|

|

|

|

|||||

|

|

Centrus Energy LEU shares have fallen 11% since it reported third-quarter 2025 results on Nov. 5. Even though Centrus Energy reported improvement in both the top and bottom lines, it fell short of expectations.

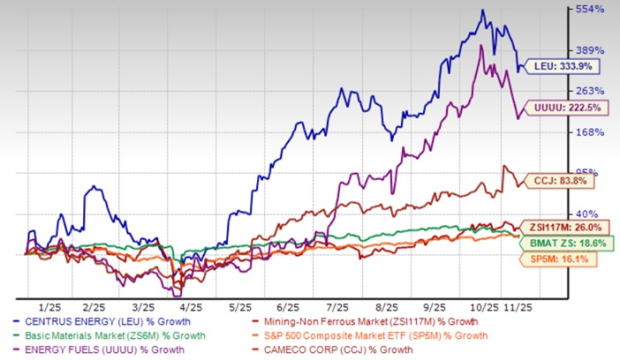

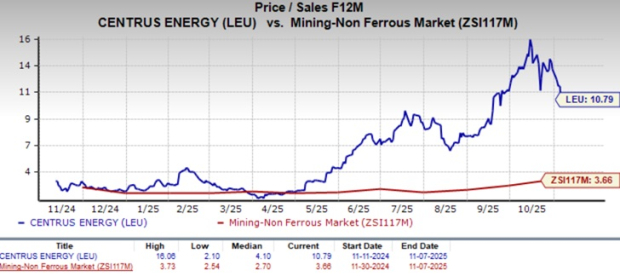

Despite the dip, Centrus Energy stock has surged 333.9% so far this year compared with the non-ferrous mining industry’s 26% growth. The Zacks Basic Materials sector has gained 18.6% and the S&P 500 has risen 16.1% in the same time frame. Centrus Energy has outpaced peers Energy Fuels UUUU and Cameco CCJ, which have gained 222.5% and 83.8% respectively.

With LEU stock soaring, investors may be tempted to join the rally. However, before making a decision, it would be prudent to consider the bigger picture, the company’s financials, growth prospects and risks (if any) in investing.

Centrus Energy operates two business segments: Low-Enriched Uranium (LEU) and Technical Solutions segments.

The LEU segment generates revenues from sales of the Separative Work Units (SWU) component of low-enriched uranium, sales of natural uranium hexafluoride, uranium concentrates or uranium conversion, and sales of enriched uranium products.

Revenues for the LEU segment rose 29% year over year to $44.8 million in the third quarter. This was attributed to uranium sales in the quarter (contributing $34.1 million) in contrast to nil uranium revenues in the year-ago quarter. Meanwhile, SWU revenues were down 69% to $10.7 million due to lower SWU prices.

The Technical Solutions segment’s revenues are primarily derived from the production of High-Assay, Low-Enriched Uranium (HALEU) under the HALEU Operation Contract with the U.S Department of Energy (DOE). It also includes technical, manufacturing, engineering and operations services offered to public and private sector customers.

Technical Solutions revenues jumped 31% to $30 million in the quarter, driven by a $7.3 million boost from the HALEU Operation Contract, along with contributions from other contracts.

Overall, Centrus Energy’s total revenues increased 30% to $75 million but missed the Zacks Consensus Estimate of $80 million.

Cost of sales for the LEU segment surged 78% mainly to higher volumes of uranium sold. Cost of sales for the Technical Solutions segment were up 39%, mainly driven by a $8.5 million increase in costs incurred under the HALEU Operation Contract.

The LEU segment reported a gross loss of $7.8 million while the Technical Solutions segment reported a gross profit of $3.5 million. Centrus Energy reported a total gross loss of $4.3 million against a gross profit of $8.9 million in the year-ago quarter.

The company, however, witnessed year-over-year declines in advanced technology costs and SG&A expenses. Operating loss was $16.6 million in the reported quarter compared with a loss of $7.6 million in the last year quarter.

Despite the operating loss, Centrus Energy managed to deliver net income of $3.9 million (or earnings per share of 19 cents) attributed to an income tax benefit and higher investment income. The company had reported a loss per share of 30 cents in the year-ago quarter. The earnings for the third quarter of 2025 came in a tad lower than the consensus mark of 20 cents.

Centrus Energy currently has a $3.9 billion revenue backlog, which includes long-term sales contracts with major utilities through 2040.

Centrus Energy is the only source of HALEU enrichment in the Western world. HALEU is expected to be needed in the next few years to power both existing reactors and a new generation of advanced reactors to meet the world’s growing need for carbon-free electricity. Unlike low-enriched uranium, which contains uranium concentration below 5%, HALEU contains uranium enriched to between 5% and 20%. It offers advantages such as improved efficiency, extended fuel cycles and lower waste.

The market opportunity is substantial, with the HALEU market value expected to grow from $0.26 billion in 2025 to $6.14 billion by 2035. Centrus Energy is planning to expand production capacity in Ohio so that it can meet the domestic demand for HALEU as well as low-enriched uranium. Meanwhile LEU opportunity is also expected to grow $2.4 billion per year.

The company recently unveiled ambitious plans to significantly expand its uranium enrichment plant in Piketon, OH, to boost the production of Low-Enriched Uranium and HALEU. This project will mark a significant step in restoring America’s ability to enrich uranium at scale. Centrus Energy’s multi-billion-dollar plan requires public and private investment and involves adding thousands of additional centrifuges at the plant to enable large-scale production.

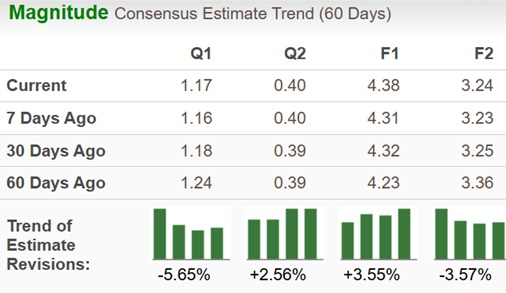

While the EPS estimates for 2025 have moved up over the past 60 days, the same for 2026 has seen downward revision.

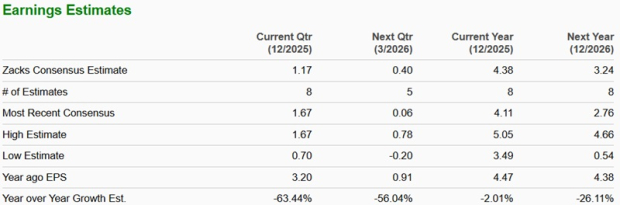

The Zacks Consensus Estimate for Centrus Energy’s 2025 earnings, which is pegged at $4.38 per share, indicates a 2% year-over-year decline. The estimate for 2026 is $3.24, suggesting a decline of 26.11%.

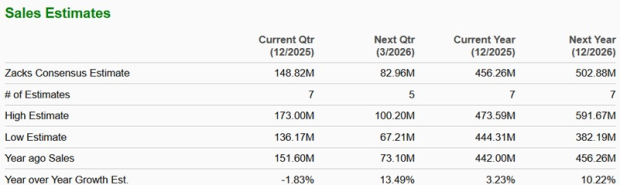

This is despite revenue growth projected for both the years, as shown in the chart below.

While LEU has seen a CAGR of 14% in its top line over 2021-2024, the bottom line has declined 29%.

LEU is trading at a forward 12-month price/sales multiple of 10.79X, a significant premium to the industry’s 3.66X. LEU’s Value Score of F suggests that the stock is not so cheap and a stretched valuation at this moment.

Meanwhile, Energy Fuels is trading way higher at 44.32X and Cameco at 16.10X.

As the only company with a Nuclear Regulatory Commission license for HALEU enrichment, Centrus Energy has a clear first-mover advantage to capitalize on the expected surge in demand. Investors holding LEU shares should continue to do so to benefit from the solid long-term fundamentals.

However, new investors can wait for a better entry point, considering the premium valuation and the expected decline in earnings. Centrus Energy stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite