|

|

|

|

|||||

|

|

Trilogy Metals Inc. TMQ and NioCorp Developments Ltd. NB are both familiar names operating in the Zacks Mining - Miscellaneous industry. As rivals, both companies are engaged in the exploration and mining of minerals and metals, primarily in North America.

Both companies have been enjoying significant growth opportunities in the mineral and metal mining industry owing to growing demand for minerals in electric vehicles and renewable energy markets, and increased adoption of advanced technologies like AI, automation and data analytics. Let’s take a closer look at their fundamentals, growth prospects and challenges.

Trilogy Metals has been focusing on its Ambler mining district project located in a mineral- rich area in Alaska. Although the project is in the pre-production exploration stage, the company is taking a step ahead with Ambler Metals LLC, which is a joint venture with South32 Limited.

In July 2025, Ambler Metals concluded its summer field program at the Bornite camp safely and on schedule, which included routine site maintenance, environmental baseline data collection, annual biomonitoring with the Alaska Department of Fish and Game as well as weather and water station maintenance with Boreal Environmental Services. The company also began a multi-year core re-boxing program to protect the stored drill core for long-term future use. These significant steps will likely keep the Arctic and Bornite projects ready for a potential development phase.

The company also remains focused on disciplined capital allocation. For the first nine months of fiscal 2025 (ended August 2025), Ambler Metals incurred costs of $3.8 million related to these ongoing programs. However, Trilogy’s share of the loss was approximately $2.2 million in the same period. This reflects the company’s advancement in the project while controlling its development burn rate.

Overall, Trilogy Metals’ continued advancement in the Ambler mining district project positions it for a significant transformation in the near future. With this steady pace and controlled budget, TMQ is well-positioned for long-term growth.

NioCorp is working to move its Elk Creek Project in Nebraska closer to production. The project will produce niobium, scandium, titanium and rare earth elements, which are essential for electric vehicles, clean energy and defense technologies.

During fiscal 2025 (ended June 2025), the company worked on drilling programs at Elk Creek to upgrade its resource estimates and improve the accuracy of its feasibility study. This will facilitate NioCorp in launching the Elk Creek Project and take it to the commercial operation phase.

It’s worth noting that NB raised about $60 million through public offerings in September 2025 to fund its progress. The company has also applied for a possible loan with the U.S. Export-Import Bank under the “Make More in America” program. The company’s deal with the U.S. Department of Defense will also support its engineering and drilling activities at the Elk Creek site.

Recently, the company acquired additional land in Johnson County, which will allow it to host both its planned underground mine and surface processing facility. With this, NB currently holds all surface and mineral rights required to commence construction once project financing is finalized.

However, NioCorp’s growth depends on securing approximately $1.1 billion in funding to move the Elk Creek project into the production stage. Nevertheless, the company is actively working to secure the project financing required to launch the project, which will enable it to transform into a leading U.S. mineral producer.

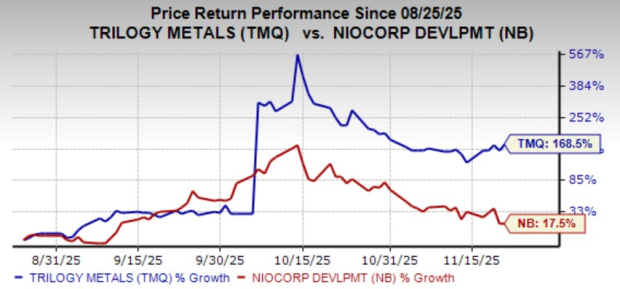

In the past three months, Trilogy Metals shares have surged 168.5%, while NioCorp stock has risen 17.5%.

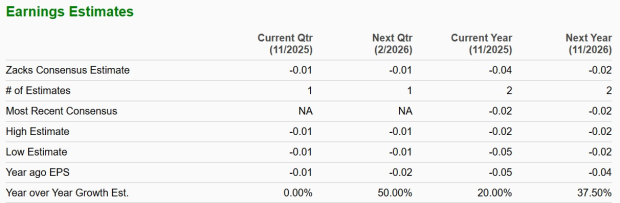

The Zacks Consensus Estimate for TMQ’s fiscal 2025 (ending November 2025) bottom line is pegged at a loss of four cents per share. However, the figure suggests an increase of 20% year over year.

The Zacks Consensus Estimate for NB’s fiscal 2026 bottom line is pegged at a loss of 28 cents per share. The figure reflects a year-over-year increase of 20%.

TMQ is trading at a trailing 12-month price-to-earnings ratio of a negative 85.40X, much below its median of a negative 8.78X over the last three years. NioCorp’s trailing earnings multiple sits at a negative 12.96X, lower than its median of a negative 3.04X over the same time frame.

NioCorp is well-positioned to capitalize on the growing demand for critical minerals across industries and establish itself as a key player in the mineral-mining industry. However, the company’s need to secure a substantial fund to move its Elk Creek project into the production stage will require some additional time.

In contrast, Trilogy Metals continues to make steady progress at the Ambler mining district. Additionally, the company’s disciplined spending has enabled it to progress with the Ambler project while controlling its development burn rate. Further, the stock’s bottom-line growth estimates instill investor confidence.

Given these factors, TMQ seems a better pick for investors than NB currently. While Trilogy Metals carries a Zacks Rank #2 (Buy), NioCorp currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-16 | |

| Feb-11 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite