|

|

|

|

|||||

|

|

Oklo is developing a novel nuclear reactor with fuel recycling capabilities.

The company is making progress through the regulatory process and could turn on its first reactor in 2027.

Oklo is pre-revenue and likely won't have significant top-line growth for several years.

Picture, for a moment, the classic image of a nuclear power plant. The hourglass cooling tower, a plume of steam rising from the top, maybe some industrial equipment around it.

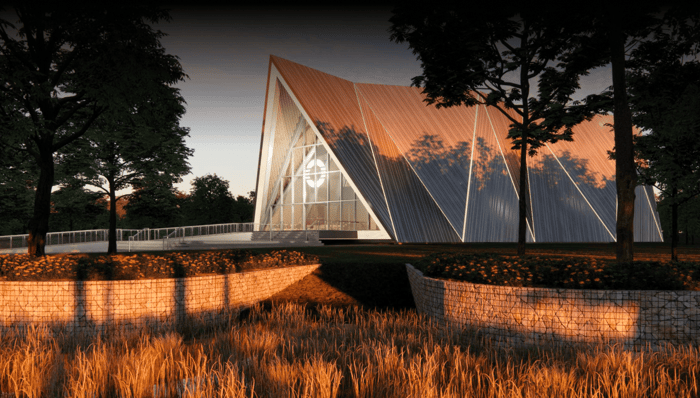

Now strip the cooling tower from your mental image. And let's replace it with something else, something a little more pleasing on the eye: an eco-cabin in the woods, with a sharp roofline like a Nordic cathedral.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

That, in a nutshell, is the kind of reactor the nuclear start-up Oklo (NYSE: OKLO) is trying to build.

A rendering of an Oklo "Aurora" powerhouse. Image source: Oklo.

Clearly, Oklo's reactor isn't isn't the kind you'd see in The China Syndrome or Chernobyl. Indeed, you wouldn't even see Oklo's in the wild: its "Aurora" powerhouse only exists as a rendering. The company is still in the early stages of development -- it doesn't have regulatory approval to operate Aurora commercially -- and yet its stock has shot up triple-digits on the year.

What's behind Oklo's magic? And can this nuclear stock still grow from here?

Oklo is designing a small, fast-spectrum nuclear reactor with complementary fuel recycling capabilities. Its vision is to revolutionize nuclear power by building small, modular reactors and sell clean power under long-term contracts.

Its largest opportunity is -- you guessed it -- with artificial intelligence (AI). It's not hard to imagine why. Oklo's powerhouse is small enough that it could be housed within a hyperscale data center without intrusion. And since these reactors run continuously, they can provide reliable 24/7 power to thirsty AI models.

Oklo's model could be appealing to other companies as well. Mining companies, for instance, could use them to power remote sites where grid access is limited or diesel too costly. The same could apply to military camps, research bases (think: Antarctica), disaster-relief zones, and other industrial facilities.

As noted earlier, Oklo isn't licensed to operate just yet, but it's getting closer.

After its first application was denied in 2022, the company has reconnected with the Nuclear Regulatory Commission (NRC). In July 2025, it cleared phase 1 of the pre-application readiness review. Up next is a formal application, another acceptance review, and a full technical evaluation that spans design, safety, and environmental factors.

This process normally takes several years. However, thanks to recent leglislative moves the Trump administration made relted to nuclear power, Oklo's countdown to deployment could move a little quicker.

In May 2025, the White House issued an executive order -- "Reforming Nuclear Reactor Testing at the Department of Energy" -- aimed at overhauling how the Department of Energy (DOE) tests and approves advanced nuclear reactors. In a nutshell, it asks the DOE to accelerate reactor testing at national labs, with the explicit aim of approving three advanced reactor design by mid-2026.

Oklo is among a handful of companies whose reactor design has been fast-tracked for deployment through this initiative. Indeed, in September 2025, Oklo broke ground on its first Aurora powerhouse at Idaho National Laboratory (INL). If all goes well -- and there's still a lot to demonstrate -- the company could turn on its first commercial reactor in 2027.

At today's price, Oklo is trading about 40% lower than its mid-October highs (around $170 a share). Given the policy winds at its back, it could have plenty of lift long-term. At the same time, there are risks -- and its valuation is one of them.

Despite having zero revenue and no reactor in operation, Oklo's market cap sits around $16 billion at today's price. That's extraordinary for a start-up that's still in the research and development (R&D) phase.

For comparison, NuScale Power (NYSE: SMR) -- another advanced nuclear company designing a small reactor -- is valued at around $8.5 billion. And that's a company with an approved reactor design and revenue (well, some).

Investors will likely have to wait a year or two before Oklo is seeing significant top-line growth. Indeed, one estimate projects a meager $15 million in total revenue for 2027.

OKLO Revenue Estimates for Current Fiscal Year data by YCharts

Then there are capital costs. Securing fuel, building production facilities, funding NRC compliance, and training a workforce will likely pressure the company's balance sheet long before it's profitable.

Add in other potential headwinds -- like a party change in the White House or an engineering problem in its design -- and this growth stock could get bumpy in the near term.

As such, Oklo is a speculative play on the future of energy, but not a core position. Even with shares below $120, this stock is for risk-tolerant investors only. More conservative investors may want to sit this one out, or track the nuclear energy market with an exchange-traded fund (ETF).

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $612,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,184,044!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 10, 2025

Steven Porrello has positions in Oklo. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-07 | |

| Feb-07 | |

| Feb-07 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite