|

|

|

|

|||||

|

|

Circle Internet Group (CRCL) shares have lost 16.2% since the company reported its third-quarter 2025 results on Nov. 12. Despite reporting better-than-expected results, shares declined as investors seemed worried about rising expenses, signalling some near-term pressure on margins.

In the third quarter of 2025, Circle’s adjusted operating expenses increased 35% year over year to $131 million. Moreover, adjusted operating expenses for full-year 2025 are expected to be between $495 million and $510 million, up from the prior guidance of $475-$490 million.

Circle Internet Group, Inc. price-consensus-eps-surprise-chart | Circle Internet Group, Inc. Quote

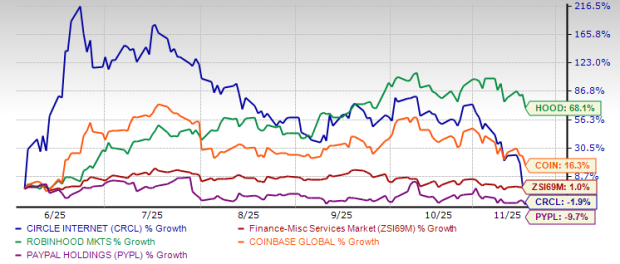

Circle shares are down 1.9% since it started trading on the stock exchange on June 5, 2025, underperforming the Zacks Financial - Miscellaneous Services industry’s return of 1%. During the same time frame, compared with its peers, Circle has outperformed PayPal (PYPL) while underperforming Robinhood Markets (HOOD) and Coinbase Global (COIN). Shares of Coinbase and Robinhood have gained 16.3% and 68.1%, respectively, while PayPal shares have plunged 9.7%.

The fall in the share price raises the question: should investors exit or does the dip present a buying opportunity?

Circle Internet offers USD Coin (USDC) stablecoin, which is redeemable on a one-for-one basis for U.S. dollars. USDC, along with EURO Coin (EURC), are digital currency tokens issued natively on blockchain networks and backed by reserves consisting of highly liquid, price-stable cash and cash equivalents. Both USDC and EURC are used for payments, settlements, and as a digital dollar store of value.

USDC in circulation grew 108% year over year to $73.7 billion at the third-quarter end. Average USDC in circulation surged 97% year over year to $67.8 billion. In the third quarter of 2025, USDC on-chain transaction volume grew 6.8 times year over year to nearly $9.6 trillion, reflecting growing usage.

An improving regulatory environment, including the passage of the GENIUS Act on July 18, provides a legal background to stablecoins like USDC, paving the way for more enterprise adoption. This bodes well for Circle Internet, which has minted USDC worth $79.7 billion, up 128% year over year, in the third quarter of 2025. The company redeemed USDC worth $67.3 billion, up 112% year over year. Meaningful wallets, defined as wallets holding more than $10 of USDC, surged 77% year over year as USDC adoption continues to expand globally.

The growing adoption of Circle Internet’s stablecoin network drove total revenues and reserve income by 66% year over year to $740 million. The top line beat the Zacks Consensus Estimate by 4.4%. Additionally, Circle reported adjusted earnings of 64 cents per share, which beat the Zacks Consensus Estimate of 20 cents. Moreover, CRCL’s revenues less distribution costs (RLDC) jumped 55% year over year to $292 million. However, the RLDC margin contracted 270 basis points (bps) year over year to 39%. Circle Internet expects the 2025 RLDC margin to be around 38%.

Circle is moving closer to its goal of building a full-scale internet-based financial platform with the launch of its Arc Network. In the third quarter of 2025, Circle started the public testnet for Arc, which already has more than 100 major partners testing it, including AWS, BlackRock, HSBC, Mastercard, Standard Chartered, and Visa.

Arc is built to work as a base layer for internet finance. It aims to make payments and transactions faster, cheaper, and more secure. Furthermore, the company also plans to create a native token for Arc to support its growth and help manage how the network operates. The company expects to launch Arc commercially in 2026.

Arc connects closely with Circle’s Payments Network (CPN), which is growing fast. CPN now has 29 financial institutions using it, and more than 500 are in the process of joining. The payment volume on CPN has grown about 100 times in just five months, showing early signs of strong demand. If Arc and CPN work together as planned, Circle could become one of the main players linking traditional finance with blockchain-based systems.

However, Arc is still in the testing phase. Circle needs to prove that it can scale the network and attract real-world usage. if Arc succeeds, it could play a key role in driving Circle’s next phase of growth, while also expanding the company's global payments business.

For fourth-quarter 2025, the Zacks Consensus Estimate for Circle Internet’s earnings is pegged at 18 cents per share, revised upward by 3 cents over the past seven days.

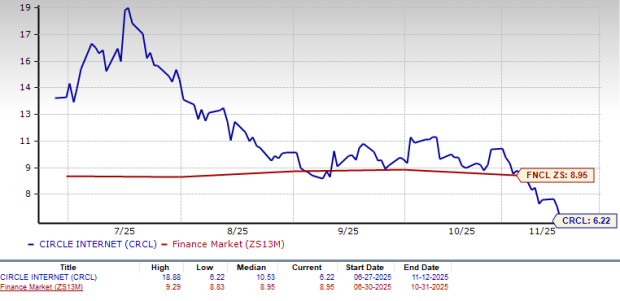

Circle is currently trading at a lower price-to-sales (P/S) multiple compared with the Zacks Finance Sector. The stock’s forward 12-month P/S ratio sits at 6.22X, lower than the Sector’s forward 12-month P/S ratio of 8.95X.

Circle stock also trades at a lower P/S compared with Robinhood Markets and Coinbase Global PayPal, while trading at a higher P/S compared with PayPal. At present, PayPal, Robinhood Markets and Coinbase Global have P/S multiples of 1.81X, 23.53X and 10.15X, respectively.

Circle Internet is growing as more people and companies use its USDC stablecoin for payments and money transfers. Supportive regulations and more trust in stablecoins are helping the company expand. Moreover, the company’s partnerships with major firms like Visa and Mastercard also make its network stronger.

Additionally, the Arc Network could be an important step for Circle. If it works as planned, it will make payments faster and easier, while also helping regular banking connect with blockchain systems. Overall, Circle is moving in a good direction with steady growth in stablecoin use and new platform developments, which bodes well for the company's prospects in the long term.

Circle currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 21 min | |

| 35 min | |

| 1 hour | |

| 1 hour |

Coinbase Stock Struggles Amid Gloomy Odds For Clarity Act; Is Coinbase Stock A Sell Now?

COIN

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite