|

|

|

|

|||||

|

|

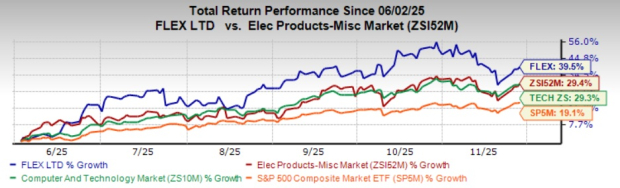

Flex Ltd. FLEX stock has surged 39.5% in the past six months, outperforming the Zacks Electronics - Miscellaneous Products industry, the Zacks Computer and Technology sector and the S&P 500 composite’s growth of 29.4%, 29.3% and 19.1%, respectively. The stock has risen 10.2% in the past three months.

The company is gaining from strong results across its cloud and power portfolios. Robust cash flow and strategic acquisitions also bode well. The company recently reported second-quarter fiscal 2026 results, wherein revenues and earnings not only increased year over year but also surpassed estimates. Driven by better-than-expected results, the company raised its outlook for fiscal 2026.

Let us evaluate the pros and cons of FLEX and decide the best course of action for your portfolio.

Flex has evolved into an end-to-end solutions provider where it is engaged in design, procurement, manufacturing and supply services for a broad range of products, from electronics to athletic shoes. In addition, the company offers value-added services in design, metal, components, supply chain management integration and aftermarket services, like the circular economy. These capabilities and a diversified end-market and client base are key positives for the company’s business model.

Flex is aggressively moving into the high-growth data center market. For the second quarter of fiscal 2026, Flex’s data center business continues to deliver exceptional performance across both cloud and power segments. Recently, Flex announced a partnership with LG Electronics to co-develop integrated modular cooling systems designed to tackle the growing thermal challenges of AI-driven data centers. Flex also announced a collaboration with NVIDIA to build modular, high-performance, energy-efficient AI data centers at scale. Leveraging Flex’s advanced manufacturing and integration capabilities, the partnership aims to address power, heat and scalability challenges in modern data centers. Flex remains on track to generate approximately $6.5 billion in revenue from data centers, implying year-over-year growth of at least 35% and accounting for 25% of its total revenues.

In September 2025, Flex unveiled its Modular Rack-Level Cooling Distribution Unit (CDU), developed by its liquid cooling subsidiary, JetCool. This new solution is available immediately and represents the latest addition to Flex’s expanding cooling portfolio. Also, it underscores Flex’s broader strategy to provide comprehensive, vertically integrated cooling infrastructure for next-generation data center needs. Moreover, the company plans to release a dedicated in-row CDU by April 2026, showcasing its long-term commitment to offering a complete range of scalable cooling solutions.

With 4% revenue growth in the first half and stronger demand expected in Power and Cloud in the fiscal fourth quarter, Flex has revised its fiscal 2026 revenue guidance to $26.7–$27.3 billion, up $500 million from the prior midpoint. It expects an adjusted operating margin of 6.2% to 6.3%, indicating consistent performance above 6%.

For fiscal 2026, Flex now anticipates adjusted EPS of $3.09 to $3.17, raising the midpoint by 17 cents per share. It is targeting to achieve the fiscal 2027 goal of a positive 6% adjusted operating margin a year ahead of schedule. For Reliability Solutions, revenues are expected to grow in the low- to mid-single digits, while for Agility Solutions, revenue is expected to increase in the mid- to high-single digits.

For the third quarter of fiscal 2026, Flex expects revenues to be between $6.65 billion and $6.95 billion. Management expects adjusted earnings of 74-80 cents per share. Adjusted operating income is projected to be between $405 million and $435 million.

Flex faces several risks that could hamper its growth trajectory. The company’s highly leveraged balance sheet, macro uncertainty and evolving trade policy remain overhangs. Within the Reliability Solutions segment, the company expects broader trends and the macro environment to remain weak in the automotive unit. Tariffs tied to raw material sourcing could weigh on margins and disrupt cash flow despite pass-through efforts. The company also faces stiff competition from other EMS providers. Intensifying competition can negatively impact contract wins, which can hurt top-line growth.

The stock trades at a forward 12-month price-to-earnings (P/E) ratio of 19.34, below the industry’s average of 23.85.

With a VGM Score of A, the stock has a long-term earnings growth expectation of 13.3%. Flex delivered an earnings surprise of 11.43%, on average, in the trailing four quarters. The company has an average brokerage recommendation (ABR) of 1.36 on a scale of 1 to 5 (Strong Buy to Strong Sell). ABR is the calculated average of actual recommendations made by brokerage firms and portends the future potential of the stock.

Backed by strong fundamentals and valuation, this Zacks Rank #2 (Buy) stock appears primed for further appreciation.

Some top-ranked stocks from the broader technology space are Mistras Group, Inc. MG, SiTime Corporation SITM and Teradyne, Inc. TER. GRMN, SITM and TER carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the last reported quarter, MG delivered an earnings surprise of 16.76%. Mistras Group’s long-term earnings growth rate is 16%. Its shares have soared 29.7% in the past year.

SITM’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 58.82%. In the last reported quarter, SiTime delivered an earnings surprise of 22.54%. Its shares have surged 37.1% in the past year.

Teradyne earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 10.76%. In the last reported quarter, TER delivered an earnings surprise of 8.97%. Its shares have jumped 60.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| 9 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite