|

|

|

|

|||||

|

|

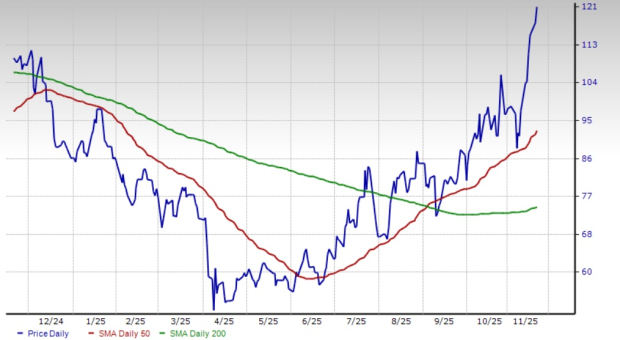

Albemarle Corporation’s ALB shares have shot up 26.2% in the past month, outperforming the Zacks Chemical - Diversified industry’s decline of 11.5% and the S&P 500’s fall of 1.2%. The rally has been driven by the company’s better-than-expected performance in the third quarter, aided by volume growth in the Energy Storage segment and its cost reduction efforts.

ALB’s peers, Sociedad Quimica y Minera de Chile S.A. SQM and Rio Tinto Group RIO, have gained 34.4% and 0.7%, respectively, over the same period.

Technical indicators show that ALB is currently trading above its 200-day simple moving average (SMA) and 50-day SMA. Following a golden crossover on Sept. 3, 2025, the 50-day SMA is reading higher than the 200-day SMA, indicating a bullish trend.

Let’s take a look at ALB’s fundamentals to analyze the stock better.

Albemarle is well-placed to gain from long-term growth in the battery-grade lithium market. The market for lithium batteries and energy storage remains strong, especially for electric vehicles (EVs), offering significant opportunities for the company to develop innovative products and expand capacity. Lithium demand is expected to grow on the back of significant global EV penetration.

Global EV sales surged 30% year over year this year through September 2025, driven by China and Europe battery electric vehicles, per the company. Lithium demand also rose 30% on the back of energy transition and higher global demand for EVs and grid storage. ALB expects lithium demand to rise at a compound annual growth rate (CAGR) of 15-30% from 2024 to 2030.

The company is strategically executing its projects aimed at boosting its global lithium conversion capacity. It remains focused on investing in high-return projects to drive productivity. Healthy customer demand, capacity expansion, and plant productivity improvements are supporting its volumes. ALB saw higher sales volumes in its Energy Storage unit in the third quarter of 2025 on record production from its integrated conversion facilities. The Salar yield improvement project in Chile has achieved a 50% operating rate. The ramp-up at the Meishan lithium conversion facility in China is also progressing ahead of schedule.

Albemarle is also taking aggressive cost-saving and productivity actions in the wake of tumbling lithium prices. The company expects to deliver roughly $450 million in cost and productivity improvements in 2025, having surpassed its initial target of $300-$400 million. ALB is taking actions to maintain its competitive position, including the initiation of a comprehensive review of cost and operating structure, optimization of the conversion network and reduction of capital expenditure. It has lowered the full-year 2025 capital expenditures outlook to around $600 million.

Albemarle remains committed to driving shareholder value by leveraging healthy cash flows and strong liquidity. At the end of the third quarter of 2025, ALB had liquidity of around $3.5 billion, including cash and cash equivalents of around $1.9 billion. Its operating cash flow was around $893.8 million for the first nine months of 2025, up 29% from the prior-year period. ALB expects to generate free cash flow of $300-$400 million in 2025, driven by strong cash conversion, lower capital spending and productivity measures.

The company remains focused on maintaining its dividend payout. It has raised its quarterly dividend for the 30th straight year. ALB offers a dividend yield of 1.4% at the current stock price. Backed by healthy cash flows and sound financial health, the company's dividend is perceived to be safe and reliable.

Weaker lithium market prices are weighing on the company’s performance. ALB’s revenues fell roughly 3.5% year over year to $1,307.8 million in the third quarter, hurt by lower prices in Energy Storage. Sales from its Energy Storage unit fell around 8% due to lower lithium market prices. Lithium prices have declined amid slowing demand growth for electric vehicles, inventory glut and increased supply. The uncertain macroeconomic environment and high interest rates have weighed on demand. Weaker lithium prices are likely to continue to hurt the company’s results in the fourth quarter.

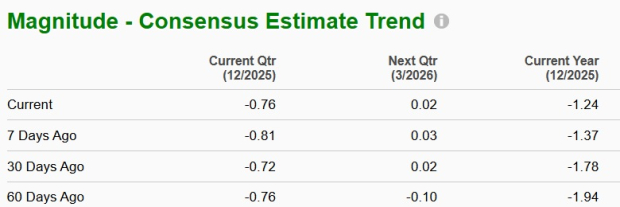

The Zacks Consensus Estimate for 2025 for ALB has been revised upward over the past 60 days. The consensus estimate for the fourth quarter of 2025 has been stable over the same time frame.

The Zacks Consensus Estimate for 2025 earnings is currently pegged at a loss of $1.24, suggesting a year-over-year increase of 47%. Earnings are expected to register a rise of roughly 30.3% in the fourth quarter.

ALB is currently trading at a forward price-to-sales ratio of 2.73, well above the industry. It is trading at a discount to Sociedad Quimica and a premium to Rio Tinto. Albemarle and Sociedad Quimica currently have a Value Score of D each, while Rio Tinto has a Value Score of A.

Albemarle is benefiting from higher lithium volumes on project ramp-ups and actions to boost its global lithium conversion capacity and productivity actions. ALB is well-placed to capitalize on the significant growth opportunity in the battery-grade lithium market underpinned by the global shift toward EVs. However, soft lithium prices could dampen its near-term prospects. Its stretched valuation also might not offer an attractive entry point at this time. Considering these factors, holding onto this Zacks Rank #3 (Hold) stock will be prudent for investors who already own it.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite