|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Caterpillar Inc. CAT is anticipated to report lower year-over-year earnings despite modest revenue growth when it releases third-quarter 2025 results on Oct. 29, before the opening bell. While we expect each of its segments to post volume and revenue growth in the quarter, higher costs stemming from tariff-related pressures are likely to have weighed on its bottom-line performance.

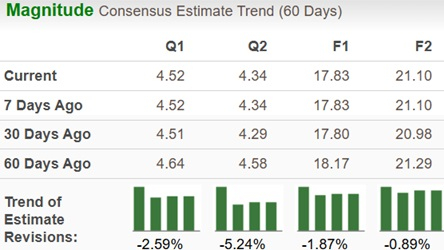

The Zacks Consensus Estimate for Caterpillar’s third-quarter revenues is pegged at $16.75 billion for the quarter, indicating a 3.98% year-over-year rise. The consensus estimate for earnings has moved down 2.59% over the past 60 days to $4.52 per share, which implies a 12.6% decline from the year-ago actual.

CAT’s earnings outpaced the Zacks Consensus Estimates in one of the trailing four quarters while missing in the remaining three quarters, the average surprise being a negative 1.01%. This is depicted in the following chart.

Our proven model does not conclusively predict an earnings beat for Caterpillar this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: CAT has an Earnings ESP of +1.44%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

The manufacturing sector remained in contraction through the third quarter of 2025, as indicated in the Institute for Supply Management’s manufacturing index, which registered 48% in July, 48.7% in August and 49.1% in September. Although the New Orders Index briefly expanded in August at 51.4%, it remained below 50% in the other two months, signaling ongoing weakness. Concerns over tariffs led customers to scale back orders, a trend likely to have reflected in Caterpillar’s third-quarter order volumes.

CAT’s substantial backlog of $37.5 billion at the beginning of the third quarter of 2025 and higher aftermarket parts and service-related revenues are likely to have supported its top line.

All segments are expected to show volume improvement in the quarter. Notably, this suggests the Resource Industries and Construction Industries segment will likely return to volume growth in the quarter.

Overall, we expect a 4.5% contribution from volumes on third-quarter revenues, partly offset by a 0.6% decline in pricing and a 0.4% unfavorable currency impact.

Tariffs (estimated to be around $500-$600 million) are likely to have driven a 10.1% spike in the cost of sales. We anticipate a 6% increase in selling, general and administrative expenses and a 27% rise in research and development costs.

Factoring in the expected growth in revenues offset by higher costs, our model projects a 19% year-over-year decrease in adjusted operating income to $2.62 billion. We expect the operating margin to be 15.8% in the third quarter, implying a contraction from the 20% reported in the third quarter of 2024.

Our model projects the Resource Industries segment's external sales at $2.95 billion for the third quarter, indicating a 0.4% year-over-year uptick. We expect a 3.6% rise in volume for the segment and an unfavorable 3.2% pricing.

The segment is expected to report an operating profit of $615.7 million, suggesting a 0.5% year-over-year dip. The segment’s operating margin is projected to be 20.9%, lower than the 21.1% reported in third-quarter 2024.

The Construction Industries segment’s external sales are projected at $6.72 billion, indicating growth of 6.4% from the year-ago quarter’s actual. We expect a 7.8% improvement in volumes. However, it will be offset by a 0.8% drop in pricing and an unfavorable impact of 0.6% from currency translation.

The segment’s operating profit is projected to be $1.55 billion, indicating year-over-year growth of 4.5%. We project the segment’s margins at 23.1%, implying a slight contraction from the year-ago quarter’s 23.5%.

For the Energy and Transportation segment, we expect external sales to be $6.1 billion, suggesting a 1.7% rise from the year-ago quarter’s actual. Volume growth is projected to be 1.1% as improved demand in Power Generation, Oil and Gas, and Industrial is expected to have been offset by declines in Transportation. Pricing is expected to contribute 0.8% to the segment’s sales growth, while currency impact is expected to have a negative 0.3% impact.

Our estimate for the segment’s operating profit is $1.53 billion for the third quarter of 2025, suggesting a 7.1% increase year over year. The operating margin is projected to be 25.1%, higher than the 23.9% reported in the third quarter of 2024.

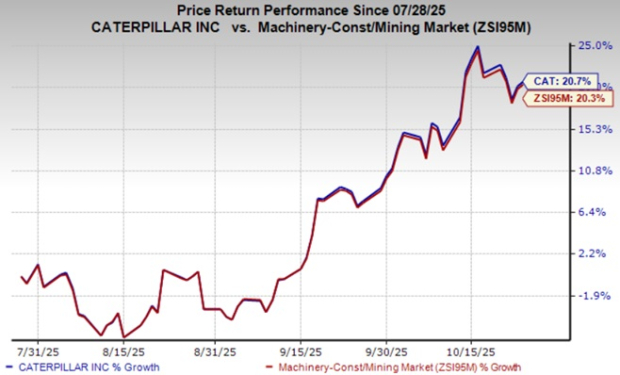

CAT has gained 20.7% in the past three months compared with the industry’s 20.3% growth.

Here are some companies with the right combination of elements to post an earnings beat in their upcoming releases.

AptarGroup ATR, slated to release third-quarter 2025 results on Oct. 30, has an Earnings ESP of +1.27% and a Zacks Rank of 2 at present. The Zacks Consensus Estimate for AptarGroup’s third-quarter 2025 earnings is pegged at $1.57 per share, suggesting a year-over-year rise of 5.4%. AptarGroup has a trailing four-quarter average surprise of 8.3%.

Terex Corporation TEX, slated to release third-quarter 2025 results on Oct. 30, has an Earnings ESP of +0.27% and a Zacks Rank of 3 at present. The Zacks Consensus Estimate for Terex’s third-quarter 2025 earnings is pegged at $1.22 per share, suggesting a year-over-year decline of 16.4%. Terex has a trailing four-quarter average surprise of 22.3%.

Sealed Air Corporation SEE, set to release third-quarter 2025 results on Nov. 4, has an Earnings ESP of +1.28% and a Zacks Rank of 3 at present. The Zacks Consensus Estimate for Sealed Air’s third-quarter 2025 earnings is pegged at 68 cents per share, suggesting a year-over-year decline of 13.9%. Sealed Air has a trailing four-quarter average surprise of 19.04%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite