|

|

|

|

|||||

|

|

Constellation Brands, Inc. STZ remains a dominant force in beer, and wine & spirits, thanks to its consistent focus on premiumization, brands and disciplined portfolio management. With a lineup of consumer-preferred, high-quality labels, including Modelo Especial, Corona Extra, Pacifico, Robert Mondavi Winery, Kim Crawford, The Prisoner Wine Company, High West Whiskey and Casa Noble Tequila, the company is positioned to meet the evolving consumer tastes.

The company is further strengthening its position by investing in innovation and launching products that align with priority consumer trends, supporting sustained growth across its Power Brand portfolio. STZ continues to prioritize high-margin, fast-growing segments across the beverage alcohol market. The company is effectively capitalizing on the ongoing premiumization trends through direct-to-consumer capabilities and an expanded global footprint.

Constellation Brands’ premiumization strategy is quite encouraging. Within Wine & Spirits, the company is reshaping its portfolio toward premium labels that better align with evolving consumer preferences. In beer, premiumization is also driving momentum across both traditional and flavored segments, including seltzers, flavored beers, RTD spirits and flavored malt beverages.

Constellation Brands’ core brand strategy is gaining strong momentum in 2025, particularly within its beer business, and is helping drive higher earnings. STZ’s brand-building efforts, further complemented by momentum in the beer business, tapping premiumization, innovations and solid cost savings, will continue to deliver growth ahead.

Anheuser-Busch InBev SA/NV BUD, The Boston Beer Company, Inc. SAM and Molson Coors Beverage Company TAP are the key companies that compete with Constellation Brands.

Anheuser-Busch InBev SA/NV alias AB InBev’s relentless execution, investment in brands and accelerated digital transformation have been encouraging. The company’s premiumization strategy is a key growth driver. AB InBev has been investing in developing a diverse portfolio of global, international and crafts and specialty premium brands in its markets. Among the above-core brands, Corona has been leading the performance, delivering low-teens revenue growth outside of Mexico, including double-digit volume gains across more than 30 markets. BUD has been focused on expanding its Beyond Beer portfolio as well.

Boston Beer remains focused on product innovations and brand development to strengthen its market position and drive operational performance. Among the most iconic brands in American craft brewing, Samuel Adams is the keystone of Boston Beer. Boston Beer has diversified its lineup with beverages like Truly Hard Seltzer and has grown beyond traditional beer. SAM’s diversification strategy centers on expanding its “Beyond Beer” portfolio, including hard seltzers, ciders and other alternative alcoholic beverages, to capitalize on the evolving consumer taste, reducing reliance on the traditional beer segment.

Molson Coors remains committed to bolstering growth through innovation and premiumization. To accelerate portfolio premiumization, the company has been aggressively growing its above-premium portfolio. It remains focused on stabilizing its larger above-premium brands in the US, while simultaneously pursuing meaningful growth opportunities for its most strategic, high-performing brands. The company intends to invest in iconic brands and growth opportunities in the above-premium beer space and expand in adjacencies and beyond beer.

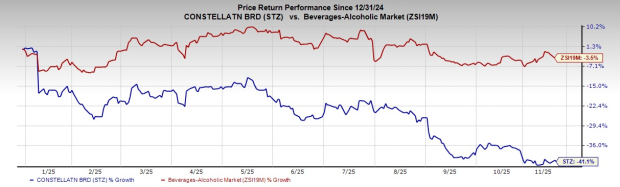

Shares of Constellation Brands have lost 41.1% year to date compared with the industry’s dip of 3.5%.

From a valuation standpoint, STZ trades at a forward price-to-earnings ratio of 10.70X compared with the industry’s average of 14.29X.

The Zacks Consensus Estimate for STZ’s fiscal 2026 earnings implies a year-over-year decline of 16.6%, while that for fiscal 2027 indicates growth of 8.8%. The company’s EPS estimate for fiscal 2026 and fiscal 2027 has been stable in the past 30 days.

Constellation Brands stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-08 | |

| Mar-08 | |

| Mar-08 | |

| Mar-08 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite