|

|

|

|

|||||

|

|

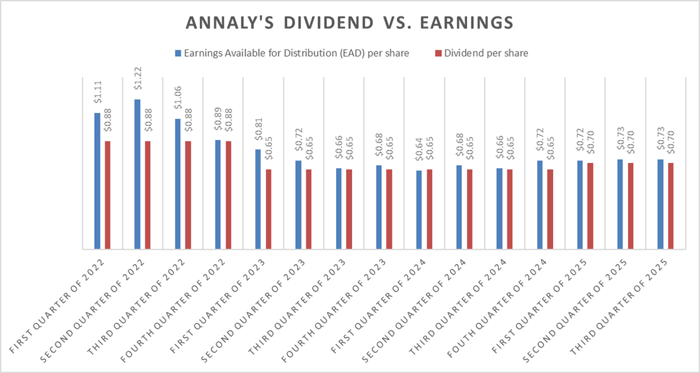

Annaly Capital Management's dividend can fluctuate with its earnings.

Delek Logistics Partners has increased its distribution for over 50 straight quarters.

Verizon recently extended its dividend growth streak to 19 years in a row.

The average stock yields around 1.1% these days, using the S&P 500's dividend yield as a proxy. That's near a record low.

However, some stocks are bucking this trend. Here are three with notably high yields for investors seeking more income.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Verizon.

Annaly Capital Management (NYSE: NLY) leads this group with a 13% yield. The real estate investment trust (REIT) invests in residential mortgages. It primarily invests in agency mortgage-backed securities (MBSes), mortgage pools protected against credit losses by government agencies such as Fannie Mae. Additionally, the mortgage REIT invests in non-agency residential mortgages and mortgage servicing rights.

Mortgages tend to be lower-risk investments with modest fixed-income returns (usually in the low to mid single digits). Annaly invests in these assets using leverage, which can significantly boost its returns. It's currently earning returns in the low to mid teens.

While leverage can boost Annaly's returns, it also increases its risk profile. Its earnings can fluctuate based on changes in market conditions and interest rates. That can impact its dividend rate, which the company has adjusted based on its earnings:

Data source: Annaly Capital Management. Chart by author.

Given this variability, Annaly is better suited for investors comfortable with added risk in exchange for a higher yield.

Delek Logistics Partners (NYSE: DKL) currently has a 10% distribution yield. The master limited partnership (MLP) owns energy midstream assets such as oil pipelines, gas processing plants, and water disposal systems. These assets generate fairly stable cash flows backed by long-term contracts or government-regulated rate structures.

The MLP, which sends investors a Schedule K-1 federal tax form, expects to generate enough cash to cover its monster payout by more than 1.3 times this year. That allows it to retain some cash to fund its continued expansion. The company recently completed its new Libby 2 gas processing plant, providing customers with much-needed additional gas processing capacity. Delek also closed its acquisition of Gravity Water earlier this year, which, along with last year's H2O Midstream purchase, has significantly enhanced its produced water gathering and disposal operations.

Delek's investments to grow its operations are increasing its cash flow. That's allowing the MLP to raise its distribution. It has hiked that payment for more than 50 quarters in a row. With stable cash flows and a sound financial profile, Delek has the flexibility to continue growing its midstream operations and high-yielding distribution.

Verizon Communications' (NYSE: VZ) dividend yields 7%. The telecom giant generates prodigious cash flows as consumers and businesses pay their wireless and internet bills. It has produced $15.7 billion in free cash flow through the first nine months of this year after spending $12.3 billion in capital to maintain and expand its networks. That was more than enough cash to cover the $8.6 billion in dividends it paid out.

The company supplements its heavy capital investments with acquisitions to enhance its growth. Verizon is currently working to close its $20 billion purchase of Frontier Communications to bolster its fiber network. It also agreed to buy Starry to enhance its ability to deliver high-speed internet to urban communities and signed a commercial fiber agreement with Eaton Fiber to further accelerate the expansion of its fiber business.

Verizon's investments to grow its business should boost cash flows, enabling it to raise the dividend. The company recently extended its dividend growth streak to 19 straight years.

Annaly Capital Management, Delek Logistics Partners, and Verizon currently have big-time dividend yields. All three have raised their already massive dividend payments in the last year. That makes them enticing options for investors seeking lucrative streams of passive dividend income.

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $592,390!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,196,494!*

Now, it’s worth noting Stock Advisor’s total average return is 1,053% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 3, 2025

Matt DiLallo has positions in Verizon Communications. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

| 28 min | |

| 9 hours | |

| 14 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite