|

|

|

|

|||||

|

|

CoreWeave, Inc. CRWV reported a third-quarter 2025 loss per share of 22 cents compared with a loss of $1.82 in the year-ago quarter.

Adjusted net loss for the quarter was $41 million against adjusted net income of $67 million a year ago.

The Zacks Consensus Estimate was pegged at a loss of 39 cents per share.

Revenues in the quarter were a record $1364.7 million, which beat the Zacks Consensus Estimate by 6.8%. Total revenues jumped 134% year over year. The top-line performance was driven by increasing demand for the AI-cloud platform.

The company’s strong performance showcases disciplined execution across all aspects of the business — from scaling infrastructure and increasing capacity to strengthening customer relationships and enhancing its software and services. CoreWeave’s role as the go-to cloud for AI is more solid than ever, as it continues to fuel growth through focus and innovation to enable the next generation of AI.

CoreWeave Inc. price-consensus-eps-surprise-chart | CoreWeave Inc. Quote

In the third quarter of 2025, CoreWeave achieved strong momentum, driven by major customer wins across AI labs, hyperscalers and enterprises. The company entered into a multi-year deal worth up to approximately $14.2 billion with Meta to power next-generation workloads. It expanded its partnership with OpenAI through a deal of up to $6.5 billion, bringing total commitments to about $22.4 billion. CoreWeave also deepened ties with a leading hyperscaler, marking their sixth contract, and continued to serve as the preferred partner for innovators, such as Inference.net, Mizuho Bank, NASA JPL and Poolside.

The company rapidly scaled its purpose-built AI infrastructure, adding around 120 MW of active power to reach approximately 590 MW in total and expanding contracted power to 2.9 GW. Key technology milestones included becoming the first to deploy NVIDIA GB300 NVL72 systems and offer NVIDIA RTX PRO 6000 Blackwell Server Edition instances, alongside the acquisition of OpenPipe to strengthen AI training capabilities.

Revenue backlog (inclusive of remaining performance obligation and other amounts the company estimates will be recognized as revenues in future periods under committed customer contracts) was $55.6 billion, rising 271% year over year. This growth was driven by major contracts with clients such as OpenAI, Meta and several hyperscalers. The revenue backlog nearly doubled quarter over quarter.

However, the company has lowered its 2025 outlook. CRWV expects full-year 2025 revenues to be between $5.05 billion and $5.15 billion compared with $5.15 billion to $5.35 billion projected earlier. Adjusted operating income is forecasted to be between $690 million and $720 million compared with $800 million-$830 million anticipated earlier. Capex is estimated to be $12 billion to $14 billion compared with $20 billion to $23 billion projected earlier.

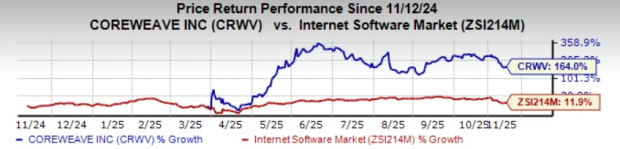

Following the results, shares declined approximately 7% in the after-market trading session yesterday. CRWV’s shares have gained 164% in the past year, significantly outperforming the 11.9% rise of its Internet Software industry.

Total operating expenses were $1.3 billion compared with $466.8 million in the year-ago quarter.

Operating income was $51.9 million compared with $117.1 million in the prior-year quarter.

Adjusted operating income was $217.2 million, up 74% year over year, while adjusted operating margin was 16%, down from 21%.

Adjusted EBITDA was $838.1 million compared with $378.8 million in the prior-year quarter.

As of Sept. 30, 2025, CRWV had $3 billion in cash, cash equivalents and restricted cash. The company exited the third quarter with cash provided in operating activities of $1.7 billion, while capex was $1.9 billion.

CRWV currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Atlassian TEAM came out with first-quarter fiscal 2026 earnings of $1.04 per share, which beat the Zacks Consensus Estimate of 83 cents. This compares to earnings of 77 cents per share a year ago.

Atlassian posted revenues of $1.43 billion for the quarter ended September 2025, surpassing the Zacks Consensus Estimate by 2.40%. The company reported revenues of $1.19 billion in the year-ago quarter.

Freshworks Inc. FRSH came out with quarterly earnings of 16 cents per share, beating the Zacks Consensus Estimate of 13 cents per share. This compares to earnings of 11 cents per share a year ago.

Freshworks posted revenues of $215.12 million for the quarter ended September 2025, surpassing the Zacks Consensus Estimate by 3.12%. This compares to year-ago revenues of $186.57 million.

BlackBerry Limited BB reported second-quarter fiscal 2026 non-GAAP earnings per share (EPS) of 4 cents. The figure beat the company’s estimate of breakeven to EPS of 1 cent. In the year-ago quarter, it reported a non-GAAP EPS at breakeven. The Zacks Consensus Estimate was pegged at 1 cent.

Quarterly total revenues of $129.6 million exceeded its guidance ($115-$125 million) and were up 3% year over year. Management reported that the Secure Communications division outperformed expectations on both top and bottom line, while achieving improvements across its key metrics.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite