|

|

|

|

|||||

|

|

Industry Description

The Zacks Automotive - Original Equipment Industry comprises companies that design, produce and provide passive safety systems for the automotive sector. These systems aim to improve safety, boost efficiency, reduce overall ownership costs and streamline fleet management, supporting individuals who tackle some of the toughest jobs globally. Companies that design, engineer and manufacture Driveline and Metal Forming technologies to support electric, hybrid and internal combustion vehicles are also part of the same industry. The industry supplies equipment to the U.S. government and big car manufacturers. Some companies also engage in equipment financing and leasing solutions for their customers, primarily through third-party funding arrangements.

Factors Influencing the Outlook of the Original Equipment Industry

Tax Incentives Aim to Boost Demand for Vehicles:The Trump administration’s “One Big Beautiful Bill Act” would grant qualifying car buyers a tax deduction of up to $10,000 on interest paid for new U.S.-assembled vehicles, per Forbes. The deduction excludes leases and commercial vehicles and phases out for individuals earning more than $100,000 or $200,000 for a joint filer. With the average new vehicle costing $48,000 and loan rates around 8.64%, a buyer paying $2,000 in yearly interest could save about $400 per year or $2,000 over a five-year loan. These savings will help offset potential price increases tied to Trump’s import tariffs. The bill will likely encourage more people to buy new cars and increase demand for equipment required to build new vehicles.

Rising Need for Advanced Electronics Lifts OEM Opportunities:Demand for advanced electrical and electronic systems, such as ADAS, infotainment and connectivity features, is rising. These technologies improve vehicle safety, convenience and the overall user experience, making them important differentiators in a competitive market. As a result, OEMs can supply more high-value components per vehicle. Since advanced electronics typically offer higher margins than traditional mechanical parts, suppliers that can produce these systems stand to benefit through improved profitability.

Protectionist Tariffs Drive Up Costs for Auto Equipment Makers:The U.S. government has taken a protectionist stance to encourage automakers to expand domestic manufacturing. Protectionism involves restricting foreign trade through measures like tariffs, quotas and subsidies to support local industries. Beginning in May 2025, the government imposed a 25% tariff on imported engines, transmissions, and other key auto parts. This has increased costs for equipment manufacturers.

Zacks Industry Rank Indicates Upbeat Near-Term Prospects

The Zacks Automotive - Original Equipment Industry is part of the broader Zacks Autos/ Tires/ Trucks sector. It carries a Zacks Industry Rank #89, which places it in the top 37% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates upbeat near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential.

Based on the positive industry outlook, we will present a few stocks that you might consider adding to your watchlist. Before that, let’s discuss the industry’s recent stock market performance and valuation picture.

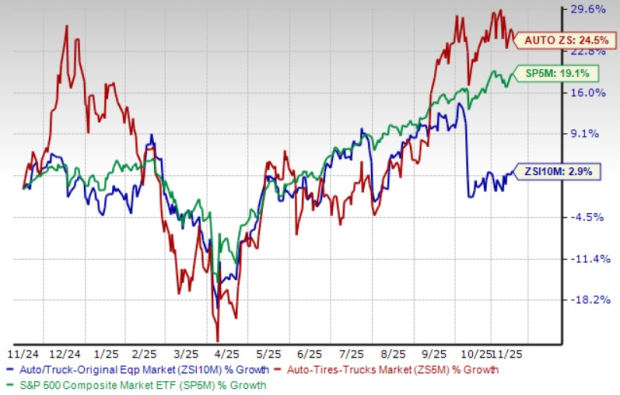

Industry Lags the S&P 500 & Sector

The Zacks Automotive - Original Equipment Industry has underperformed the S&P 500 and its sector over the past year. The industry has returned 2.9% over this period compared with than the S&P 500’s growth of 19.1%. The broader sector has returned 24.5% in the same time frame.

Industry's Current Valuation

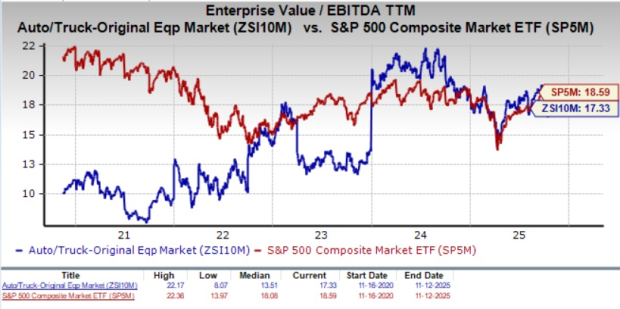

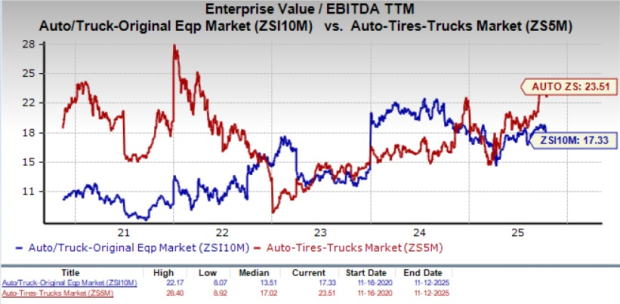

Since automotive companies are debt-laden, it makes sense to value them based on the Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA) ratio.

Based on the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 17.33X compared with the S&P 500’s 18.59X and the sector’s 23.51X.

Over the past five years, the industry has traded as high as 22.17X and as low as 8.07X, with the median being 13.51X, as the chart below shows.

3 Stocks to Consider Right Now

Magna: It is a mobility technology company and global automotive supplier that offers comprehensive vehicle engineering and contract manufacturing expertise. Its broad range of product and service offerings minimizes its risk exposure. The company is actively focusing on innovation and technology development, along with program launches across its business segments and stands to benefit from key emerging trends, including electrification and autonomous driving. Magna is steadily securing new business, which bodes well for its top-line growth.

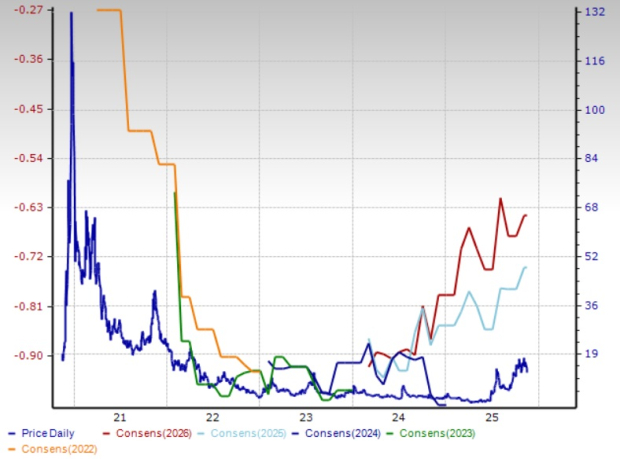

MGA currently carries a Zacks Rank #2 (Buy) and has a Value Score of A. Magna has surpassed estimates in three of the trailing four quarters and missed once, the average earnings surprise being 7.67%. The Zacks Consensus Estimate for MGA’s 2025 and 2026 EPS has improved 21 cents and 15 cents, respectively, in the past 30 days.

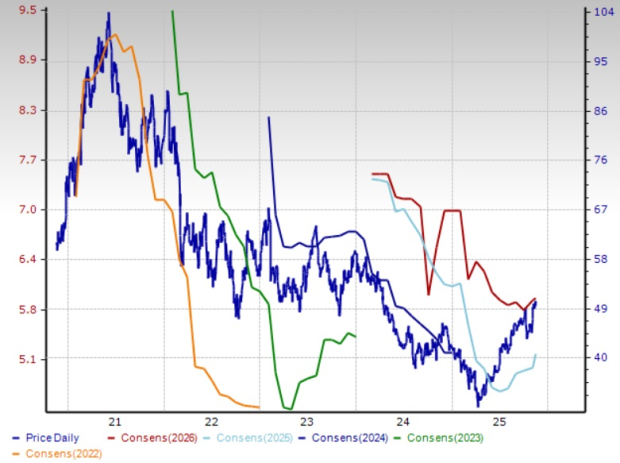

Price & Consensus: MGA

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

QuantumScape: It is a battery developer for electric vehicles. Its big breakthrough came with its Cobra separator process, a next-generation manufacturing method that could make solid-state batteries commercially viable. The company announced in June that Cobra had successfully entered baseline cell production. Another turning point came with QuantumScape’s public demonstration of its technology at the IAA Mobility show in Munich, held in September. The company, together with Volkswagen’s (VWAGY) battery arm PowerCo, showcased a Ducati MotoE race bike powered by QuantumScape’s QSE-5 solid-state cells.

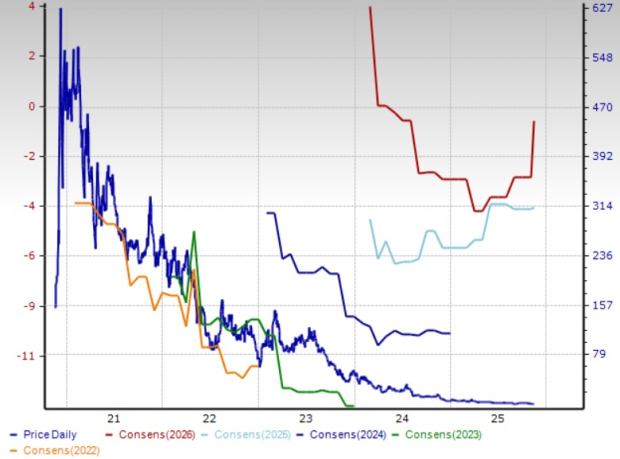

QS currently carries a Zacks Rank #2. QuantumScape has surpassed estimates in one of the trailing four quarters and matched thrice, the average earnings surprise being 1.09%. The Zacks Consensus Estimate for 2025 EPS implies year-over-year growth of 21.3%. The Zacks Consensus Estimate for QS’ 2025 and 2026 EPS has narrowed 4 cents each in the past 30 days.

Price & Consensus: QS

Luminar: It is an autonomous vehicle sensor and software company. Its LiDAR technology has been adopted in the Volvo EX90 and ES90, making it the first high-performance LiDAR integrated as standard in a global production vehicle. Partnerships with Nissan and Mercedes-Benz further highlight its strong automotive positioning, which is critical as automakers move toward higher levels of autonomy. LAZR is also diversifying into commercial and defense markets, where adoption is progressing more quickly. Its 1550-nanometer LiDAR is being tested for military and drone applications, areas that could bring earlier revenue opportunities and stronger unit economics than passenger cars. This diversification provides a meaningful hedge while waiting for mass consumer adoption.

LAZR currently carries a Zacks Rank #2. Luminar has surpassed estimates in three of the trailing four quarters and missed once, the average earnings surprise being 2.98%. The Zacks Consensus Estimate for 2025 EPS implies year-over-year growth of 52.2%. The Zacks Consensus Estimate for LAZR’s 2025 and 2026 EPS has narrowed 37 cents and $1.19, respectively, in the past 30 days.

Price & Consensus: LAZR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 13 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite