|

|

|

|

|||||

|

|

GE HealthCare GEHC recently unveiled Allia Moveo, a next-generation interventional imaging platform built to enhance mobility, access and workflow. Its compact, cable-free, wide-bore C-arm is designed to offer better patient access, improved comfort and high-quality CBCT imaging across a broad range of procedures.

Per management, Allia Moveo blends streamlined movement, AI-driven workflow tools and multi-modality integration to help clinicians work with greater ease and precision. GEHC expects the system’s efficiency-focused design and versatility to strengthen its interventional portfolio and support wider global adoption.

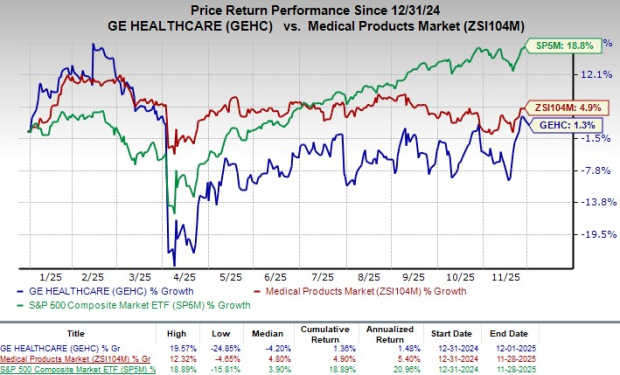

Following the announcement, the company's shares traded flat at yesterday’s closing. In the year-to-date period, shares have gained 1.3% compared with the industry’s 4.9% decline. The S&P 500 has gained 18.8% in the same time frame.

In the long run, Allia Moveo is likely to strengthen GEHC’s position in interventional imaging by expanding its reach in the fast-growing minimally invasive procedures market. The system’s mobility, workflow efficiency and AI-enabled guidance are designed to help hospitals handle higher case volumes with lower procedural friction, making it an attractive upgrade path for existing customers. Its versatile, future-ready platform also supports broader adoption across diverse care settings, which can drive recurring revenue through service, software and ecosystem integrations—ultimately enhancing GEHC’s competitiveness and long-term growth trajectory.

GEHC currently has a market capitalization of $36.44 billion.

Allia Moveo brings a reimagined C-arm design to the interventional suite with a focus on mobility, access and patient comfort. The system’s slim, compact and cable-free structure is built to maximize space and allow clinicians to move freely around the patient during both simple and complex procedures. Its wide-bore C-arm enables high-quality cone beam CT imaging and is designed to accommodate a broader range of body types, supporting more inclusive care.

GEHC also emphasized ergonomic enhancements, including motion controls placed within easy reach from nearly any position—aimed at reducing physical strain and helping clinicians maintain focus on the procedure itself. The patient experience is also central to the platform, with smooth table panning and a design intended to deliver comfort regardless of weight or body size.

The platform incorporates workflow-enhancing technologies like SmartMove, which lets clinicians move the C-arm away and return it to its exact prior position with a single button, helping limit setup delays and procedural interruptions. GEHC also integrated AI and augmented guidance tools to support more precise, efficient interventional work, along with broad multimodality connectivity so the system can serve as the hub of a fully integrated interventional environment.

Management noted that Allia Moveo reflects years of collaboration with clinicians, aiming to create a future-ready solution that simplifies workflow, reduces barriers and boosts confidence in high-volume, high-complexity settings. With FDA 510(k) clearance pending, the system is positioned to elevate GEHC’s interventional portfolio and drive adoption as hospitals seek smarter, more flexible imaging infrastructure.

Currently, GEHC carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 earnings per share (EPS) of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, sporting a Zacks Rank #1 at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 16 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite