|

|

|

|

|||||

|

|

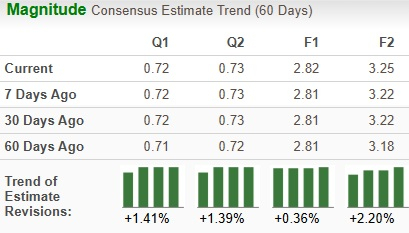

Arista Networks, Inc. ANET is scheduled to report third-quarter 2025 earnings on Nov. 4. The Zacks Consensus Estimate for revenues and earnings is pegged at $2.24 billion and 72 cents per share, respectively, up from $1.81 billion and 60 cents recorded in the year-ago quarter. Earnings estimates for Arista for 2025 have increased 0.4% to $2.82 per share over the past 60 days and 2.2% to $3.25 for 2026.

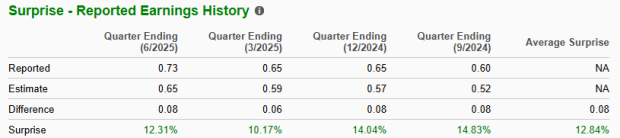

The communications components provider delivered a four-quarter earnings surprise of 12.8%, on average, beating estimates on each occasion. In the last reported quarter, the company pulled off an earnings surprise of 12.3%.

Our proven model predicts an earnings beat for Arista for the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is perfectly the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Arista currently has an ESP of +4.17% with a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products, while retaining a leadership position in 100-gigabit Ethernet switches for the high-speed datacenter segment. The company is witnessing solid demand trends among enterprise customers backed by its multi-domain modern software approach, which is built upon its unique and differentiating foundation, the single EOS (Extensible Operating System) and CloudVision stack.

During the quarter, the company strengthened its footprint in the Indian subcontinent with continued investments for developing AI for Networking centers of excellence across the country. This will help support the domestic production of high-performance data center and campus network switches, as well as enterprise access points, with an increasing focus on sourcing critical components locally. While unlocking high-value employment opportunities for local talent, the investments are expected to spur innovation and local manufacturing in critical domains such as cloud and AI networking to solidify Arista’s market presence. This is likely to be reflected in the upcoming quarterly results.

The buyout of the VeloCloud SD-WAN portfolio from Broadcom Inc. during the quarter offered Arista complementary products and services with a production-proven SD-WAN architecture, a dedicated customer base of more than 20,000 and a seasoned sales channel. VeloCloud delivers converged cloud networking from the edge to the data center and cloud, with end-to-end automation, application continuity and branch transformation, which empowers enterprises to transform their data centers with modern, high-performance operations. The acquisition enabled Arista to offer end-to-end networking solutions to a wider range of customers and augment its secure access service edge (SASE) networking gear, which supports remote workers and branch offices.

Arista continues to lead the way in optimizing AI networks, ensuring high-efficiency AI workload execution and supporting the ever-growing demands of modern AI infrastructures. As a result, the demand for Arista's solutions is expected to rise, potentially driving higher revenues.

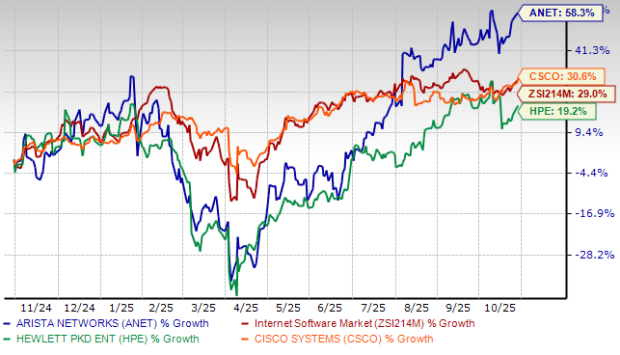

Over the past year, Arista has gained 58.3% compared with the industry’s growth of 29%, outperforming peers like Hewlett Packard Enterprise Company HPE and Cisco Systems, Inc. CSCO. Hewlett Packard has gained 19.2% and Cisco soared 30.6% during this period.

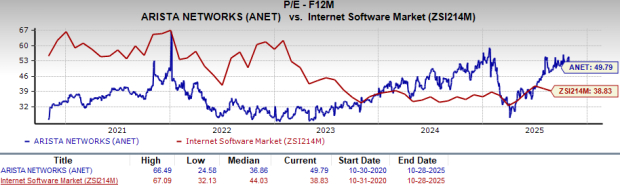

From a valuation standpoint, Arista appears to be trading at a premium compared to the industry and above its mean. Going by the price/earnings ratio, the company shares currently trade at 49.79 forward earnings, higher than 38.83 for the industry and the stock’s mean of 36.86.

Arista continues to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. It is well-positioned for growth in the data-driven cloud networking business with proactive platforms and predictive operations. It offers one of the broadest product lines of datacenter and campus Ethernet switches and routers in the industry. Arista provides routing and switching platforms with industry-leading capacity, low latency, port density and power efficiency.

In addition to high capacity and easy availability, its cloud networking solutions promise predictable performance and programmability, enabling integration with third-party applications for network management, automation and orchestration. The company also innovates in areas such as deep packet buffers, embedded optics and reversible cooling. With customers deploying transformative cloud networking solutions, the company has announced several additions to its multi-cloud and cloud-native software product family with CloudEOS Edge.

However, Arista is facing stiff competition in cloud networking solutions, particularly in the 10-gigabit Ethernet and above. Cisco is the dominant player in the data center networking market due to its diverse portfolio of IP-based networking products. Apart from Cisco, Arista faces significant competition from large network equipment and system vendors such as Brocade, Dell, Hewlett Packard, Extreme Networks and Mellanox Technologies.

With solid fundamentals and healthy revenue-generating potential driven by robust demand trends, Arista appears poised to benefit in the long run. Further, a strong emphasis on quality, diligent execution of operational plans and continuous portfolio enhancements are driving more value for customers. With improving earnings estimates, the stock is witnessing a positive investor perception.

However, it looks a bit expensive relative to its valuation metrics. Arista seems to be treading in the middle of the road, and new investors could be better off if they trade with caution. A single quarter’s results are also not so important for long-term stakeholders and investors already owning the stock could stay put to reap long-term benefits.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Stock Market Today: Dow Rises Ahead Of Fed Minutes; Nvidia Jumps On Meta Deal (Live Coverage)

CSCO

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite