|

|

|

|

|||||

|

|

Credo Technology Group Holding Ltd CRDO reported second-quarter fiscal 2026 adjusted earnings per share (EPS) of 67 cents, which surpassed the Zacks Consensus Estimate by 36.7%. The bottom line compared favorably with 7 cents posted in the prior-year quarter.

The company’s revenues surged 272.1% year over year to $268 million. The increase in sales was primarily driven by strong growth in its product business. The top line also surpassed the Zacks Consensus Estimate by 14%.

Credo delivered the strongest quarterly results in its history, driven by the rapid expansion of the world’s largest AI training and inference clusters. Looking ahead, continued momentum in the company’s core AEC and IC businesses, combined with the upcoming scale-up of its newly announced ZeroFlap Optics, ALCs and OmniConnect gearbox solutions, positions it for robust revenue growth and sustained profitability through fiscal 2026 and beyond.

In response to the better-than-anticipated results and upbeat revenue guidance, shares jumped approximately 18% in the pre-market trading session today.

Product Sales: The company’s product business surged 278.3% year over year to $261.3 million during the quarter.

IP license: The company’s IP license sales were up 127.6% year over year to $6.7 million.

In the second quarter, each of the company’s top four customers contributed more than 10% to revenues. Credo still expects that three to four customers will represent more than 10% of revenue in the coming quarters and throughout the fiscal year, as existing hyperscale customers scale to higher volumes and as the company anticipates an additional hyperscale customer in the near term.

Non-GAAP gross profit was $181.4 million in the second quarter compared with $45.8 million in the same period last year.

Non-GAAP gross margin expanded 410 basis points (bps) to 67.7% during the quarter under review, coming in above the high end of the company’s guidance and improving 11 bps sequentially.

Total non-GAAP operating expenses increased 52.4% year over year to $57.3 million.

Credo Technology Group Holding Ltd. price-consensus-eps-surprise-chart | Credo Technology Group Holding Ltd. Quote

Research and development expenses surged 82.5% year over year to $57.9 million.

Selling, general and administrative expenses doubled year over year to $44.3 million.

As of Nov. 1, 2025, CRDO had $813.6 million of cash and cash equivalents and short-term investments compared with $479.6 million as of Aug. 2, 2025.

The company generated a second-quarter fiscal 2025 cash flow from operating activities of $61.7 million, up $7.5 million sequentially. Capital expenditures were $23.2 million, driven primarily by increased purchases of production MACsec, while free cash flow totaled $38.5 million compared with $51.3 million in the first quarter due to a rise in capital investment.

For the third quarter of fiscal 2026, the company anticipates revenues to be between $335 million and $345 million. GAAP gross margin is projected to be between 63.8% and 65.8%, while non-GAAP gross margin is anticipated to fall 64-66%. GAAP operating expenses are forecasted in the range of $116 million to $120 million, with non-GAAP operating expenses expected to be between $68 million and $72 million.

For fiscal 2026, the company anticipates mid-single-digit sequential revenue growth, resulting in roughly 170% year-over-year growth. The company had earlier projected revenue growth of 120%.

The company expects non-GAAP operating expenses to rise approximately 50% year over year in fiscal 2026. Non-GAAP net margin is projected to be around 45%, resulting in net income more than quadrupling from last year.

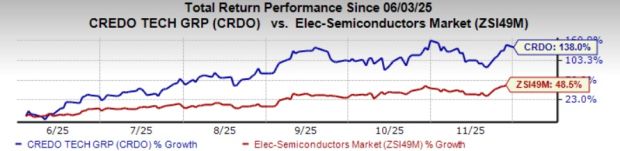

CRDO currently has a Zacks Rank #3 (Hold). Shares of the company have soared 138% in the past six months compared with the Zacks Electronics-Semiconductors industry's growth of 48.5%. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Cirrus Logic Inc. CRUS reported second-quarter fiscal 2026 adjusted EPS of $2.83, which surpassed the Zacks Consensus Estimate of $2.10. The company reported adjusted EPS of $2.25 in the prior-year quarter.

Cirrus Logic generated revenues of $561 million for the September quarter, hitting the high end of its guidance ($510-$570 million), driven by strong demand in its core smartphone component business. Sequentially, revenues increased 38%, reflecting higher shipments of smartphones. Year over year, sales rose 4%, mainly due to increased smartphone volumes and contributions from its latest generation products. The top line beat the Zacks Consensus Estimate by 3.9%.

Navitas Semiconductor NVTS reported a third-quarter 2025 non-GAAP loss of 5 cents per share, which was in line with the Zacks Consensus Estimate. The figure was narrower than the year-ago quarter’s loss of 6 cents.

Revenues decreased 53.4% year over year to $10.1 million, surpassing the Zacks Consensus Estimate by 0.1%.

Qualcomm Incorporated QCOM reported strong fourth-quarter fiscal 2025 results, with adjusted earnings and revenues exceeding the respective Zacks Consensus Estimate, driven by healthy demand trends in IoT and automotive businesses. Revenues increased year over year, led by the strength of the business model, diversification initiatives and the ability to respond proactively to the evolving market scenario.

Non-GAAP net income for the reported quarter came in at $3.26 billion or $3.00 per share compared with $3.04 billion or $2.69 per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 12 cents.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite