|

|

|

|

|||||

|

|

Henry Schein, Inc. HSIC recently expanded its agreement with vVARDIS and gained the exclusive U.S. distribution rights for the drill-free Curodont Repair Fluoride Plus (Curodont) product across all dental market segments, effective Jan. 1, 2026.

The partnership is expected to bolster the company’s Dental business.

Since the announcement, HSIC shares have risen 0.1%, closing at $73.15 in after-market trading session yesterday.

The company’s revenue growth has been consistently supported by niche acquisitions and partnerships. Accordingly, we expect the news to help support a rebound in the stock’s movement. In line with this, in August, Henry Schein inked a strategic partnership with Oral Genome, a leading innovator in salivary testing. The collaboration is aimed at bringing Oral Genome’s cutting-edge point-of-care saliva testing nationwide through Henry Schein’s distribution channels. Accordingly, we expect the latest news to maintain the stock’s positive momentum.

Henry Schein has a market capitalization of $8.78 billion at present. Going by the Zacks Consensus Estimate, the company’s 2025 earnings per share (EPS) are expected to grow 3.6% over 2024. It delivered an average earnings surprise of 1.4% in the trailing four quarters.

Curodont is a proprietary solution that treats patients with early-stage cavities with a drill and needle-free application. It is widely recognized that poor oral health can impact overall health, and untreated cavities can become life-threatening.

According to a study published in the International Journal of Epidemiology, people with fewer permanent teeth and untreated cavities were found to have higher all-cause and heart disease mortality. Up to 80% of patients have early-stage cavities, and until now, most have left the dental office without treatment, increasing the risk of more serious diseases. Curodont will empower dental practices to address this untapped opportunity by expanding patient care with a drill and needle-free approach.

The strategic expansion builds on Henry Schein’s 2024 exclusivity agreement with vVARDIS for Dental Service Organizations (DSOs). Beginning next year, the partnership will extend nationwide across multiple areas of dental care, including general dentistry, orthodontics and pediatric dentistry. This broader collaboration reflects both companies’ shared commitment to helping dental professionals run more efficient practices while advancing the oral and overall health of the communities they serve.

Image Source: Zacks Investment Research

Henry Schein is currently the market leader in selling Curodont to general practitioners and DSOs in the United States. The company also serves as the exclusive distributor of the product in the United Kingdom and holds non-exclusive distribution rights in other jurisdictions.

Per Precedence Research’s report, the global dental caries treatment market size is predicted to increase from $8.01 billion in 2025 to approximately $12.11 billion by 2034, at a CAGR of 4.70% during 2025-2034. The rising prevalence of dental diseases globally requires proper treatment to avoid any critical illness in the oral cavity. The introduction and development of novel advanced treatment options for dental caries have resulted in the growth of the dental caries treatment market, which is expected to grow continuously.

Henry Schein’s dental software business, Henry Schein One, has unveiled natively embedded AI and automation workflows at the 2025 Greater New York Dental Meeting. This includes Voice Notes, which helps practices close revenue gaps through clean claims and modernize their operations more effectively.

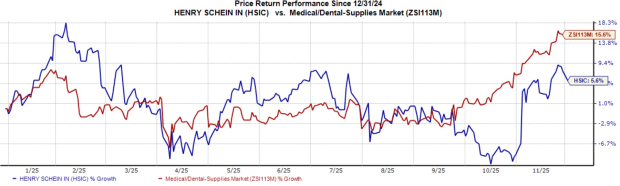

Year to date, shares of HSIC have rallied 5.7% compared with the industry’s 15.6% growth.

Henry Schein currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Globus Medical GMED, Boston Scientific BSX and Medtronic MDT. While Globus Medical sports a Zacks Rank #1 (Strong Buy), Boston Scientific and Medtronic carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Globus Medical’s EPS have increased 11.8% in the past 30 days. Shares of the company have risen 8.5% in the past year compared with the industry’s growth of 1.1%. GMED’s earnings surpassed estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 16.2%. In the last reported quarter, it delivered an earnings surprise of 49.4%.

Boston Scientific’s shares have jumped 12.3% in the past year. Estimates for the company’s 2025 EPS have increased 1 cent to $3.04 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.4%. In the last reported quarter, it posted an earnings surprise of 5.6%.

Estimates for MDT’s fiscal 2026 EPS of $5.65 have increased 0.5% in the past 30 days. Shares of the company have rallied 21.7% in the past year against the industry’s 0.1% decline. MDT’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 2.7%. In the last reported quarter, it delivered an earnings surprise of 3.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 9 hours | |

| 10 hours | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Why Top-Tier Robotic Surgery Name Globus Medical Is Getting 'Aggressive' In 2026

GMED

Investor's Business Daily

|

| Mar-06 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite