|

|

|

|

|||||

|

|

The demand for clean electricity is accelerating worldwide, driven by multiple structural and technological shifts. With this increasing demand, utility stocks like GE Vernova GEV and Enphase Energy ENPH are becoming attractive investment options.

The swift expansion of extensive artificial intelligence-driven data centers is leading to a substantial rise in energy usage, as these operations need considerable electricity to run servers and cooling systems around the clock. Increasing global temperatures are exacerbating electricity requirements, particularly for air conditioning and cooling mechanisms, while the growing use of electric vehicles (EVs) is generating new, ongoing demands for electricity.

Government decarbonization targets and clean energy mandates are also pushing utilities and corporations to transition toward renewable sources such as solar, wind, and hydro power. Grid modernization initiatives are also gaining momentum, aimed at integrating intermittent renewables and improving reliability and resilience.

Furthermore, the increasing demand for effective energy storage technologies, which are essential for maintaining supply and demand balance, underlines the strategic significance of businesses positioned as integrators of sustainable energy. Together, these patterns support the long-term growth prospects of companies engaged in energy storage, smart grid technologies, and renewable energy production.

GE Vernova benefits from its diversified business across Power, Wind, and Electrification, which allows it to provide customers with a full suite of solutions, from gas and nuclear to wind energy and grid technology. Because of its flexibility, the business appeals to a broad range of customers and remains resilient to market changes.

The company's strategy includes developing sustainable products, modernizing existing power plants, and investing in research and innovation to accelerate the transition to a more reliable, affordable, and sustainable energy future. During the third quarter of 2025, GEV’s Power unit signed over 12 gigawatts (GW) of new gas equipment contracts, including 12 GW of slot reservation agreements and 1 GW of orders. It converted 7 GW of existing slot reservation agreements to orders and shipped 4 GW of equipment. Its Wind unit secured 0.3 GW of onshore wind repowering orders, with 0.6 GW booked year to date.

Enphase Energy is a pioneer in energy storage, household energy management, and solar microinverter systems. ENPH is a solid investment in the decentralized clean energy future due to its advancements in distributed energy resources and its global presence in residential solar installations. Under each solar panel, ENPH's microinverters transform DC power into AC power individually. This method improves system reliability as well as effectiveness over conventional string inverters.

In October 2025, ENPH announced expanded support for virtual power plants (VPP) across Europe. Its products now enable advanced energy market steering and smart grid features, such as one-minute data streaming, instant alerts for VPP events and system maintenance, and home solar curtailment to support grid constraints. Additionally, the company is extending its ties with top energy providers to support regulating EV chargers and heat pumps.

Let's compare the two stocks' fundamentals to determine which one is a better investment option at present.

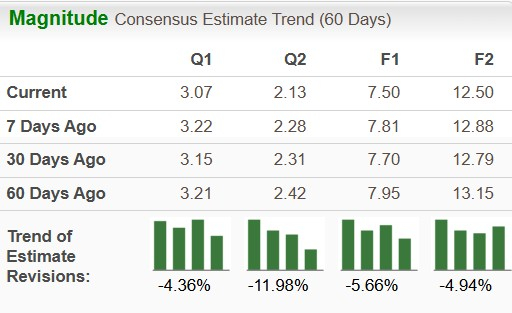

The Zacks Consensus Estimate for GE Vernova’s 2025 and 2026 earnings per share (EPS) has declined 5.66% and 4.94%, respectively, in the past 60 days.

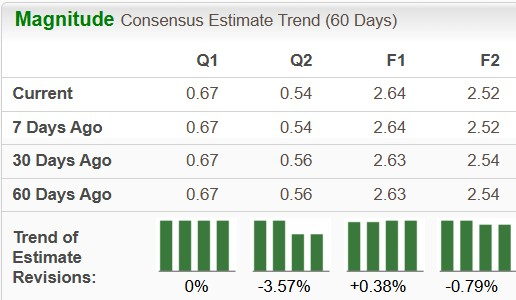

The Zacks Consensus Estimate for Enphase Energy’s EPS has increased 0.38% for 2025 and declined 0.79% for 2026 in the past 60 days.

GE Vernova’s cash and cash equivalents as of Sept. 30, 2025, totaled $7.95 billion, while both the current and long-term debt values were nil. A comparative analysis of these figures indicates that GE Vernova boasts a strong solvency position and the ability to reliably fund its ongoing operations and future growth plans.

Enphase Energy had cash and cash equivalents (including marketable securities) of 1.48 billion as of Sept. 30, 2025. As of the same date, the company’s long-term debt totaled $0.57 billion, while its current debt was $0.63 billion. A comparative analysis of these figures implies that Enphase Energy also boasts a solid solvency position. It will help the company to expand its operations and seize new market opportunities.

GEV shares trade at a forward 12-month Price/Sales (P/S F12M) multiple of 3.87 compared with ENPH’s P/S F12M of 2.89, making ENPH relatively more attractive from a valuation standpoint.

ROE measures how efficiently a company is utilizing its shareholders’ funds to generate profits. GE Vernova’s current ROE is 17.07% compared with Enphase Energy’s 47.99%.

In the past three months, shares of GE Vernova’s and Enphase Energy have declined 12.8% and 6.5%, respectively.

Both companies are deeply aligned with the global clean energy transition, but they operate at different scales within the energy ecosystem. GE Vernova focuses on large-scale power generation and grid modernization, offering solutions that enable utilities and nations to decarbonize their electricity supply.

By contrast, Enphase Energy works more closely with the consumer and distributed energy segments of the industry. It specializes in home battery storage systems, microinverters, and residential solar systems that let small businesses and families produce, store, and control their own clean electricity.

However, our choice at the moment is Enphase Energy, given its earnings growth for 2025, better ROE and financial stability. Both GEV and ENPH stocks carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite