is scheduled to report third-quarter 2025 results on Oct. 28, before the opening bell.

In the last reported quarter, the company’s adjusted earnings per share (EPS) of $1.89 missed the Zacks Consensus Estimate by a penny. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on two occasions, missed once and broke even in the other, delivering an earnings surprise of 0.3%, on average.

Let’s see how things have shaped up for Ecolab prior to this announcement.

Effective first-quarter 2025, Ecolab’s Global Industrial segment was renamed Global Water and includes Light & Heavy (previously named Water), Food & Beverage, and Paper.

The segment witnessed a sales uptick in the second quarter of 2025 on both fixed currency and organic basis, reflecting accelerating Food & Beverage sales growth and continued solid growth in Light & Heavy. Light & Heavy’s growth was led by continued strength in Global High-Tech and solid gains in Manufacturing and Downstream, while good new business gains in Food & Beverage (which leveraged the One Ecolab growth strategy) drove sales growth. We expect this momentum to have continued in the to-be-reported quarter, thereby driving up the revenues.

Ecolab continued to benefit from the Barclay Water Management acquisition in the second quarter of 2025. We expect the company to have continued to benefit from the buyout in the third quarter, thereby aiding its segmental revenues.

On second-quarter 2025 earnings call in July, management stated that in Global Hi-Tech Water, business continued to be strong. Global High-Tech sales growth also accelerated, leveraging its innovation and global capability to develop water circularity for microelectronics production (known as pads) and high-performance cooling for data centers. These look very promising for the segment as we expect this momentum to have continued in the to-be-reported quarter, thereby boosting ECL’s performance.

The Zacks Consensus Estimate for the third-quarter 2025 Global Water revenues is currently pegged at $1.94 billion.

In second-quarter 2025, the uptick in the segment’s fixed currency sales reflected organic growth and a benefit from attractive, targeted acquisitions in North America. Per ECL, improved organic sales growth was led by good gains in food & beverage, restaurants, healthcare and food retail, which continue to benefit from the company’s One Ecolab growth strategy. We expect this momentum to have continued in the to-be-reported quarter, thereby driving up the revenues.

On the second-quarter earnings call, management stated that Ecolab is currently shifting toward Pest Intelligence, which is remote monitoring of devices, mousetraps. It has already been completed for one of the major retailers, with very good results. On its Investor Day 2025 call last month, the company stated that it is currently focusing on strengthening its commercial (B2B) business in the United States, as well as a few select countries. This looks promising for the stock.

The Zacks Consensus Estimate for the third-quarter 2025 Global Pest Elimination revenues is currently pegged at $321 million, suggesting an uptick of 3.9% from the year-ago quarter’s reported figure.

Ecolab is currently integrating the Institutional and healthcare units of its Global Institutional & Specialty segment and is on track to report performance solely on a consolidated basis. In the second quarter of 2025, the segment’s Specialty business delivered strong underlying sales growth. Both the Institutional and Specialty businesses drove strong new business wins and continued value pricing, significantly outperforming end-market trends. We expect this momentum to have continued in the to-be-reported quarter, thereby driving up the revenues.

However, Ecolab continued to face declining Paper sales and softness in basic industries (comprising steel, power and chemicals businesses) in the second quarter of 2025. On the earnings call, management stated that the company is currently overcoming the headwind created by the strategic decision to exit non-core low-margin business. These exits, which are mostly in the hospitals and retail businesses, weighed on Institutional Specialty's second-quarter growth. These are likely to have weighed on its third-quarter performance as well. Also, the currently volatile macroeconomic environment stemming from tariff uncertainties raises our apprehension about the stock’s performance in the to-be-reported quarter.

For third-quarter 2025, the Zacks Consensus Estimate of $4.12 billion for total revenues implies an improvement of 3.1% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $2.06, implying an improvement of 12.6% from the prior-year period’s reported number.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: ECL has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ecolab Inc. price-eps-surprise | Ecolab Inc. Quote

Over the past three months, Ecolab’s shares have gained 1.9%, outperforming the Chemical - Specialty’s 3.9% decline. However, ECL’s shares underperformed the Zacks Basic Materials sector’s increase of 3.6% and the S&P 500’s gain of 6.6%.

Ecolab’s peers like Element Solutions Inc ESI have outperformed the company, while Symrise AG SYIEY and Croda International Plc COIHY underperformed the company. ESI’s shares are up 8.7%, while SYIEY and COIHY shares are down 8.9% and up 1.2%, respectively, in the same time frame.

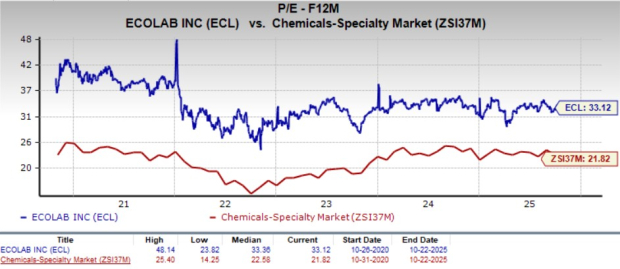

From a valuation standpoint, ECL’s forward 12-month price-to-earnings (P/E) is 33.1X, a premium to the industry's average of 21.8X, but lower than its five-year median of 33.4X.

The company is trading at a premium to its peers, Element Solutions, Symrise and Croda International. Element Solutions’ P/E currently stands at 16X, while the ratios for Symrise and Croda International stand at 18.8X and 18.2X, respectively.

This suggests that investors may be paying a higher price relative to the company's expected sales growth.

Ecolab has made impressive progress within its Global Water business, including its efforts to grow its business through the acquisition of Barclay Water Management, helping enhance its water safety and digital monitoring solutions. In August, it entered into a definitive agreement to acquire Ovivo’s Electronics business. The acquisition will further strengthen Ecolab’s global high-tech growth engine by combining Ovivo’s ultra-pure water technologies with Ecolab’s water solutions, digital technologies and global service capabilities. The combined technology platform will likely enable ECL to expand its offerings to provide circular water management solutions for its microelectronics customers, designed to significantly reduce fresh water use in their manufacturing process while maximizing chip production and quality.

Ecolab’s Global Life Sciences segment recorded strong fixed currency and organic sales growth in second-quarter 2025, with strength in bioprocessing and pharmaceutical & personal care. On its Investor Day 2025 call, management stated that the company expects the life sciences market to continue to grow. Per management, the biologics drug market is growing significantly at present and is expected to reach quite a few double-digit percentages in the next few years. ECL’s business is expected to continue to grow in double digits and meet those long-term goals in the future.

On second-quarter 2025 earnings call, management stated that Ecolab is currently trying to be a total paper-less company where everything is on digital. This will likely lead to the potential disappearance of the business.

There is no denying that ECL sits favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The stock’s strong core growth prospects are a good reason for existing investors to retain shares for potential future gains.

However, for those exploring to make new additions to their portfolios, the valuation indicates expectations of muted performance compared with its industry and sector peers. As it is still valued higher than the broader market, it does not suggest any potential room for growth until it can align more closely with overall market performance. As the chances of beating estimates are unlikely, it would be unwise to add the stock to one’s portfolio before the earnings. However, if investors are already holding the stock, it would be prudent to hold on to it at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite