|

|

|

|

|||||

|

|

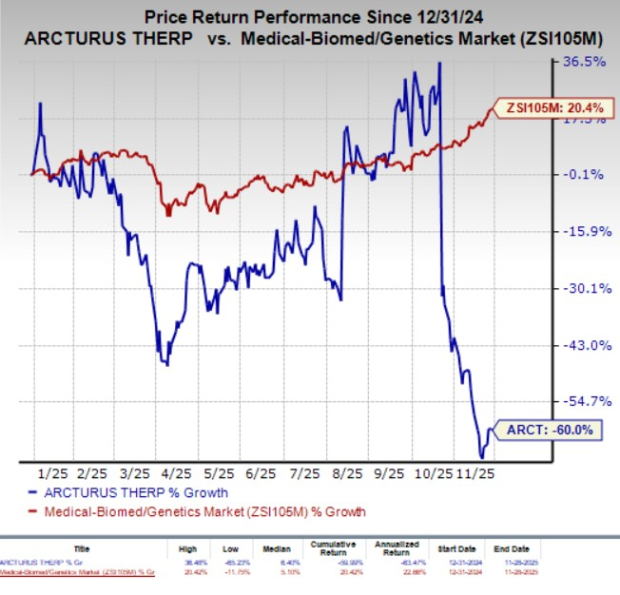

Shares of Arcturus Therapeutics ARCT have plunged 59.4% in the past three months. The massive stock price drop was primarily due to the mixed nature of the interim results reported by ARCT in late October from an ongoing mid-stage study evaluating its investigational inhaled mRNA therapy, ARCT-032, for the treatment of cystic fibrosis (CF) patients.

ARCT-032 has been developed leveraging Arcturus Therapeutics’ proprietary LUNAR lipid-mediated aerosolized platform to deliver CFTR mRNA to the lungs of people with CF who do not respond to already marketed treatments. The data readout is from cohort 2 of the phase II study, in which six adult patients with Class-I CF received inhaled 10 mg doses of ARCT-032 daily for 28 days.

Per the data readout, early evaluation of Forced Expiratory Volume in 1 second (FEV1) in ARCT-032–treated patients between day 1 and day 28 revealed no meaningful improvement. FEV1 is a pulmonary function test in CF patients that shows how much air a person can forcefully exhale in the first second after taking a full breath. A low FEV1 indicates more severe airway obstruction.

A post hoc exploratory analysis demonstrated that the average of two pre-treatment FEV1 readings to establish the baseline, when compared with the day 42 post-treatment value, showed modest lung-function gains in four of six Class-I CF patients, with mean absolute and relative increases of 3.8% and 5.1% in percent predicted FEV1. However, these changes fall within the expected natural variability of FEV1 measurements and should be interpreted cautiously.

On the other hand, AI-assisted high-resolution computed tomography (HRCT) scan analyses using FDA-cleared technology showed encouraging signs of ARCT-032 activity, with four of six Class-I CF patients demonstrating meaningful reductions in mucus plugs and mucus volume by day 28. While individual responses varied, the overall trend supports the candidate’s potential to reduce mucus burden, a key driver of CF morbidity.

Year to date, ARCT shares have plummeted 60% against the industry’s 20.4% growth.

Additionally, Arcturus Therapeutics reported that ARCT-032 continued to show a favorable safety profile, with treatment-related adverse events similar to those seen in the single-dose phase I study. One serious adverse event occurred well after dosing ended. However, the Data Monitoring Committee concluded that it was unrelated to ARCT-032, allowing the study to advance.

The third cohort in the phase II CF study, now enrolling up to six patients, is currently underway to assess the potential dose-escalation response at 15 mg and further confirm the investigational therapy’s overall safety and tolerability. Arcturus Therapeutics is also gearing up to initiate a 12-week safety and preliminary efficacy study of ARCT-032 in up to 20 CF patients in the first half of 2026.

CF is a serious, life-shortening genetic disease caused by CFTR mutations that lead to thick, hard-to-clear mucus and progressive respiratory complications. Although CFTR modulators have transformed care for many patients, they offer limited or no benefit for those with mutations that render the therapies ineffective, leaving a meaningful, underserved population in need of alternative treatment options.

Arcturus Therapeutics is looking to fulfil this gap with ARCT-032. The candidate already enjoys the Orphan Medicinal Product designation and the Orphan Drug designation in the EU and the United States, respectively, for this indication.

Arcturus Therapeutics Holdings Inc. price-consensus-chart | Arcturus Therapeutics Holdings Inc. Quote

Arcturus Therapeutics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector include CorMedix CRMD, Arcutis Biotherapeutics ARQT and ADMA Biologics ADMA. While CRMD currently sports a Zacks Rank #1 (Strong Buy), ARQT and ADMA carry a Zacks Rank #2 (Buy) each, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s 2025 earnings per share (EPS) have increased from $1.83 to $2.87. EPS estimates for 2026 have moved up from $2.48 to $2.88 during the same period. CRMD stock has surged 21.1% year to date.

CorMedix’s earnings beat estimates in each of the trailing four quarters, with an average surprise of 27.04%.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, EPS estimates for 2026 have increased from 9 cents to 41 cents. Year to date, shares of ARQT have rallied 120%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

In the past 60 days, estimates for ADMA Biologics’ EPS have increased from 57 cents to 58 cents for 2025. During the same time, EPS estimates for 2026 have improved from 88 cents to 90 cents. Year to date, shares of ADMA have gained 11.9%.

ADMA Biologics’ earnings beat estimates in one of the trailing four quarters, matched once and missed the same on the remaining two occasions, with the average negative surprise being 3.01%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite