|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The artificial intelligence (AI) saga, supported by the massive growth of cloud computing and data centers, is yet to fully unfold. This space remains rock solid supported by an extremely bullish demand scenario. The demand for data center capacity surged to manage and store the vast amount of cloud computing-based data.

Four of the “magnificent 7” stocks have decided to invest a massive $380 billion in 2025 as capital expenditure for AI-infrastructure development. This marks a significant 54% year-over-year increase in capital spending on the AI ecosystem. Moreover, these companies have also said that AI capex is likely to increase handsomely in 2026.

Here, we recommend five AI-centric non-technology stocks to enrich your portfolio in 2026. Some of these stocks have skyrocketed in 2025 and still have more fireworks in store for 2026. Some stocks are yet to pick up pace and some could be potential dark horses.

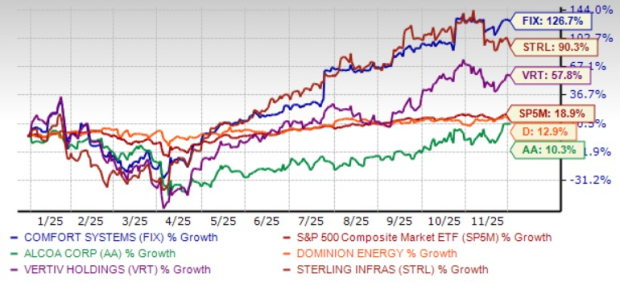

These stocks are: Comfort Systems USA Inc. FIX, Vertiv Holdings Co VRT, Sterling Infrastructure Inc. STRL, Dominion Energy Inc. D and Alcoa Corp. AA. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Zacks Rank #1 Comfort Systems USA operates primarily in the commercial and industrial heating, ventilation and air conditioning (HVAC) markets, and performs most of its services within manufacturing plants, office buildings, retail centers, apartment complexes, and healthcare, education and government facilities.

The data center boom, driven by AI, cloud computing, and high-performance computing, is fueling demand for the specialized HVAC solutions of FIX. Cooling systems for these facilities should deliver precise and reliable performance, prompting investments in advanced technologies such as liquid cooling and modular units.

This segment is becoming a significant growth driver for FIX, offering high-margin opportunities and attracting M&A activity. HVAC firms with capabilities in precision cooling and energy-efficient infrastructure are well-positioned to capture share in this fast-expanding niche.

Comfort Systems USA has an expected revenue and earnings growth rate of 14.7% and 16.4%, respectively, for next year. The Zacks Consensus Estimate for next-year’s earnings has improved 21.1% in the last 60 days.

Zacks Rank #1 Vertiv Holdings is a leading global provider of critical digital infrastructure and services for data centers, communication networks, and commercial and industrial environments. VRT is benefiting from an extensive product portfolio, which spans thermal systems, liquid cooling, UPS, switchgear, busbar and modular solutions.

Buoyed by unprecedented data center growth, VRT is strategically expanding capacity to accelerate its AI-enabled pipeline. The company also benefited from the accelerating digital transformation driven by AI and data center demand. Acquisitions have also played a key role, with Great Lakes enhancing IT systems and white space solutions, and Weeleay boosting service capabilities through real-time machine data analysis and predictive actions.

Vertiv’s partnership with NVIDIA Corp. (NVDA) is a key catalyst. VRT aims to stay one GPU generation ahead of NVIDIA, enabling efficient, scalable power solutions for next-generation AI data centers. As hyperscalers and enterprises increasingly scale AI deployments to support high-performance data centers, Vertiv’s solutions are gaining traction.

Vertiv Holdings has an expected revenue and earnings growth rate of 20.7% and 26.3%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.4% over the last 30 days.

Zacks Rank #1 Sterling Infrastructure is an engineering firm with three segments: E-Infrastructure, Transportation and Building Solutions. STRL is benefiting from strong momentum in its E-Infrastructure business, which continues to be the company’s primary growth engine. The segment has been benefiting from accelerating demand for large-scale projects across data centers, manufacturing facilities and e-commerce distribution.

In third-quarter 2025, STRL’s revenues from this segment, which represents roughly 60% of total revenues, reached $417.1 million and grew approximately 58% from the year-ago period. During the quarter, the AI-powered data center market remained the key driver, with revenues rising more than 125% year over year.

Strength in this segment is further reflected in STRL’s backlog. The company ended the third quarter with a total backlog of $2.6 billion, an increase of 64% from the prior year. E-Infrastructure Solutions accounted for $1.8 billion of this, up 97% year over year, highlighting significant customer demand and growing visibility across multi-year project cycles.

Sterling Infrastructure has an expected revenue and earnings growth rate of 19.1% and 14.6%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 8.8% over the last 30 days.

Zacks Rank #2 Dominion Energy’s long-term investment will strengthen its electric and natural gas infrastructure and increase the reliability of its services. D is adding renewable assets in its generation portfolio to achieve carbon neutrality by 2050.

Rising demand from an expanding customer base and large data centers is increasing the requirement for its services and boosting the performance of the company. D is working on a Small Modular Reactor (SMR), which can create new opportunities.

Dominion and its subsidiaries sell a substantial volume of energy produced under long-term power purchase agreements, which provide earnings visibility. D signed an MOU (Memorandum of Understanding) with Amazon.com Inc. (AMZN) to explore innovative development structures for enhancing potential SMR nuclear development in Virginia.

Dominion Energy has an expected revenue and earnings growth rate of 6% and 5.9%, respectively, for next year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

Zacks Rank #1 Alcoa could be a potential dark horse for the AI-driven data center boom. Several critical data center units like cooling towers, server racks, radiators and many more are made out of aluminum. Solar panels, wind turbines and climatization units inside data centers are also built with aluminum.

The external economies of scale that AI-powered data centers will create for aluminum and other metal industries have not yet been revealed. Though, the

U.S. aluminum industry has its hurdles such as massive power consumption and competition from international markets, it is trying to pick up production momentum to benefit from an astonishing growth potential from AI data centers in the near term.

Moreover, Alcoa is considering unlocking value from selling its temporarily or permanently closed sites with large existing power capacities, to big techs to convert them into data centers.

Alcoa has an expected revenue and earnings growth rate of 3.1% and 3.1%, respectively, for next year. The Zacks Consensus Estimate for current-year earnings has improved 17.8% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 min | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite