|

|

|

|

|||||

|

|

Ondas Holdings Inc. ONDS has headed into the final quarter of 2025 with strengthening momentum, driven by rapid growth in its autonomous systems business and a sharp rise in backlog. The company reported a consolidated backlog of $23.3 million for the third quarter of 2025, more than doubling from the start of the year. Management also highlighted that the figure exceeded $40 million, which includes approximately $18 million tied to acquisitions that closed or were pending closure in the fourth quarter.

The company’s Ondas Autonomous Systems (OAS) unit’s backlog alone was $22.2 million at the end of the third quarter. The company’s customer pipeline continues to strengthen, and it anticipates ending the year with additional backlog growth.

The company’s focus on M&A is aimed at strengthening its portfolio and expanding its presence across key domains such as unmanned ground systems, robotics, fiber-optic communications and subsurface intelligence, including demining robotics. Ondas recently announced its plan to acquire SentryCS Ltd., an Israel-based developer of Cyber-over-RF and protocol-manipulation counter-UAS technology.

Also, the company expanded its global opportunities for the Iron Drone Raider, solidifying its presence in the accelerating counter-UAS market. Multiple pilots were conducted across the United States, Europe and Asia, all confirming seamless system interoperability. On the last earnings call, ONDS highlighted that global demand for counter-drone solutions is expected to rise sharply, increasing from about $2.4 billion in 2024 to more than $10.5 billion by 2030, implying an annual growth rate of 27%, fueled by the rapid intensification of drone-related threats across defense, homeland security and critical infrastructure, along with higher government spending and tighter regulatory requirements worldwide.

Ondas is monitoring several meaningful opportunities that it expects to update in the future, which should help drive accelerating momentum heading into 2026. A robust backlog, accelerating solution adoption and the integration of newly acquired capabilities position Ondas for a multiyear growth cycle.

For 2025, Ondas increased its full-year revenue target to at least $36 million, implying fourth-quarter revenue of more than $15 million, a sizable step up from the $10.1 million delivered in the third quarter. Looking ahead, Ondas set an initial 2026 revenue target of at least $110 million, driven by increasing customer base, backlog and acquisitions. Management stated that this figure may prove conservative given the company’s expanding customer base, growing backlog, maturing pipeline and synergies from acquisition.

However, market uncertainties and rising competitive pressure remain concerns. The company faces stiff competition from other drone manufacturers, such as Draganfly Inc. DPRO and Red Cat Holdings, Inc. RCAT.

Draganfly continues to advance its position in drone technology with several notable achievements in the third quarter of 2025. The company was selected by the U.S. Army to provide Flex FPV systems and had its Commander 3XL UAV chosen by a major U.S. Department of Defense branch for advanced operations. It also sold Commander 3XL units to a leading defense contractor to support surveillance and security missions. The company’s additional wins included delivering Heavy Lift Drones to a Fortune 50 telecom firm and expanding U.S. manufacturing to meet rising demand. Draganfly showcased its systems at the T-REX 24-2 exercise, formed a teaming agreement with Autonome Labs and strengthened its balance sheet through a $25 million financing to accelerate growth and innovation. Recently, Draganfly showcased successful live border-security missions using its Outrider Border Drone with the Cochise County Sheriff’s Office.

Red Cat Holdings, a U.S. provider of advanced all-domain drone and robotic defense solutions, also reported major strategic progress across its portfolio. Blue Ops teamed with Hodgdon Shipbuilding to build the first five uncrewed surface vessel prototypes for delivery starting in the fourth quarter. Apium Swarm Robotics joined the company’s Futures Initiative to advance decentralized drone-swarming capabilities. Red Cat also partnered with AeroVironment to enable FANG deployment from the P550 UAS. The company introduced its low-cost, NDAA-compliant FANG F7 drone, expanded AI threat-detection integration with Safe Pro Group and secured NATO NSPA Catalogue approval for the Black Widow system.

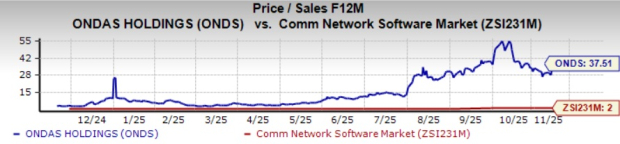

Shares of ONDS have surged 97.3% in the past three months against the Communication - Network Software industry’s decline of 6.2%.

In terms of the forward 12-month Price/Sales ratio, ONDS is trading at 37.51, higher than the Communication - Network Software industry’s multiple of 2.

The Zacks Consensus Estimate for ONDS’ earnings for the current year has been significantly revised upward over the past 60 days.

ONDS currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-07 | |

| Feb-07 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite