|

|

|

|

|||||

|

|

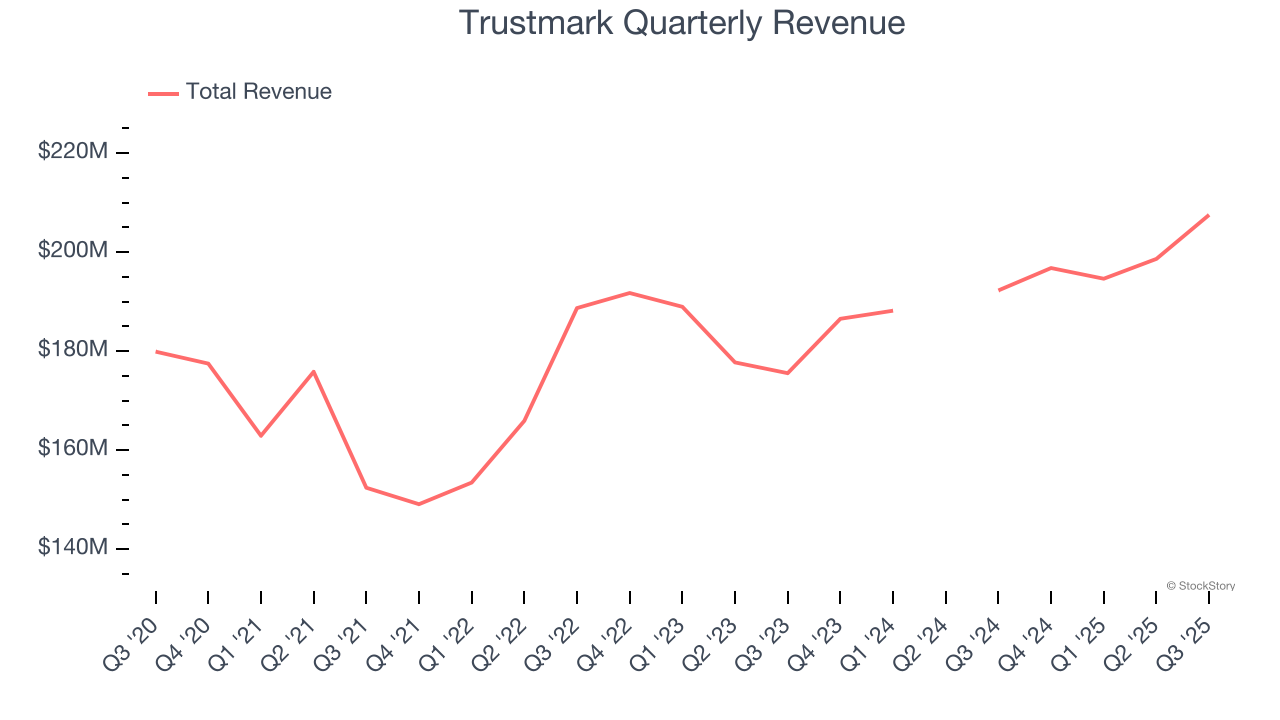

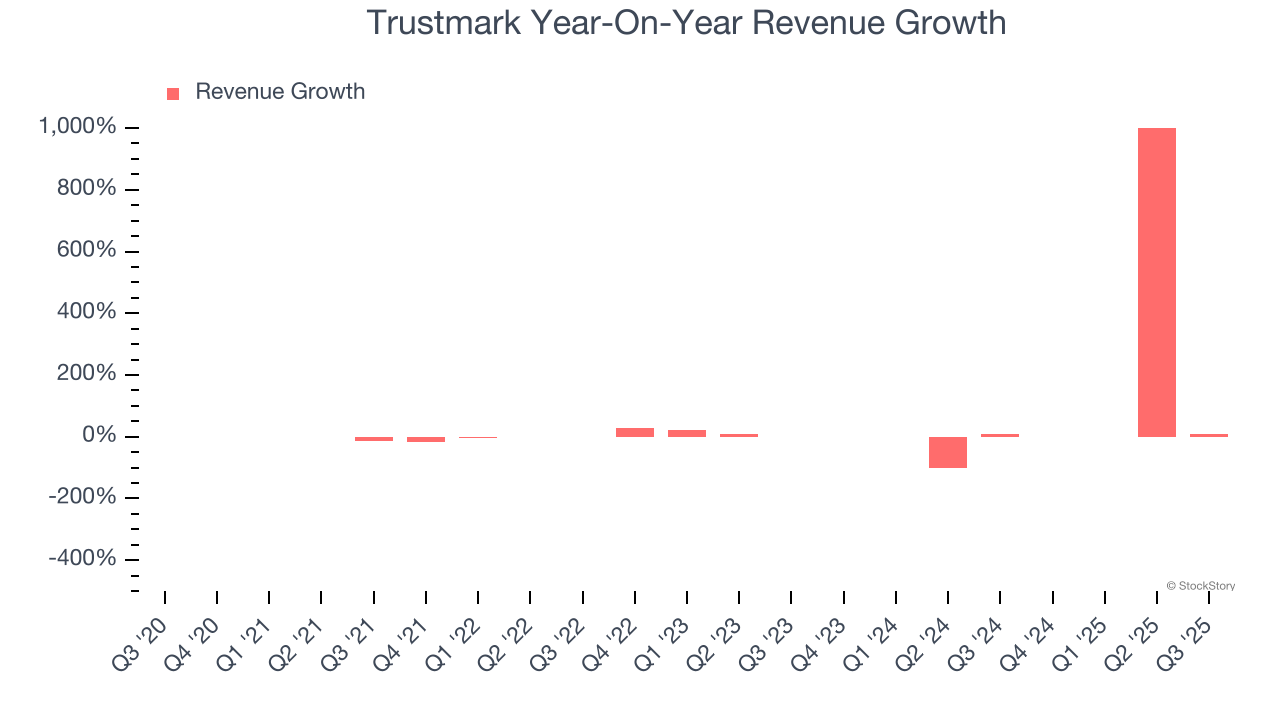

Regional banking company Trustmark (NASDAQ:TRMK) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 7.9% year on year to $207.5 million. Its non-GAAP profit of $0.94 per share was in line with analysts’ consensus estimates.

Is now the time to buy Trustmark? Find out by accessing our full research report, it’s free for active Edge members.

Duane A. Dewey, President and CEO, stated, “Our momentum continues to build as reflected in Trustmark’s solid financial performance in the third quarter. Diversified loan growth and stable credit quality continued along with cost-effective core deposit growth. Our wealth management business performed well while our mortgage business continued to execute well in a challenging operating environment. We continued to implement organic growth initiatives and make investments to capitalize on opportunities in our marketplace. During the quarter, we added established relationship managers and production talent to accelerate profitable growth in key markets across our franchise. We will continue to add seasoned professionals with proven performance records to supplement our teams and expand and deepen customer relationships. These investments are designed to further enhance our financial performance and create long-term value for our shareholders.”

Tracing its roots back to 1889 in Mississippi, Trustmark (NASDAQ:TRMK) is a financial services organization providing banking, wealth management, insurance, and mortgage services across five southeastern states.

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. Unfortunately, Trustmark’s 3.3% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the banking sector, but there are still things to like about Trustmark.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Trustmark’s annualized revenue growth of 4.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Trustmark reported year-on-year revenue growth of 7.9%, and its $207.5 million of revenue exceeded Wall Street’s estimates by 3.3%.

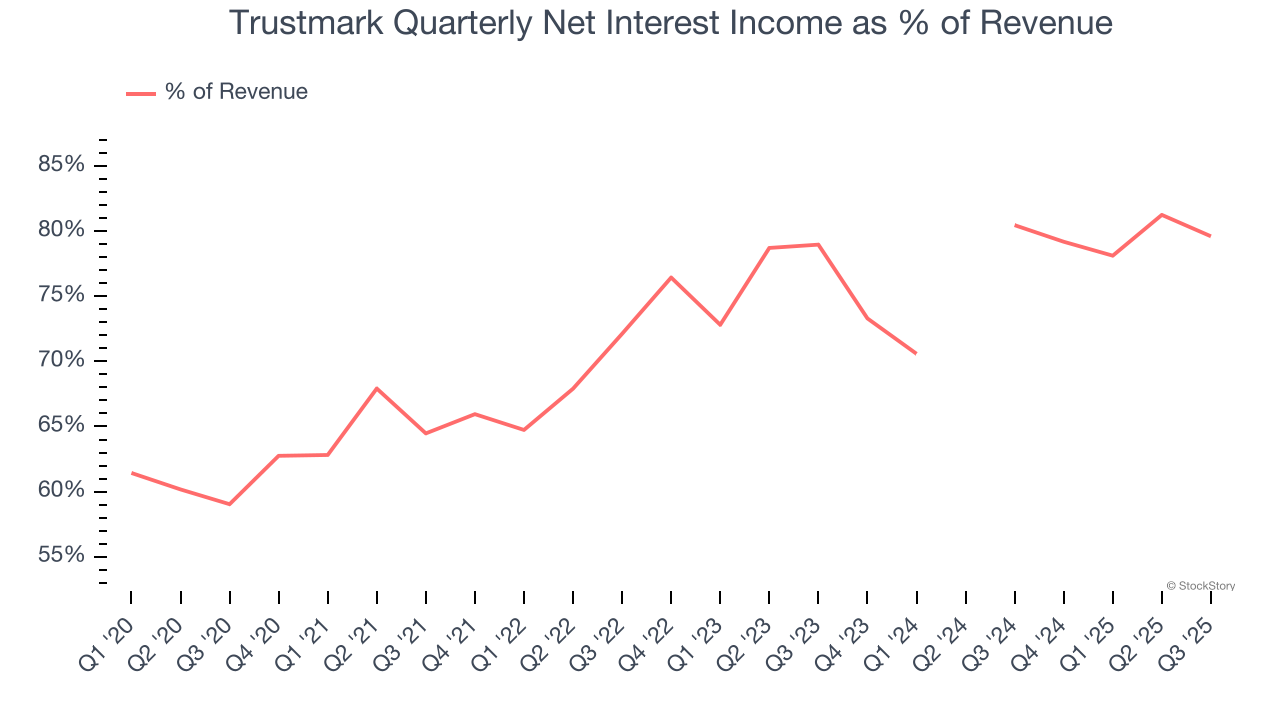

Net interest income made up -2,675% of the company’s total revenue during the last five years, meaning Trustmark is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

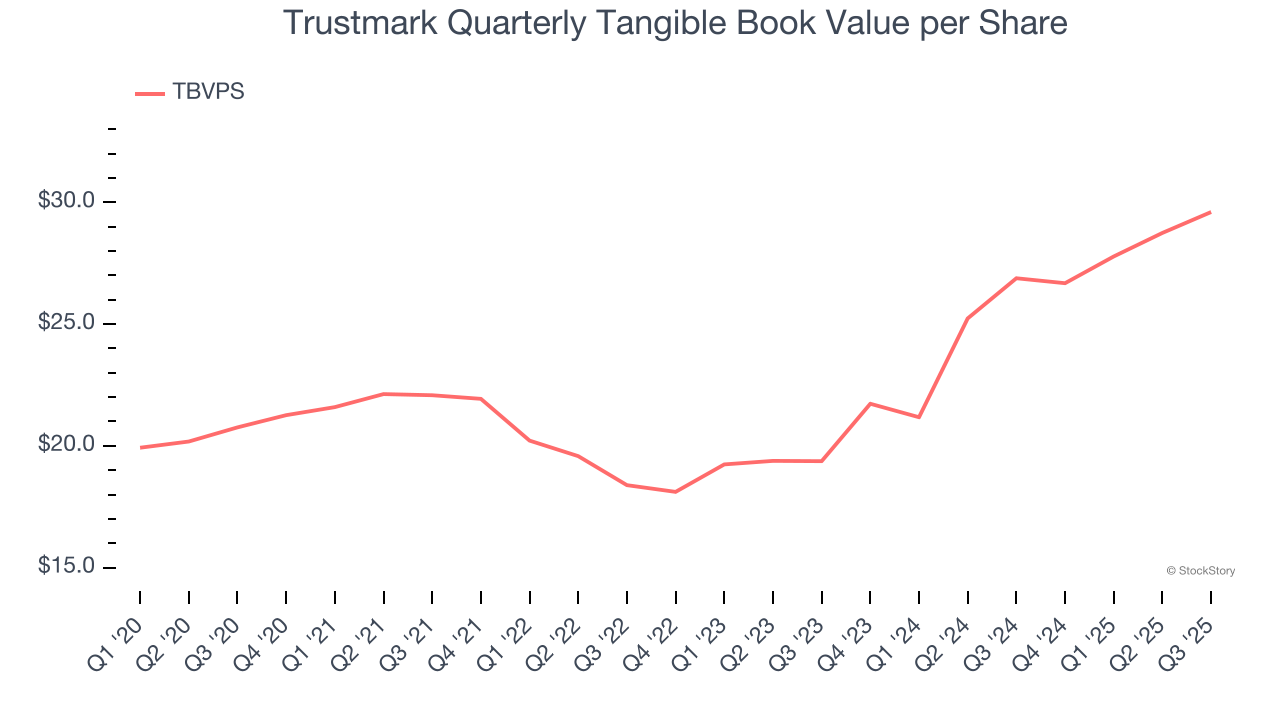

Banks profit by intermediating between depositors and borrowers, making them fundamentally balance sheet-driven enterprises. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these institutions.

When analyzing banks, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value by removing intangible assets of debatable liquidation worth. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

Trustmark’s TBVPS grew at an impressive 7.4% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 23.6% annually over the last two years from $19.37 to $29.60 per share.

Over the next 12 months, Consensus estimates call for Trustmark’s TBVPS to grow by 8.8% to $32.19, decent growth rate.

We enjoyed seeing Trustmark beat analysts’ revenue expectations this quarter. We were also happy its efficiency ratio and tangible book value per share narrowly outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Zooming out, we think this was a mixed quarter. The stock remained flat at $38.71 immediately following the results.

So do we think Trustmark is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-19 | |

| Feb-05 | |

| Feb-03 | |

| Jan-29 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-27 | |

| Jan-27 | |

| Jan-27 | |

| Jan-27 | |

| Jan-27 | |

| Jan-25 | |

| Jan-22 | |

| Jan-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite