|

|

|

|

|||||

|

|

Alphabet GOOGL is a behemoth in the digital advertising market in which Reddit RDDT is the latest challenger. Increasing deployment of AI and machine learning are driving content creation, while chatbots and virtual assistants are helping advertisers offer personalized user interactions and content personalization. These benefit both GOOGL and RDDT stocks. Both are expected to benefit from growing digital advertising spending, which, per eMarketer, expects to surpass 80% share of total ad spending in 2025.

However, shares of both Alphabet and Reddit have suffered from worsening macroeconomic environment post U.S. President Donald Trump’s decision to levy tariffs on trading partners including China, Mexico and China. This is expected to hurt digital advertising spending this year as automotive, fast-moving consumer goods and retail verticals lower spending, per Investing.com that cited analysis from KeyBanc Capital Markets.

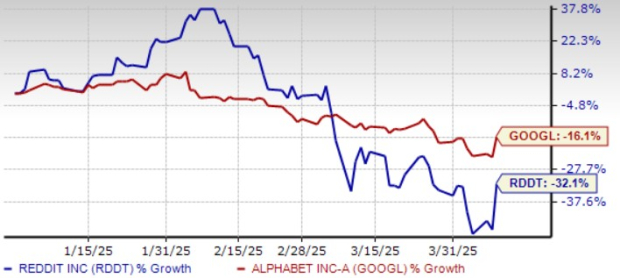

Year to date, Alphabet shares have lost 16.1%, outperforming Reddit’s plunge of 32.1%.

So, Alphabet or Reddit, which is a better buy under the current scenario?

eMarketer expects Alphabet to generate more than $200 billion in global digital ad revenues driven by Google and YouTube’s ad revenue growth in 2025. In 2024, Alphabet generated 75% of total revenues from online advertising. However, Google’s growth rate is expected to grow modestly.

Alphabet generates advertising revenues from Google Search & other, YouTube ads and Google Network, which includes revenues generated on Google Network properties participating in AdMob, AdSense and Google Ad Manager. In 2024, Google advertising revenues increased 11.2% over 2023 to $264.59 billion driven by 13.2% increase in Google Search & other revenues and 14.7% increase in YouTube ads.

Alphabet’s initiatives to deploy AI and infuse AI in Search are expected to drive top-line growth. Circle to Search is driving additional Search and is gaining popularity among younger users. Vertex usage increased 20 times in 2024, with strong developer adoption of Gemini Flash, Gemini 2.0, Imagen 3 and Veo. GOOGL recently launched Gemma 3, a collection of lightweight, state-of-the-art open models that can run on a single GPU or TPU.

RDDT’s strong user growth, improved advertising performance across multiple channels, and strong investments in AI-driven tools to enhance its global reach and ad solutions has been a key catalyst. Advertising accounted for 91.2% of Reddit’s 2024 revenues, which totaled $1.3 billion. Total revenues jumped 62% over 2023 driven by an increase in advertising revenues (up 50.3% over 2023) attributed to an increase in impressions delivered.

Reddit’s expanding advertising products portfolio is a key catalyst. The AI-powered Headline Generator and Reddit Pro Trends help businesses uncover real-time insights and grow organically on the platform. These tools enhanced the value that Reddit provides to advertisers, attracting customers and retaining existing ones.

RDDT continues to evolve its platform with new features aimed at improving user experience and community engagement. In March 2025, Reddit introduced tools to enhance user engagement and simplify posting. These include a post-check to prevent rule violations, post-recovery for retrieving removed content, and clear community info on posting requirements. These updates make it easier for users to follow guidelines and engage with communities without the frustration of accidental rule violations.

The Zacks Consensus Estimate for GOOGL’s 2025 earnings is pegged at $8.92 per share, up by a couple of cents over the past 60 days, indicating a 10.95% increase over 2024’s reported figure.

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

The consensus mark for Reddit’s 2025 earnings has jumped 39.8% to $1.16 per share over the past 60 days, suggesting 134.83% growth over 2024.

Reddit Inc. price-consensus-chart | Reddit Inc. Quote

Both GOOGL’s and RDDT’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. However, Reddit’s average surprise of 194.08% is better than Alphabet’s surprise of 11.57%, reflecting good quality of earnings beat on a consistent basis.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Valuation-wise, both Alphabet and Reddit are overvalued, as suggested by the Value Score of C and F, respectively.

In terms of forward 12-month Price/Sales, Alphabet shares are trading at 5.69X, lower than Reddit’s 10.15X.

Although Alphabet dominates the digital advertising market, Google’s ad growth is expected to grow at a moderate pace. Meanwhile, despite trading at a premium compared with GOOGL, Reddit’s prospects benefit from an expanding advertising business, increasing international reach, and improving the user experience with upgraded search and discovery features.

Currently, Reddit has a Zacks Rank #2 (Buy), making the stock a stronger pick compared with Alphabet, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 23 min | |

| 43 min | |

| 56 min | |

| 57 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite