|

|

|

|

|||||

|

|

Franklin Resources BEN has been actively expanding through a series of acquisitions and strategic partnerships as it accelerates its push into alternative investments and multi-asset solutions. Through targeted acquisitions, specialized teams, and expanded global distribution, the company is reshaping its product lineup to meet the evolving needs of institutional and wealth-management clients.

In sync with this, in October 2025, Franklin Resources, a global investment management company operating as Franklin Templeton, announced the closure of its acquisition of Apera Asset Management. The acquisition expanded BEN's global alternative credit asset under management (AUM) by more than $90 billion, with the firm’s total alternative asset strategies standing at nearly $270 billion in aggregate as of Sept. 30, 2025. This milestone strengthens BEN’s standing as a leading diversified alternatives manager with deep expertise across private credit, real assets, and multi-strategy platforms.

Earlier, in September 2025, it also partnered with Copenhagen Infrastructure Partners, DigitalBridge and Actis, expanding its private infrastructure platform for high-net-worth and institutional clients.

Beyond private credit and infrastructure, Franklin has been strengthening its multi-asset and next-generation investment capabilities. In July 2024, the firm partnered with Japan’s SBI Holdings to expand into ETFs, digital assets, and emerging investment categories, aiming to engage younger investors and diversify product distribution in Asia. In January 2024, Franklin acquired Putnam Investments, adding scale in retirement solutions and boosting its defined-contribution AUM above $100 billion, a key to long-term, recurring-fee revenue.

These strategic moves strengthen BEN’s footprint in the separately managed account (SMA) market while materially expanding its investment capabilities across private debt, real estate, hedge funds, and private equity. Collectively, these initiatives reinforce Franklin’s ability to deliver a broader, more sophisticated suite of private-market and multi-asset solutions.

Notably, the company’s continued push into higher-growth asset classes—particularly alternatives, where client demand remains elevated positions BEN to capture incremental flows and support long-term AUM expansion. By aligning its platform with industry segments experiencing accelerated adoption, Franklin is enhancing both its competitive positioning and its potential for sustained revenue growth.

Franklin’s peers, BlackRock, Inc. BLK and T. Rowe Price Group, Inc. TROW, have actively expanded through acquisitions and strategic partnerships, reflecting a focus on inorganic growth to diversify offerings and increase market share.

BlackRock has expanded significantly through a series of domestic and international acquisitions. It acquired Preqin for $3.2 billion in October 2025 to enhance its private markets and data offerings, ElmTree Funds to broaden investment solutions, and HPS Investment Partners in July 2025 to bolster alternative strategies. Earlier, in 2024, it also completed the buyout of SpiderRock’s remaining stake, strengthening separately managed accounts and acquired Global Infrastructure Partners to enhance infrastructure origination and investment capabilities.

Additionally, its Aladdin platform partnered with OTCX to digitize dealer-to-client voice derivative trading, extending technology offerings to institutional clients. These inorganic initiatives demonstrate BlackRock’s ongoing focus on diversifying revenue streams and expanding its global footprint.

T. Rowe Price has pursued acquisitions and partnerships to grow its retirement, alternative investment, and multi-asset capabilities. In September 2025, T. Rowe Price partnered with Goldman Sachs to expand access to private markets and retirement-focused solutions, including Target-Date strategies, model portfolios, and multi-asset funds.

In 2024, TROW partnered with Aspida to manage public and private assets, supporting its insurance business expansion and client offerings. In 2023, it acquired Retiree, a fintech firm providing retirement income planning software, enhancing retirement solutions and practitioner tools for financial professionals. In 2021, it acquired OHA, strengthening alternative investment offerings and diversifying revenue streams. These strategic moves reflect T. Rowe Price’s commitment to long-term growth and broadening its product and service capabilities.

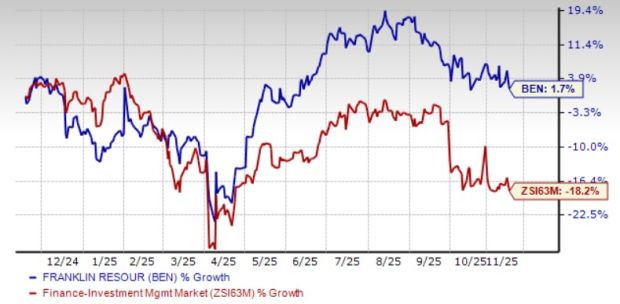

Shares of Franklin have risen 1.7% in the past three months against the industry’s decline of 18.2%.

From a valuation standpoint, BEN trades at a forward price-to-earnings (P/E) ratio of 8.71X, below the industry’s average of 13.98.

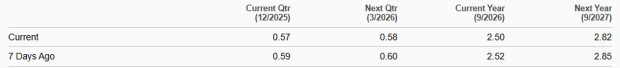

The Zacks Consensus Estimate for BEN’s 2026 and 2027 earnings implies year-over-year growth of 12.6% and 12.5%, respectively. However, estimates for 2026 and 2027 have been revised downward over the past seven days.

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 44 min | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite