|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Sterling Infrastructure, Inc. STRL is scheduled to report third-quarter 2025 results on Nov. 3, after the closing bell.

In the last reported quarter, Sterling delivered adjusted earnings per share of $2.69, surpassing the Zacks Consensus Estimate by 19% and rising 41% year over year. Revenues of $614.5 million exceeded estimates by 10.7% and increased 21% from the prior year. The company’s performance was driven by strong growth in E-Infrastructure Solutions and Transportation Solutions, which offset softness in the Building Solutions segment. Gross margin expanded 400 basis points to 23%, supported by a shift toward higher-margin projects. Backed by solid revenue growth and improved margins, adjusted EBITDA rose 35% from the year-ago quarter.

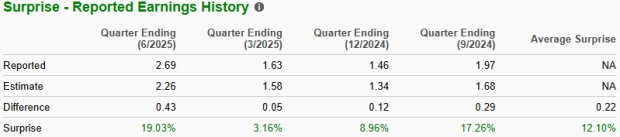

This Texas-based e-infrastructure solutions, building solutions and transportation solutions provider has an impressive record of surpassing earnings expectations, exceeding the consensus mark in the last four quarters. The average surprise over this period is 12.1%, as shown in the chart below.

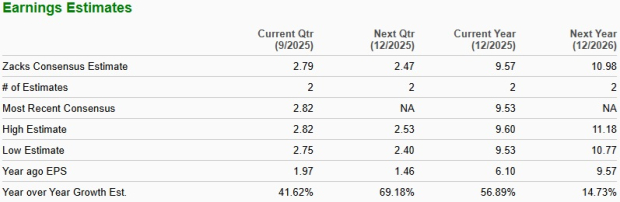

The Zacks Consensus Estimate for the third-quarter EPS has been unchanged at $2.79 over the past 30 days. The estimated figure implies 41.6% growth from the year-ago reported figure. The consensus mark for revenues is $612.4 million, indicating 3.1% year-over-year growth.

For 2025, STRL is expected to register 56.9% EPS growth from that reported a year ago.

Our proven model does not predict an earnings beat for Sterling for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: STRL has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sterling is likely to have maintained its growth momentum in the third quarter of 2025. The company continues to benefit from its focus on high-margin markets, such as data centers, e-commerce distribution and manufacturing facilities. Expansion into new geographies and steady transportation activity are expected to have supported growth during the quarter. Strategic acquisitions, including CEC Facilities Group, are expected to have strengthened service capabilities and customer reach. A healthy project pipeline and a strong backlog are likely to have provided multi-year visibility.

Segment-wise, E-Infrastructure Solutions (which accounted for 51% of second-quarter 2025 revenues) is expected to have remained the key growth driver in the to-be-reported quarter. The segment is likely to have benefited from robust demand in data center development, driven by ongoing AI and digital transformation trends. Expansion into new markets such as Texas and early activity in the Northwest are expected to have supported growth.

Rising e-commerce distribution and manufacturing projects might have added further momentum. The segment is also likely to have gained from consistent bid activity and visibility into multi-phase projects. The Zacks consensus Estimate for E-infrastructure Solutions revenues for the to-be-reported quarter is pegged at $349 million, up from $264 million reported a year ago.

The Transportation Solutions segment (which accounted for 32% of total second-quarter 2025 revenues) is expected to have delivered steady performance in the third quarter. Growth is likely to have been supported by solid backlog levels and sustained federal funding under the IIJA program. Continued demand in key markets, including the Rocky Mountain and Arizona regions, might have driven activity.

The planned downsizing of low-bid heavy highway operations in Texas is expected to have moderated revenues but supported margin improvement through a more profitable mix. The consensus mark for Transportation Solutions revenues is pegged at $170 million, reflecting a decrease of 25.1% year over year.

Sterling’s Building Solutions segment (which accounted for 17% of total second-quarter 2025 revenues) is expected to have faced mixed conditions in the to-be-reported quarter. Elevated mortgage rates and affordability pressures might have continued to weigh on residential demand. However, steady construction activity in key markets such as Dallas, Fort Worth, Houston and Phoenix is expected to have supported volumes.

The company’s efforts toward service diversification and operational discipline are likely to have offset part of the softness in the housing market. The consensus mark for Building Solutions revenues is pegged at $96 million, implying a decrease of 6.8% year over year.

From the margin perspective, Sterling is expected to have benefited from its growing mix of large-scale, complex projects. Execution efficiency and a disciplined approach to project selection are likely to have supported higher profitability. The company’s continued shift toward mission-critical infrastructure work, especially in the data center and industrial markets, is expected to have contributed to margin resilience in the quarter.

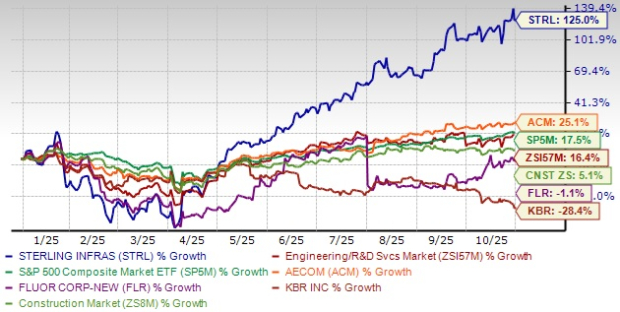

So far this year, shares of Sterling have risen 125%, well above the Zacks Engineering – R&D Services industry’s 16.4% growth. The stock has further outperformed the broader Construction sector and the S&P 500, which have gained 5.1% and 17.5%, respectively, in the same period.

STRL stock has outperformed some other players, including AECOM ACM, Fluor Corporation FLR and KBR, Inc. KBR. In the year-to-date period, AECOM has rallied 25.1%, while KBR and Flour have lost 28.4% and 1.1%, respectively. Let us look at the factors driving this performance.

Sterling’s shares are currently trading at a forward 12-month price-to-earnings (P/E) ratio of 35.29, a 39.6% premium to the industry average of 25.28.

STRL stock also appears overvalued compared with other peer companies. AECOM, Fluor and KBR have a forward P/E of 23.44, 22.21 and 10.08, respectively.

Sterling is likely to have delivered another steady quarter, supported by disciplined project execution and rising demand in high-value infrastructure markets. Expansion into new geographies, along with contributions from recent acquisitions, is expected to have enhanced service capabilities and customer reach. The company’s strong backlog and exposure to mission-critical projects continue to provide long-term visibility.

With favorable market conditions and a continued focus on profitability, Sterling appears well-positioned to sustain growth in the near term. Investors may view the stock as a potential long-term play on the expanding e-infrastructure and transportation markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite