|

|

|

|

|||||

|

|

HealthEquity HQY recently took a major step forward in its member experience strategy with the deployment of new agentic AI capabilities designed to make support faster, more intuitive and more personal. Powered by Parloa’s enterprise-grade AI platform, the system enables natural, conversational interactions across voice and digital channels, removing the friction of traditional phone menus and giving members immediate, action-oriented assistance when navigating health and financial decisions.

This launch is poised to strengthen HQY’s competitive position by creating a more scalable, consistent, and high-touch service model that can support millions of members with real-time guidance.

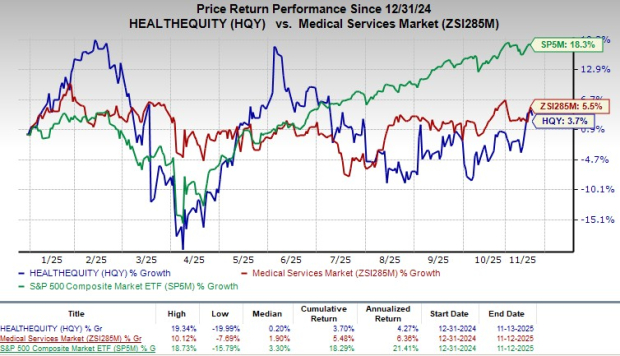

Following the announcement, the company's shares traded flat at yesterday’s closing. In the year-to-date period, shares have gained 3.7% compared with the industry’s 5.5% decline. The S&P 500 has gained 18.3% in the same time frame.

In the long run, this agentic AI deployment positions HQY to drive stronger member retention, lower servicing costs and deepen engagement across its large HSA ecosystem. By delivering faster, more accurate, and more personal support at scale, HQY can meaningfully improve member satisfaction, which is an important lever for cross-selling, increasing contribution levels and boosting investment adoption.

HQY currently has a market capitalization of $8.66 billion. In the last reported quarter, HQY delivered an earnings surprise of 17.4%.

HealthEquity’s agentic AI rollout meaningfully elevates how members navigate support by replacing rigid IVR menus with fluid, natural conversations across voice, mobile and web channels. The system’s ability to understand intent over multiple turns and maintain context leads to smoother interactions and faster resolutions, regardless of where a member initiates the conversation. By pairing AI-driven responsiveness with the option for live assistance when needed, the company is creating a more thoughtful and human service model, one that reduces friction in moments when members are dealing with health and financial decisions that often carry stress.

HealthEquity is building this new capability on top of a proven foundation of AI-enabled tools that already enhance the member experience. Expedited Claims AI has significantly reduced claims entry time by automatically identifying discounts and sales tax from uploaded receipts, helping members save roughly 70% of the time typically required, with more than half of claims processed in under two minutes.

HSAnswers has supported hundreds of thousands of personalized conversations, addressing everything from basic HSA questions to complex topics like Medicare coordination and contribution eligibility. Complementing these tools, the HealthEquity Assist suite, including Analyzer, Navigator, and Momentum, helps members make smarter spending decisions, leverage real-time analytics and take proactive steps toward long-term financial and health goals. Together, these solutions create a connected ecosystem that prepares the company well for the next wave of AI-driven innovation.

The phased rollout through 2026 reflects a disciplined approach that balances innovation with quality and reliability. Starting with a limited release allows HealthEquity to collect real-world feedback, fine-tune conversational models, and ensure consistent performance before expanding to its full member base. This step-by-step strategy positions the company to extend the value of AI even further, with future enhancements aimed at optimizing HSA contributions, maximizing tax benefits, and supporting smarter healthcare spending and investment decisions. The initiative ultimately reinforces HealthEquity’s broader vision of building a technology-enabled platform that helps millions of members make clearer, more confident financial choices around their health.

Currently, HQY carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Medpace Holdings MEDP , Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently sporting a Zacks Rank #1 (Strong Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, carrying a Zacks Rank #2 (Buy) at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite