|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

EMCOR Group, Inc. EME is scheduled to report third-quarter 2025 results on Oct. 30, before the opening bell.

In the last reported quarter, EMCOR delivered a strong second-quarter 2025, marked by record revenue, profitability, and backlog. Revenues rose 17.4% year over year to $4.30 billion, driven by robust activity across construction segments, especially data centers, healthcare, manufacturing, and institutional markets. Operating margin expanded to 9.6% from 9.1% a year ago, reflecting disciplined project execution, favorable mix, and productivity gains. Diluted earnings per share (EPS) grew 28% to $6.72, also reaching a quarterly record. The company's backlog (Remaining Performance Obligations, or RPOs) was an all-time high at $11.91 billion.

After delivering robust results in the first half of the year—including record second-quarter revenues and margins—investors will watch closely to see if EMCOR can sustain its outperformance through the third quarter despite macro uncertainties.

This specialty contracting services provider surpassed earnings estimates in each of the trailing four quarters, with an average of 16.8%.

The Zacks Consensus Estimate for the third-quarter EPS has increased to $6.65 from $6.57 over the past 30 days. The estimated figure indicates 14.7% growth from the year-ago reported figure. The consensus mark for revenues is pegged at $4.26 billion, suggesting a 15.2% year-over-year increase.

For 2025, EMCOR is expected to register a 15.4% increase from a year ago in revenues. Its bottom line is expected to witness an improvement of 17.1% from a year ago. Below is what to expect in the third quarter for EME stock.

Record Backlog Providing Strong Revenue Visibility

EMCOR ended the second quarter with record RPOs of $11.91 billion, up 32.4% year over year. This robust backlog across Network & Communications, Institutional, Manufacturing & Industrial, Healthcare and Hospitality & Entertainment sectors provides substantial conversion opportunities for the third quarter project execution. The elevated RPO base ensures steady revenue flow and supports the stronger full-year outlook.

Strength in Electrical and Mechanical Construction

The company’s core U.S. Electrical (which accounted for 31% of second-quarter total revenues) and Mechanical Construction operations (which accounted for 41% of second-quarter total revenues) continue to deliver exceptional results, supported by strong demand in data centers, manufacturing and healthcare. With both segments reporting record revenues and margin expansion in the second quarter, this strength is expected to carry into the third quarter as multi-phase build-outs progress and large-scale project activity remains healthy.

Margin Tailwinds from Execution Discipline and Productivity Initiatives

EMCOR anticipates maintaining strong margin execution into the third quarter, supported by disciplined project management, a favorable mix and productivity gains. The company’s use of virtual design and construction, prefabrication and strong labor and project planning continues to enhance productivity and support margins. For 2025, the company now expects operating margins between 9% and 9.4%, signaling confidence in sustaining high-quality project execution in the coming quarters. Given that the second quarter delivered a 9.6% operating margin, management commentary suggests stable to strong margin performance continuing into the third quarter.

Improved Outlook for Building Services Operations

The U.S. Building Services segment saw a positive shift as Mechanical Services growth outweighed prior declines in site-based operations, indicating improving demand across HVAC service, retrofit and repair work. This turnaround increases the likelihood of steady contribution from this segment in the third quarter.

Earnings Visibility and Profitability Guidance

Guidance for non-GAAP EPS for 2025 has been raised to a range of $24.50 to $25.75 from $22.65-$24.00 during the second-quarter earnings call, driven by higher profitability expectations for the back half of the year. As the third quarter is a key seasonal execution period for EMCOR, this upgraded outlook signals management’s confidence in sustaining high project throughput and profitability in the quarter. The EPS guidance increased from the prior $22.65 to $24.00 range, which incorporates stronger-than-anticipated first-half performance and expected continuity of this trend into the third quarter.

Our proven model predicts an earnings beat for EMCOR for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: EME has an Earnings ESP of +0.20%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

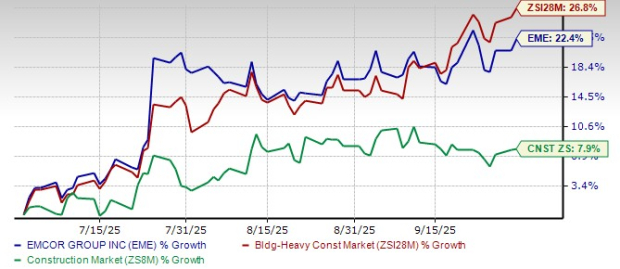

EME stock has gained 22.1% over the July to September 2025 period, underperforming the Zacks Building Products - Heavy Construction industry but performing better than the Zacks Construction sector.

EME shares reached $754.85 as of Oct. 28, 2025—just 0.1% below the 52-week high of $755.57 and nearly 135.2% above the low of $320.89, underscoring investor conviction in EMCOR’s resilient earnings and record project pipeline.

EME’s July-September Share Price Performance

EMCOR’s forward P/E of 28.22X remains elevated compared with the industry average of 24.35X and its own five-year median of 17.27X, nearing the top of its historical band of 11.88X–28.22X. This premium places the stock alongside sector leaders such as Quanta Services PWR, Comfort Systems USA FIX and MasTec MTZ, all of which have ridden strong momentum from data center expansion, electrification initiatives and industrial infrastructure upgrades. The key debate now is whether EMCOR can continue to command this valuation premium as growth gradually normalizes and cost pressures persist. For context, Quanta, Comfort Systems and MasTec currently trade at 36.78X, 38.95X and 28.18X, respectively.

EMCOR is riding strong momentum, backed by solid earnings visibility and a business mix positioned in the fastest-growing areas of the construction landscape. The company isn’t just benefiting from cyclical tailwinds, it is delivering structural outperformance, evidenced by record backlog, expanding margins, raised full-year EPS guidance and a consistent earnings-beat track record. With the Zacks Consensus Estimate moving higher ahead of the release and a Zacks Rank #2 (Buy), the setup leans favorably toward another solid quarter.

While the stock trades at a premium, EMCOR has earned it. Its valuation sits in the same league as industry leaders like Quanta, Comfort Systems and MasTec benefiting from long-duration secular catalysts such as data centers, electrification, healthcare infrastructure and industrial capacity expansion. With record RPOs providing multi-quarter revenue visibility and management signaling sustained margin strength into the back half of 2025, the company is positioned to continue justifying and potentially expanding that premium.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Blue Collar AI Stock Comfort Systems Jumps On Blowout Earnings, Soaring Backlog

FIX +6.46%

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite