|

|

|

|

|||||

|

|

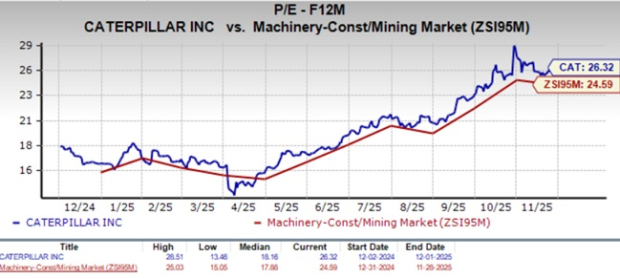

Caterpillar Inc. CAT is currently trading at a forward 12-month price/earnings (P/E) ratio of 26.32X compared with the manufacturing - construction and mining industry average of 24.59X.

With a Value Score of D, CAT stock does not appear to be a compelling value proposition at these levels. Caterpillar’s steep valuation is concerning, given its ongoing earnings pressure tied to tariffs.

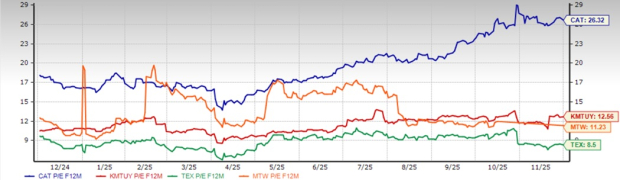

Against competitors, CAT appears notably expensive. Komatsu KMTUY, Terex Corporation TEX and The Manitowoc Company MTW are trading below the industry at 12.56, 8.5 and 11.23, respectively.

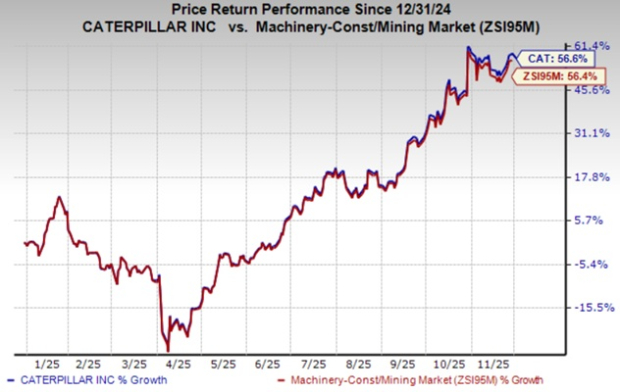

CAT shares have gained 56.6% so far this year compared with the industry’s 56.4% growth. In comparison, the Zacks Industrial Products sector and the S&P 500 have gained 5.7% and 18.9%, respectively, in the same period.

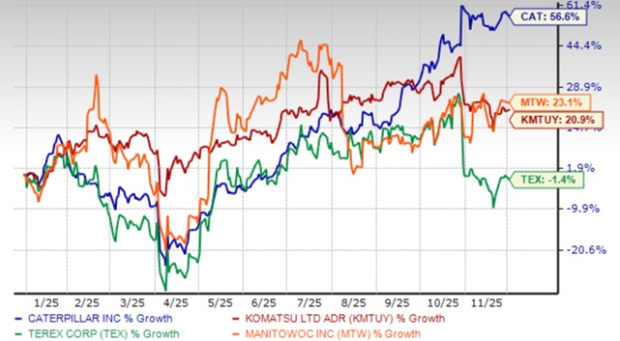

CAT has outpaced the year-to-date performances of Komatsu, Terex and Manitowoc, as shown in the chart below.

The company posted third-quarter 2025 revenues of around $17.6 billion, its highest quarterly total ever and up 9.5% year over year. This was supported by a 10% increase in sales volume and a favorable currency impact of 1%, somewhat offset by an unfavorable price realization of 1.3%.

Broad-based volume gains helped CAT break a streak of six straight quarters of revenue declines. Backlog rose sequentially by $2.4 billion, reaching a record $39.9 billion.

However, the cost of sales surged 16% on higher manufacturing costs and tariff effects. Despite stronger revenues, EPS came in at $4.95, down 4% year over year. This marks the sixth consecutive quarter of earnings decline for the company.

CAT now expects 2025 revenues to be “modestly” higher compared with 2024, an improvement from its prior projection of “slightly” higher revenues.

Net incremental tariffs are projected at $1.6-$1.75 billion for 2025. Considering this impact, Caterpillar expects the adjusted operating margin to be near the bottom of its target range.

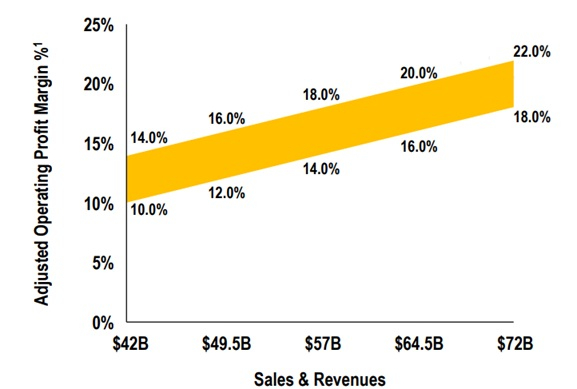

The company maintains its revenue projection at $42-$72 billion, and margins are anticipated between 10% and 22%, per the respective revenue levels. This is shown in the chart below.

The Institute for Supply Management’s manufacturing index remained in contraction territory for 26 straight months through December 2024. The index briefly returned to expansion in January (50.9%) and February (50.3%), but it was short-lived. In March, the index slipped back into contraction and has remained in contraction since, with the latest reading of 48.2% in November.

The New Orders Index has been in contraction for three straight months. Notably, the index has failed to sustain consistent growth since the end of its 24-month expansion streak in May 2022. Tariffs and economic uncertainty continue to weigh on demand.

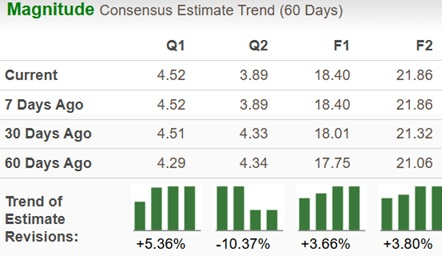

Earnings estimates for Caterpillar for both 2025 and 2026 have moved up over the past 60 days.

Despite the revision, the Zacks Consensus Estimate for CAT’s 2025 earnings indicates a year-over-year decline of 15.98%. The consensus mark for 2025 revenues suggests growth of 2.01%. However, earnings estimates for 2026 suggest 18.80% growth, with revenues rising 8.23%.

Looking ahead, CAT stands to benefit from the surge in projects, driven by the United States Infrastructure Investment and Jobs Act. The shift toward clean energy will drive the demand for essential commodities, boosting the need for Caterpillar’s mining equipment. Meanwhile, given their efficiency and safety, CAT’s autonomous fleet are gaining momentum among miners.

As technology companies establish data centers globally to support their generative AI applications, Caterpillar is witnessing robust order levels for reciprocating engines for data centers. The company is planning to double its output with a multi-year capital investment. Caterpillar recently entered into a long-term strategic collaboration with Hunt Energy Company, L.P., to meet the surging power needs of data centers. The first project is planned for Texas and is expected to serve as the launchpad for a multi-year program to deliver up to one gigawatt of power generation capacity for data centers across North America.

Caterpillar has also entered into an agreement to develop advanced energy optimization solutions for data centers. This collaboration focuses on integrating Vertiv's power distribution and cooling portfolio with Caterpillar’s know-how in power generation and CCHP (Combined Cooling, Heat and Power).

CAT’s efforts to grow its aftermarket parts and service-related revenues, which generate high margins, will also aid growth.

Caterpillar’s return on equity (ROE) is 47.16%, higher than the industry’s average of 46.52% and the S&P 500’s 32.54%. Meanwhile, Komatsu offers a ROE of 20.9% and Manitowoc’s is 23.1%. Meanwhile, Terex’s ROE is a negative 1.4%.

CAT’s premium valuation, combined with continuing earnings declines despite higher revenues owing to tariff impact, suggests caution for new investors. Existing shareholders should stay invested in Caterpillar’s stock to benefit from its solid long-term demand prospects, backed by infrastructure spending and energy-transition trends, as well as its focus on growing service revenues. CAT’s strong financial position enables it to invest in its businesses and return cash to shareholders through share buybacks and consistent dividend payments.

The company currently has a Zacks Rank #3 (Hold), which supports our view. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 10 hours | |

| 11 hours | |

| 13 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite